Entergy 2008 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2008 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

62

62

ENTERGY CORPORATION AND SUBSIDIARIES 2008

62

Notes to Consolidated Financial Statements

NOTE 1. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

The accompanying consolidated financial statements include

the accounts of Entergy Corporation and its direct and indirect

subsidiaries. As required by generally accepted accounting

principles, all significant intercompany transactions have been

eliminated in the consolidated financial statements. The Utility

operating companies and many other Entergy subsidiaries

maintain accounts in accordance with FERC and other regulatory

guidelines. Certain previously reported amounts have been

reclassified to conform to current classifications, with no effect on

net income or shareholders’ equity.

US E O F ES T I M A T E S IN T H E PR E P A R A T I O N O F

FI N A N C I A L STAT E M E N T S

In conformity with generally accepted accounting principles,

the preparation of Entergy Corporation’s consolidated financial

statements and the separate financial statements of the Registrant

Subsidiaries requires management to make estimates and

assumptions that affect the reported amounts of assets, liabilities,

revenues, and expenses and the disclosure of contingent assets

and liabilities. Adjustments to the reported amounts of assets and

liabilities may be necessary in the future to the extent that future

estimates or actual results are different from the estimates used.

RE V E N U E S A N D FU E L CO S T S

Entergy Arkansas, Entergy Gulf States Louisiana, Entergy

Louisiana, Entergy Mississippi, and Entergy Texas generate,

transmit, and distribute electric power primarily to retail customers

in Arkansas, Louisiana, Louisiana, Mississippi, and Texas,

respectively. Entergy Gulf States Louisiana also distributes gas to

retail customers in and around Baton Rouge, Louisiana. Entergy

New Orleans sells both electric power and gas to retail customers in

the City of New Orleans, except for Algiers, where Entergy Louisiana

is the electric power supplier. Entergy’s Non-Utility Nuclear segment

derives almost all of its revenue from sales of electric power generated

by plants owned by the Non-Utility Nuclear segment.

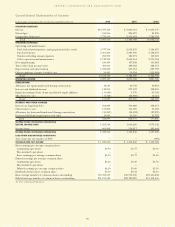

Entergy recognizes revenue from electric power and gas sales

when power or gas is delivered to customers. To the extent that

deliveries have occurred but a bill has not been issued, Entergy’s

Utility operating companies accrue an estimate of the revenues

for energy delivered since the latest billings. The Utility operating

companies calculate the estimate based upon several factors

including billings through the last billing cycle in a month,

actual generation in the month, historical line loss factors, and

prices in effect in Entergy’s Utility operating companies’ various

jurisdictions. Changes are made to the inputs in the estimate as

needed to reflect changes in billing practices. Each month the

estimated unbilled revenue amounts are recorded as revenue

and unbilled accounts receivable, and the prior month’s estimate

is reversed. Therefore, changes in price and volume differences

resulting from factors such as weather affect the calculation of

unbilled revenues from one period to the next, and may result

in variability in reported revenues from one period to the next as

prior estimates are reversed and new estimates recorded.

Entergy’s Utility operating companies’ rate schedules include

either fuel adjustment clauses or fixed fuel factors, which allow

either current recovery in billings to customers or deferral of

fuel costs until the costs are billed to customers. Because the fuel

adjustment clause mechanism allows monthly adjustments to

recover fuel costs, Entergy New Orleans and, prior to 2006, Entergy

Louisiana and Entergy Gulf States Louisiana include a component

of fuel cost recovery in their unbilled revenue calculations.

Effective January 1, 2006, however, for Entergy Louisiana and

Entergy Gulf States Louisiana this fuel component of unbilled

accounts receivable was reclassified to a deferred fuel asset and is

no longer included in the unbilled revenue calculations, which is in

accordance with regulatory treatment. Where the fuel component

of revenues is billed based on a pre-determined fuel cost (fixed

fuel factor), the fuel factor remains in effect until changed as

part of a general rate case, fuel reconciliation, or fixed fuel factor

filing. Entergy Mississippi’s fuel factor includes an energy cost

rider that is adjusted quarterly. In the case of Entergy Arkansas and

Entergy Texas, a portion of their fuel under-recoveries is treated in

the cash flow statements as regulatory investments because those

companies are allowed by their regulatory jurisdictions to recover

the fuel cost regulatory asset over longer than a twelve-month

period, and the companies earn a carrying charge on the under-

recovered balances.

System Energy’s operating revenues are intended to recover

from Entergy Arkansas, Entergy Louisiana, Entergy Mississippi,

and Entergy New Orleans operating expenses and capital costs

attributable to Grand Gulf. The capital costs are computed by

allowing a return on System Energy’s common equity funds

allocable to its net investment in Grand Gulf, plus System Energy’s

effective interest cost for its debt allocable to its investment in

Grand Gulf.

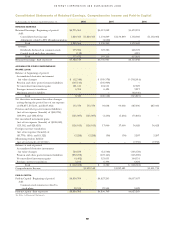

PR O P E R T Y , PL A N T , A N D EQ U I P M E N T

Property, plant, and equipment is stated at original cost.

Depreciation is computed on the straight-line basis at rates

based on the applicable estimated service lives of the various

classes of property. For the Registrant Subsidiaries, the original

cost of plant retired or removed, less salvage, is charged to

accumulated depreciation. Normal maintenance, repairs, and

minor replacement costs are charged to operating expenses.

Substantially all of the Registrant Subsidiaries’ plant is subject to

mortgage liens.

Electric plant includes the portions of Grand Gulf and

Waterford 3 that have been sold and leased back. For financial

reporting purposes, these sale and leaseback arrangements are

reflected as financing transactions.

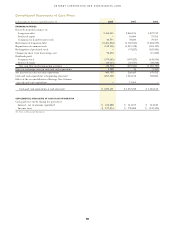

Net property, plant, and equipment for Entergy (including

property under capital lease and associated accumulated

amortization) by business segment and functional category, as of

December 31, 2008 and 2007, is shown below (in millions):

Non-Utility

2008 Entergy Utility Nuclear All Other

Production:

Nuclear $ 7,998 $ 5,468 $2,530 $ –

Other 1,944 1,723 – 221

Transmission 2,757 2,724 33 –

Distribution 5,361 5,361 – –

Other 1,554 1,283 271 –

Construction work in progress 1,713 1,441 252 20

Nuclear fuel (leased and owned) 1,102 596 506 –

Property, plant, and

equipment - net $22,429 $18,596 $3,592 $241