Entergy 2008 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2008 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

6666

ENTERGY CORPORATION AND SUBSIDIARIES 2008

Notes to Consolidated Financial Statements continued

66

RE A C Q U I R E D DE B T

The premiums and costs associated with reacquired debt of

Entergy’s Utility operating companies and System Energy (except

that portion allocable to the deregulated operations of Entergy

Gulf States Louisiana) are included in regulatory assets and are

being amortized over the life of the related new issuances, in

accordance with ratemaking treatment.

TA X E S IM P O S E D O N RE V E N U E -PR O D U C I N G TR A N S A C T I O N S

Governmental authorities assess taxes that are both imposed on

and concurrent with a specific revenue-producing transaction

between a seller and a customer, including, but not limited to,

sales, use, value added, and some excise taxes. Entergy presents

these taxes on a net basis, excluding them from revenues, unless

required to report them differently by a regulatory authority.

NE W AC C O U N T I N G PR O N O U N C E M E N T S

The FASB issued Statement of Financial Accounting Standards

No. 141(R), “Business Combinations” (SFAS 141(R)) during the

fourth quarter 2007. The significant provisions of SFAS 141R are

that: (i) assets, liabilities and non-controlling (minority) interests

will be measured at fair market value; (ii) costs associated with the

acquisition such as transaction-related costs or restructuring costs

will be separately recorded from the acquisition and expensed as

incurred; (iii) any excess of fair market value of the assets, liabilities

and minority interests acquired over the fair market value of the

purchase price will be recognized as a bargain purchase and a gain

recorded at the acquisition date; and (iv) contractual contingencies

resulting in potential future assets or liabilities may be recorded at

fair market value at the date of acquisition if certain criteria are

met. SFAS 141(R) applies prospectively to business combinations

for which the acquisition date is on or after the beginning of the

first annual reporting period beginning on or after December 15,

2008. An entity may not apply SFAS 141(R) before that date.

The FASB issued Statement of Financial Accounting Standards No.

160, “Noncontrolling Interests in Consolidated Financial Statements”

(SFAS 160) during the fourth quarter 2007. SFAS 160 enhances

disclosures and affects the presentation of minority interests in the

balance sheet, income statement and statement of comprehensive

income. SFAS 160 will also require a parent to record a gain or loss when

a subsidiary in which it retains a minority interest is deconsolidated

from the parent company. SFAS 160 applies prospectively to business

combinations for which the acquisition date is on or after the beginning

of the first annual reporting period beginning on or after December

15, 2008. An entity may not apply SFAS 160 before that date. Pursuant

to SFAS 160, beginning in 2009, Entergy will prospectively reclassify as

equity its subsidiary preferred stock without sinking fund.

In March 2008 the FASB issued Statement of Financial Accounting

Standards No. 161 “Disclosures about Derivative Instruments and

Hedging Activities, an amendment of FASB Statement No. 133”

(SFAS 161), which requires enhanced disclosures about an entity’s

derivative and hedging activities. SFAS 161 requires qualitative

disclosures about objectives and strategies for using derivatives,

quantitative disclosures about fair value amounts of and gains and

losses on derivative instruments, and disclosures about credit-risk-

related contingent features in derivative agreements. SFAS 161 is

effective for financial statements issued for fiscal years and interim

periods beginning after November 15, 2008.

NOTE 2. RATE AND REGULATORY MATTERS

RE G U L A T O R Y AS S E T S

Hurricane Gustav and Hurricane Ike

In September 2008, Hurricane Gustav and Hurricane Ike caused

catastrophic damage to portions of Entergy’s service territories

in Louisiana and Texas, and to a lesser extent in Arkansas and

Mississippi. Entergy has recorded the estimated costs incurred,

including payments already made, that were necessary to return

customers to service. Entergy has recorded approximately

$746 million against its storm damage provisions or as regulatory

assets and approximately $484 million in construction expenditures.

