Entergy 2008 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2008 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

8080

ENTERGY CORPORATION AND SUBSIDIARIES 2008

Notes to Consolidated Financial Statements continued

80

2002 – 2003 IRS Audit

The IRS completed its examination of the 2002 and 2003 tax

returns and issued an Examination Report on June 29, 2007. In

the report the IRS proposed adjustments for the U.K. Windfall Tax

foreign tax credit issue and street lighting issue mentioned above

as well as other issues related to certain storm repair deductions,

research and experimentation (R&E) deductions and credits.

Entergy disagreed with the IRS Examination Division position and

filed a formal protest on July 30, 2007. Entergy reached agreement

with the IRS Appeals Division in the fourth quarter of 2008 on all

matters, except for the U.K. Windfall Tax and street lighting issues

which will be disposed of in accordance with the decisions in the

Tax Court litigation previously discussed. The settlement of the

remaining issues had no material effect on results of operations,

financial position and cash flows for Entergy or its subsidiaries

since Entergy sustained a significant portion of the deductions and

credits at issue and the conceded deductions will have the effect of

reducing the 2003 consolidated net operating loss carryover.

2004 – 2005 IRS Audit

The IRS commenced an examination of Entergy’s 2004 and 2005

U.S. federal income tax returns in the fourth quarter 2007. As of

December 31, 2008, the IRS had proposed only one change with

which Entergy did not agree; the street lighting issue mentioned

above. The IRS is expected to issue their 2004 - 2005 Revenue

Agent’s Report in the second quarter of 2009.

In December 2008, Entergy reached settlement with the IRS

related to the following:

nThe recognition of a capital loss from the sale of stock in one

of Entergy’s Non-Nuclear Wholesale subsidiaries - Entergy

sustained $374 million of the capital loss.

nMark-to-market deductions claimed by the Non-Utility

Nuclear subsidiaries for wholesale power contracts for which

the settlement resulted in no material effect on results of

operations, financial position, and cash flows.

nMark-to-market deductions claimed for wholesale power

contracts held by its Utility operating companies and a

Non-Nuclear Wholesale subsidiary for which the settlement

resulted in no material effect on results of operations, financial

position, and cash flows.

Because Entergy has consolidated net operating losses that

carryover to 2004 and 2005, these settlements have the effect of

reducing the consolidated net operating loss carryover and no

payments to the IRS are anticipated at this time.

Entergy has deposits and overpayments of $548 million on

account with the IRS to cover its uncertain tax positions.

NOTE 4. REVOLVING CREDIT FACILITIES, LINES OF CREDIT

AND SHORT-TERM BORROWINGS

Entergy Corporation has a revolving credit facility that expires in

August 2012 and has a borrowing capacity of $3.5 billion. Entergy

Corporation also has the ability to issue letters of credit against

the total borrowing capacity of the credit facility. The facility

fee is currently 0.09% of the commitment amount. Facility fees

and interest rates on loans under the credit facility can fluctuate

depending on the senior unsecured debt ratings of Entergy

Corporation. The weighted average interest rate as of December

31, 2008 was 2.171% on the drawn portion of the facility. Following

is a summary of the borrowings outstanding and capacity available

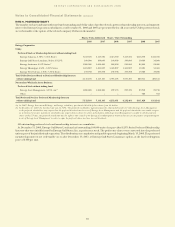

under the facility as of December 31, 2008 (in millions):

Capacity Borrowings Letters of Credit Capacity Available

$3,500 $3,237 $68 $195

Entergy Corporation’s facility requires it to maintain a

consolidated debt ratio of 65% or less of its total capitalization.

Entergy is in compliance with this covenant. If Entergy fails to meet

this ratio, or if Entergy or one of the Utility operating companies

(except Entergy New Orleans) defaults on other indebtedness or

is in bankruptcy or insolvency proceedings, an acceleration of the

facility maturity date may occur.

Entergy Arkansas, Entergy Gulf States Louisiana, Entergy

Louisiana, Entergy Mississippi, and Entergy Texas each had credit

facilities available as of December 31, 2008 as follows (in millions):

Amount

Expiration Amount of Interest Drawn as of

Company Date Facility Rate(a) Dec. 31, 2008

Entergy Arkansas April 2009 $100(b) 2.75% –

Entergy Gulf

States Louisiana August 2012 $100(c) 0.84563% –

Entergy Louisiana August 2012 $200(d) 0.84563% –

Entergy

Mississippi May 2009 $ 30(e) 1.71125% –

Entergy

Mississippi May 2009 $ 20(e) 1.71125% –

Entergy Texas August 2012 $100(f) 2.285% $100

(a) The interest rate is the weighted average interest rate as of December 31, 2008

applied or that would be applied to the outstanding borrowings under the facility.

(b) The credit facility requires Entergy Arkansas to maintain a debt ratio of

65% or less of its total capitalization.

(c) The credit facility allows Entergy Gulf States Louisiana to issue letters of

credit against the borrowing capacity of the facility. As of December 31,

2008, no letters of credit were outstanding. The credit facility requires

Entergy Gulf States Louisiana to maintain a consolidated debt ratio of

65% or less of its total capitalization. Pursuant to the terms of the credit

agreement, the amount of debt assumed by Entergy Texas ($770 million as

of December 31, 2008 and $1.079 billion as of December 31, 2007)

is excluded from debt and capitalization in calculating the debt ratio.

(d) The credit facility allows Entergy Louisiana to issue letters of credit

against the borrowing capacity of the facility. As of December 31, 2008,

no letters of credit were outstanding. The credit facility requires Entergy

Louisiana to maintain a consolidated debt ratio of 65% or less of its

total capitalization.

(e) Borrowings under the Entergy Mississippi credit facilities may be secured by

a security interest in its accounts receivable.

(f) The credit facility allows Entergy Texas to issue letters of credit against the

borrowing capacity of the facility. As of December 31, 2008, no letters of credit

were outstanding. The credit facility requires Entergy Texas to maintain a con-

solidated debt ratio of 65% or less of its total capitalization. Pursuant to the

terms of the credit agreement, the transition bonds issued by Entergy Gulf States

Reconstruction Funding I, LLC, a subsidiary of Entergy Texas, are excluded

from debt and capitalization in calculating the debt ratio.

The facility fees on the credit facilities range from 0.09% to 0.15%

of the commitment amount.

The short-term borrowings of the Registrant Subsidiaries and certain

other Entergy subsidiaries are limited to amounts authorized by the

FERC. The current FERC-authorized limits are effective through March

31, 2010 (except the Entergy Gulf States Louisiana and Entergy Texas

limits, which are effective through November 8, 2009). In addition to

borrowings from commercial banks, these companies are authorized

under a FERC order to borrow from the Entergy System money pool.

The money pool is an inter-company borrowing arrangement designed

to reduce Entergy’s subsidiaries’ dependence on external short-term

borrowings. Borrowings from the money pool and external short-term

borrowings combined may not exceed the FERC-authorized limits. As

of December 31, 2008, Entergy’s subsidiaries’ aggregate money pool

and external short-term borrowings authorized limit was $2.1 billion,

the aggregate outstanding borrowing from the money pool was

$436.2 million, and Entergy’s subsidiaries’ had no outstanding short-

term borrowings from external sources (borrowings by Entergy Texas

under its credit facility are classified as long-term debt).