Entergy 2008 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2008 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

19

move the Indian Point site to an even higher performance level, consistent

with the commitment to operational excellence that is a hallmark of Entergy-

operated assets. Entergy Nuclear continues to work through the license renewal

process with the NRC and most recently received draft environmental impact

and safety evaluation reports.

Point-of-View-Driven Hedging Strategy

We continue to pursue opportunities with natural buyers and other market

participants in the region served by our non-utility nuclear fleet who can commit

for large blocks of power on a longer term basis and with other counterparties.

We layer in hedges on an annual basis that are consistent with our dynamic points

of view on factors affecting commodity prices, including carbon legislation and

regional generation and infrastructure constraints. Our objective is to avoid risks

associated with attempting to time the market.

As of year-end 2008, 86 percent of our planned generation for 2009 was under

contract, 66 percent for 2010 and 46 percent for 2011 at average energy prices per

MWh of $61, $60 and $56, respectively.

Opportunities for a Premier Generation Company

When the spin transaction is executed, Enexus will be a premier generation

company. A number of short- and long-term growth opportunities exist for an

entity with the assets and capabilities of Enexus.

In the short term, Enexus will be able to execute a flexible generation hedging

strategy that is consistent with its risk profile as a merchant business. Despite the

recent downturn, our point of view on power pricing over the long term in the

Northeast remains bullish given capacity constraints in that market region and the

likelihood of carbon legislation. In addition, Enexus will evaluate the opportunity

to further increase its generation capacity through uprates at its existing fleet of

plants. Past uprates have added 245 megawatts of generating capacity to the

non-utility nuclear plants.

In the long term, Enexus growth opportunities also include potential

acquisitions of existing U.S. nuclear assets, complementary generation assets or

businesses with complementary assets. As a 50 percent owner of EquaGen, Enexus

can also realize growth from the provision of EquaGen’s nuclear services to

other operators. EquaGen has the ability to offer a complete life cycle of services

including construction management, operations, license renewal processes

and decommissioning.

Ultimately, we believe Enexus has the potential to deliver $2 billion in earnings

before interest, taxes, depreciation and amortization through higher power prices

and/or incremental investment. A combination of heat rate expansion, carbon

legislation, capacity markets and/or changes in gas prices are expected to affect

power prices.

ENTERGY CORPORATION AND SUBSIDIARIES 2008

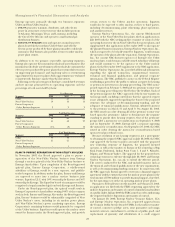

Non-Utility Nuclear Fleet

Capability Factor

%

Non-Utility Nuclear Fleet

Production Costs

$ per MWh

Even as we pursued plans

to spin our non-utility nuclear

fleet, our teams of nuclear

engineers, operators and

managers delivered another

outstanding year of operating

performance.

Before ETR

ownership

2008

73

95

Before ETR

ownership

2008

30

22

operational excellence