Entergy recorded the regulatory assets in accordance with its

accounting policies and based on the historic treatment of such

costs in its service territories (except for Entergy Arkansas because

it discontinued regulatory storm reserve accounting in July 2007

as a result of an APSC order), because management believes that

recovery through some form of regulatory mechanism is probable.

Because Entergy has not gone through the regulatory process

regarding these storm costs, however, there is an element of risk,

and Entergy is unable to predict with certainty the degree of success

it may have in its recovery initiatives, the amount of restoration costs

that it may ultimately recover, or the timing of such recovery.

Other Regulatory Assets

The Utility business is subject to the provisions of SFAS 71,

“Accounting for the Effects of Certain Types of Regulation.”

Regulatory assets represent probable future revenues associated

with certain costs that are expected to be recovered from customers

through the ratemaking process. In addition to the regulatory

assets that are specifically disclosed on the face of the balance

sheets, the table below provides detail of “Other regulatory assets”

that are included on Entergy’s and the Registrant Subsidiaries’

balance sheets as of December 31, 2008 and 2007 (in millions):

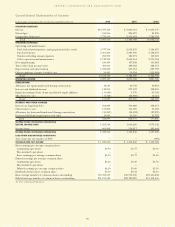

Entergy 2008 2007

Asset retirement obligation - recovery dependent

upon timing of decommissioning (Note 9)(b) $ 371.2 $ 334.9

Deferred capacity - recovery timing will be

determined by the LPSC in the formula

rate plan filings (Note 2 - Retail Rate Proceedings -

Filings with the LPSC) 48.4 86.4

Deferred fuel - non-current - recovered through

rate riders when rates are redetermined periodically

(Note 2 - Fuel and Purchased Power Cost Recovery) 20.7 32.8

Gas hedging costs - recovered through fuel rates 66.8 9.7

Pension & postretirement costs

(Note 11 - Qualified Pension Plans, Other Postretirement

Benefits, and Non-Qualified Pension Plans)(b) 1,468.6 675.1

Postretirement benefits - recovered through 2012

(Note 11 - Other Postretirement Benefits)(b) 9.6 12.0

Provision for storm damages, including hurricane

costs - recovered through securitization,

insurance proceeds, and retail rates (Note 2 -

Hurricane Gustav and Hurricane Ike and Storm

Cost Recovery Filings with Retail Regulators)(c) 1,163.4 1,339.8

Removal costs - recovered through depreciation rates

(Note 9)(b) 63.9 –

River Bend AFUDC - recovered through August 2025

(Note 1 - River Bend AFUDC) 29.9 31.8

Sale-leaseback deferral - recovered through June 2014

(Note 10 - Sale and Leaseback Transactions -

Grand Gulf Lease Obligations)(c) 91.0 103.9

Spindletop gas storage facility - recovered through

December 2032(a) 35.8 37.4

Transition to competition - recovered through

February 2021 (Note 2 - Retail Rate Proceedings -

Filings with the PUCT and Texas Cities) 107.6 112.9

Unamortized loss on reacquired debt -

recovered over term of debt 124.0 137.1

Other 14.2 57.6

Total $3,615.1 $2,971.4

(a) The jurisdictional split order assigned the regulatory asset to Entergy Texas.

The regulatory asset, however, is being recovered and amortized at Entergy Gulf

States Louisiana. As a result, a billing will occur monthly over the same term

as the recovery and receipts will be submitted to Entergy Texas. Entergy Texas

has recorded a receivable from Entergy Gulf States Louisiana and Entergy Gulf

States Louisiana has recorded a corresponding payable.

(b) Does not earn a return on investment, but is offset by related liabilities.

(c) Does not earn a return on investment at this time. For the provision for

storm damages, this only applies to Entergy Texas’ storm damages for

Hurricane Gustav and Hurricane Ike, approximately $358 million, and

Entergy New Orleans’ storm damages for Hurricane Gustav of approximately

$18 million. Other provision for storm damages amounts earn a return

on investment.