Entergy 2008 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2008 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

102102

ENTERGY CORPORATION AND SUBSIDIARIES 2008

Notes to Consolidated Financial Statements continued

102

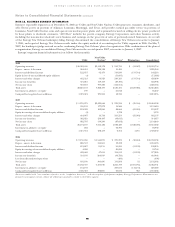

NOTE 17. DECOMMISSIONING TRUST FUNDS

Entergy holds debt and equity securities, classified as available-for-

sale, in nuclear decommissioning trust accounts. The NRC requires

Entergy to maintain trusts to fund the costs of decommissioning

ANO 1, ANO 2, River Bend, Waterford 3, Grand Gulf, Pilgrim,

Indian Point 1 and 2, Vermont Yankee, and Palisades (NYPA

currently retains the decommissioning trusts and liabilities for

Indian Point 3 and FitzPatrick). The funds are invested primarily

in equity securities; fixed-rate, fixed-income securities; and cash and

cash equivalents. The securities held at December 31, 2008 and 2007

are summarized as follows (in millions):

Total Total

Fair Unrealized Unrealized

Value Gains Losses

2008

Equity securities $1,436 $ 85 $177

Debt securities 1,396 77 21

Total $2,832 $162 $198

2007

Equity securities $1,928 $466 $ 9

Debt securities 1,380 40 3

Total $3,308 $506 $ 12

The debt securities have an average coupon rate of approximately

4.95%, an average duration of approximately 5.13 years, and an

average maturity of approximately 8.9 years. The equity securities

are generally held in funds that are designed to approximate or

somewhat exceed the return of the Standard & Poor’s 500 Index.

A relatively small percentage of the securities are held in funds

intended to replicate the return of the Wilshire 4500 Index or the

Russell 3000 Index.

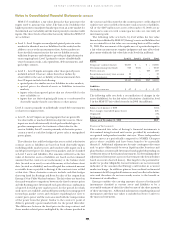

The fair value and gross unrealized losses of available-for-sale

equity and debt securities, summarized by investment type and

length of time that the securities have been in a continuous loss

position, are as follows at December 31, 2008 (in millions):

Equity Securities Debt Securities

Gross Gross

Fair Unrealized Fair Unrealized

Value Losses Value Losses

Less than 12 months $968 $160 $271 $18

More than 12 months 29 17 17 3

Total $997 $177 $288 $21

The unrealized losses in excess of twelve months above relate to

Entergy’s Utility operating companies and System Energy.

The fair value of debt securities, summarized by contractual

maturities, at December 31, 2008 and 2007 are as follows

(in millions):

2008 2007

Less than 1 year $ 21 $ 83

1 year – 5 years 526 388

5 years – 10 years 490 535

10 years – 15 years 146 127

15 years – 20 years 52 81

20 years+ 161 166

Total $1,396 $1,380

During the years ended December 31, 2008, 2007, and 2006,

proceeds from the dispositions of securities amounted to $1,652

million, $1,583 million, and $778 million, respectively. During

the years ended December 31, 2008, 2007, and 2006, gross gains

of $26 million, $5 million, and $5 million, respectively, and gross

losses of $20 million, $4 million, and $10 million, respectively, were

reclassified out of other comprehensive income into earnings.

OT H E R TH A N TE M P O R A R Y IM P A I R M E N T S A N D

UN R E A L I Z E D GA I N S A N D LO S S E S

Entergy evaluates unrealized losses at the end of each period to

determine whether an other than temporary impairment has

occurred. The assessment of whether an investment has suffered

an other than temporary impairment is based on a number of factors

including, first, whether Entergy has the ability and intent to hold

the investment to recover its value, the duration and severity of

any losses, and, then, whether it is expected that the investment

will recover its value within a reasonable period of time. Entergy’s

trusts are managed by third parties who operate in accordance with

agreements that define investment guidelines and place restrictions

on the purchases and sales of investments. Non-Utility Nuclear

recorded charges of $50 million in 2008 to interest income resulting

from the recognition of the other than temporary impairment of

certain securities held in its decommissioning trust funds. Non-

Utility Nuclear did not record any significant impairments in 2007

on these assets.

Due to the regulatory treatment of decommissioning collections

and trust fund earnings, Entergy Arkansas, Entergy Gulf States

Louisiana, Entergy Louisiana, and System Energy record regulatory

assets or liabilities for unrealized gains and losses on trust investments.

For the unregulated portion of River Bend, Entergy Gulf States

Louisiana has recorded an offsetting amount of unrealized gains

or losses in other deferred credits due to existing contractual

commitments with the former owner.

NOTE 18. ENTERGY NEW ORLEANS

BANKRUPTCY PROCEEDING

As a result of the effects of Hurricane Katrina and the effect of

extensive flooding that resulted from levee breaks in and around

the New Orleans area, on September 23, 2005, Entergy New

Orleans filed a voluntary petition in bankruptcy court seeking

reorganization relief under Chapter 11 of the U.S. Bankruptcy

Code. On May 7, 2007, the bankruptcy judge entered an order

confirming Entergy New Orleans’ plan of reorganization. With the

receipt of CDBG funds, and the agreement on insurance recovery

with one of its excess insurers, Entergy New Orleans waived the

conditions precedent in its plan of reorganization, and the plan

became effective on May 8, 2007. Following are significant terms

in Entergy New Orleans’ plan of reorganization:

nEntergy New Orleans paid in full, in cash, the allowed third-

party prepetition accounts payable (approximately $29 million,

including interest). Entergy New Orleans paid interest from

September 23, 2005 at the Louisiana judicial rate of interest for

2005 (6%) and 2006 (8%), and at the Louisiana judicial rate of

interest (9.5%) plus 1% for 2007 through the date of payment.