Entergy 2008 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2008 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENTERGY CORPORATION AND SUBSIDIARIES 2008

Management’s Financial Discussion and Analysis

Entergy operates primarily through two business segments:

Utility and Non-Utility Nuclear.

nUTILITY generates, transmits, distributes, and sells electric

power in a four-state service territory that includes portions

of Arkansas, Mississippi, Texas, and Louisiana, including

the City of New Orleans; and operates a small natural gas

distribution business.

nNON-UTILITY NUCLEAR owns and operates six nuclear power

plants located in the northern United States and sells the

electric power produced by those plants primarily to wholesale

customers. This business also provides services to other nuclear

power plant owners.

In addition to its two primary, reportable, operating segments,

Entergy also operates the non-nuclear wholesale assets business. The

non-nuclear wholesale assets business sells to wholesale customers the

electric power produced by power plants that it owns while it focuses

on improving performance and exploring sales or restructuring

opportunities for its power plants. Such opportunities are evaluated

consistent with Entergy’s market-based point-of-view.

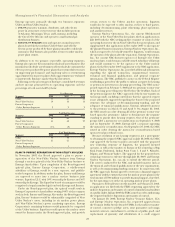

Following are the percentages of Entergy’s consolidated revenues

and net income generated by its operating segments and the

percentage of total assets held by them:

% of Revenue

Segment 2008 2007 2006

Utility 79 80 84

Non-Utility Nuclear 19 18 14

Parent Company &

Other Business Segments 2 2 2

% of Net Income

Segment 2008 2007 2006

Utility 48 60 61

Non-Utility Nuclear 65 48 27

Parent Company &

Other Business Segments (13) (8) 12

% of Total Assets

Segment 2008 2007 2006

Utility 79 78 81

Non-Utility Nuclear 21 21 17

Parent Company &

Other Business Segments – 1 2

PLAN TO PURSUE SEPARATION OF NON-UTILITY NUCLEAR

In November 2007, the Board approved a plan to pursue a

separation of the Non-Utility Nuclear business from Entergy

through a tax-free spin-off of the Non-Utility Nuclear business to

Entergy shareholders. Upon completion of the Board-approved

spin-off plan, Enexus Energy Corporation, a wholly-owned

subsidiary of Entergy, would be a new, separate, and publicly-

traded company. In addition, under the plan, Enexus and Entergy

are expected to enter into a nuclear services business joint

venture, EquaGen LLC, with 50% ownership by Enexus and 50%

ownership by Entergy. The EquaGen board of managers would be

comprised of equal membership from both Entergy and Enexus.

Under the Board-approved plan, the spin-off would result in

Entergy Corporation’s shareholders owning 100% of the common

stock in both Enexus and Entergy. Also under the Board-approved

plan, Enexus’ business would be substantially comprised of Non-

Utility Nuclear’s assets, including its six nuclear power plants,

and Non-Utility Nuclear’s power marketing operation. Entergy

Corporation’s remaining business would primarily be comprised

of the Utility business. EquaGen would operate the nuclear assets

owned by Enexus under the Board-approved plan, and provide

certain services to the Utility’s nuclear operations. EquaGen

would also be expected to offer nuclear services to third parties,

including decommissioning, plant relicensing, plant operations,

and ancillary services.

Entergy Nuclear Operations, Inc., the current NRC-licensed

operator of the Non-Utility Nuclear plants, filed an application in

July 2007 with the NRC seeking indirect transfer of control of the

operating licenses for the six Non-Utility Nuclear power plants, and

supplemented that application in December 2007 to incorporate

the planned business separation. Entergy Nuclear Operations, Inc.,

which is expected to be wholly-owned by EquaGen, would remain

the operator of the plants after the separation. Entergy Operations,

Inc., the current NRC-licensed operator of Entergy’s five Utility

nuclear plants, would remain a wholly-owned subsidiary of Entergy

and would continue to be the operator of the Utility nuclear

plants. In the December 2007 supplement to the NRC application,

Entergy Nuclear Operations, Inc. provided additional information

regarding the spin-off transaction, organizational structure,

technical and financial qualifications, and general corporate

information. The NRC published a notice in the Federal Register

establishing a period for the public to submit a request for hearing

or petition to intervene in a hearing proceeding. The NRC notice

period expired on February 5, 2008 and two petitions to intervene

in the hearing proceeding were filed before the deadline. Each of

the petitions opposes the NRC’s approval of the license transfer on

various grounds, including contentions that the approval request

is not adequately supported regarding the basis for the proposed

structure, the adequacy of decommissioning funding, and the

adequacy of financial qualifications. Entergy submitted answers

to the petitions on March 31 and April 8. On August 22, 2008,

the NRC issued an order denying all of the petitions to intervene

based upon the petitioners’ failure to demonstrate the requisite

standing to pursue their hearing requests. One of the petitioner

groups filed a motion for reconsideration on September 4, 2008

and on September 15, 2008, Entergy filed a response opposing

the motion for reconsideration. On September 23, 2008, the NRC

issued an order denying the motion for reconsideration based

upon several procedural errors.

Because resolution of any hearing requests is not a prerequisite

to obtaining the required NRC approval, on July 28, 2008, the NRC

staff approved the license transfers associated with the proposed

new ownership structure of EquaGen, the proposed licensed

operator, as well as the transfers to Enexus of the ownership of Big

Rock Point, FitzPatrick, Indian Point Units 1, 2 and 3, Palisades,

Pilgrim, and Vermont Yankee. The approval for the proposed new

ownership structure is effective through July 28, 2009, and Entergy

Nuclear Operations, Inc. can ask to extend the effective period.

The review conducted by the NRC staff included matters such as

the financial and technical qualifications of the new organizations,

as well as decommissioning funding assurance. In connection with

the NRC approvals, Enexus agreed to enter into a financial support

agreement with the entities that own the nuclear power plants in the

total amount of $700 million to provide financial support, if needed,

for the operating costs of the six operating nuclear power plants.

Pursuant to Federal Power Act Section 203, on February 21, 2008,

an application was filed with the FERC requesting approval for the

indirect disposition and transfer of control of jurisdictional facilities

of a public utility. In June 2008 the FERC issued an order authorizing

the requested indirect disposition and transfer of control.

On January 28, 2008, Entergy Nuclear Vermont Yankee, LLC

and Entergy Nuclear Operations, Inc. requested approval from

the Vermont Public Service Board (VPSB) for the indirect transfer

of control, consent to pledge assets, issue guarantees and assign

material contracts, amendment to certificate of public good, and

replacement of guaranty and substitution of a credit support

28

ENTERGY CORPORATION AND SUBSIDIARIES 2008