Entergy 2008 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2008 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

8888

ENTERGY CORPORATION AND SUBSIDIARIES 2008

88

Notes to Consolidated Financial Statements continued

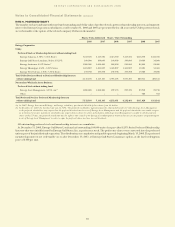

WA T E R F O R D 3 LE A S E OB L I G A T I O N S (EN T E R G Y LO U I S I A N A )

In 1989, in three separate but substantially identical transactions,

Entergy Louisiana sold and leased back undivided interests

in Waterford 3 for the aggregate sum of $353.6 million. The

interests represent approximately 9.3% of Waterford 3. Upon the

occurrence of certain events, Entergy Louisiana may be obligated

to pay amounts sufficient to permit the termination of the lease

transactions and may be required to assume the outstanding bonds

issued to finance, in part, the lessors’ acquisition of the undivided

interests in Waterford 3.

EM P L O Y M E N T A N D LA B O R -RE L A T E D PR O C E E D I N G S

The Registrant Subsidiaries and other Entergy subsidiaries are

responding to various lawsuits in both state and federal courts and

to other labor-related proceedings filed by current and former

employees and third parties not selected for open positions. These

actions include, but are not limited to, allegations of wrongful

employment actions; wage disputes and other claims under the Fair

Labor Standards Act or its state counterparts; claims of race, gender

and disability discrimination; disputes arising under collective

bargaining agreements; unfair labor practice proceedings and other

administrative proceedings before the National Labor Relations

Board; claims of retaliation; and claims for or regarding benefits

under various Entergy Corporation sponsored plans. Entergy

and the Registrant Subsidiaries are responding to these suits and

proceedings and deny liability to the claimants.

AS B E S T O S LI T I G A T I O N

Numerous lawsuits have been filed in federal and state courts

primarily in Texas and Louisiana, primarily by contractor employees

who worked in the 1940-1980s timeframe, against Entergy Gulf

States Louisiana and Entergy Texas, and to a lesser extent the other

Utility operating companies, as premises owners of power plants,

for damages caused by alleged exposure to asbestos. Many other

defendants are named in these lawsuits as well. Currently, there

are approximately 500 lawsuits involving approximately 6,000

claimants. Management believes that adequate provisions have

been established to cover any exposure. Additionally, negotiations

continue with insurers to recover reimbursements. Management

believes that loss exposure has been and will continue to be handled

so that the ultimate resolution of these matters will not be material,

in the aggregate, to the financial position or results of operation of

the Utility operating companies.

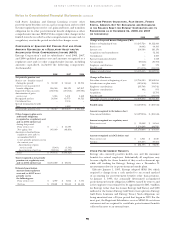

NOTE 9. ASSET RETIREMENT OBLIGATIONS

SFAS 143, “Accounting for Asset Retirement Obligations,” requires

the recording of liabilities for all legal obligations associated with the

retirement of long-lived assets that result from the normal operation

of those assets. For Entergy, substantially all of its asset retirement

obligations consist of its liability for decommissioning its nuclear

power plants. In addition, an insignificant amount of removal costs

associated with non-nuclear power plants is also included in the

decommissioning line item on the balance sheets.

These liabilities are recorded at their fair values (which are the

present values of the estimated future cash outflows) in the period

in which they are incurred, with an accompanying addition to the

recorded cost of the long-lived asset. The asset retirement obligation

is accreted each year through a charge to expense, to reflect the time

value of money for this present value obligation. The accretion will

continue through the completion of the asset retirement activity.

The amounts added to the carrying amounts of the long-lived assets

will be depreciated over the useful lives of the assets. The application

of SFAS 143 is earnings neutral to the rate-regulated business of the

Registrant Subsidiaries.

In accordance with ratemaking treatment and as required by

SFAS 71, the depreciation provisions for the Registrant Subsidiaries

include a component for removal costs that are not asset retirement

obligations under SFAS 143. In accordance with regulatory

accounting principles, the Registrant Subsidiaries have recorded

regulatory assets (liabilities) in the following amounts to reflect their

estimates of the difference between estimated incurred removal

costs and estimated removal costs recovered in rates (in millions):

December 31, 2008 2007

Entergy Arkansas $ 5.9 $ 23.0

Entergy Gulf States Louisiana $ (3.6) $(13.9)

Entergy Louisiana $(43.5) $(64.0)

Entergy Mississippi $ 40.0 $ 35.7

Entergy New Orleans $ 15.4 $ 1.5

Entergy Texas $ 34.7 $ (4.9)

System Energy $ 14.5 $ 16.9

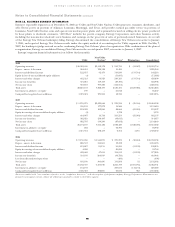

The cumulative decommissioning and retirement cost liabilities

and expenses recorded in 2008 by Entergy were as follows

(in millions):

Change

Liabilities in Cash Liabilities

as of Dec. Flow as of Dec.

31, 2007 Accretion Estimate Spending 31, 2008

Utility:

Entergy Arkansas $ 505.6 $35.1 $ – $ – $ 540.7

Entergy Gulf States

Louisiana $ 204.8 $18.1 $ – $ – $ 222.9

Entergy Louisiana $ 257.1 $19.9 $ (0.2) $ – $ 276.8

Entergy Mississippi $ 4.5 $ 0.3 $ – $ – $ 4.8

Entergy New Orleans $ 2.8 $ 0.2 $ – $ – $ 3.0

Entergy Texas $ 3.1 $ 0.2 $ – $ – $ 3.3

System Energy $ 368.6 $27.6 $ – $ – $ 396.2

Non-Utility Nuclear $1,141.6 $93.6 $13.7 $(20.1) $1,228.7

Other $ 1.1 $ – $ – $ 0.1 $ 1.2

The cumulative decommissioning and retirement cost liabilities

and expenses recorded in 2007 by Entergy were as follows

(in millions):

Change

Liabilities in Cash Liabilities

as of Dec. Flow as of Dec.

31, 2006 Accretion Estimate Spending 31, 2007

Utility:

Entergy Arkansas $472.8 $32.8 $ – $ – $ 505.6

Entergy Gulf States

Louisiana $191.0 $16.9 $ (3.1)(a) $ – $ 204.8

Entergy Louisiana $238.5 $18.6 $ – $ – $ 257.1

Entergy Mississippi $ 4.3 $ 0.2 $ – $ – $ 4.5

Entergy New Orleans $ 2.6 $ 0.2 $ – $ – $ 2.8

Entergy Texas $ 2.9 $ 0.2 $ – $ – $ 3.1

System Energy $342.8 $25.8 $ – $ – $ 368.6

Non-Utility Nuclear(b) $993.0 $78.6 $100.4 $(30.4) $1,141.6

Other $ 1.1 $ – $ – $ – $ 1.1

(a) Represents the $3.1 million allocated to Entergy Texas as part of the

jurisdictional separation.

(b) The Non-Utility Nuclear liability as of December 31, 2006 includes

$219.7 million for the Palisades nuclear plant which was acquired in

April 2007.

Entergy periodically reviews and updates estimated decommissioning

costs. The actual decommissioning costs may vary from the estimates

because of regulatory requirements, changes in technology, and

88

ENTERGY CORPORATION AND SUBSIDIARIES 2008

Notes to Consolidated Financial Statements continued