Entergy 2008 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2008 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

8989

ENTERGY CORPORATION AND SUBSIDIARIES 2008

89

Notes to Consolidated Financial Statements continued

89

increased costs of labor, materials, and equipment. As described

below, during 2006, 2007, and 2008 Entergy updated decommission-

ing cost estimates for certain Non-Utility Nuclear plants.

In the third quarter 2008, Entergy’s Non-Utility Nuclear business

recorded an increase of $13.7 million in decommissioning liabilities

for certain of its plants as a result of revised decommissioning cost

studies. The revised estimates resulted in the recognition of a

$13.7 million asset retirement obligation asset that will be depreciated

over the remaining life of the units.

In the fourth quarter 2007, Entergy’s Non-Utility Nuclear business

recorded an increase of $100 million in decommissioning liabilities

for certain of its plants as a result of revised decommissioning cost

studies. The revised estimates resulted in the recognition of a $100

million asset retirement obligation asset that will be depreciated

over the remaining life of the units.

In the third quarter 2006, Entergy’s Non-Utility Nuclear business

recorded a reduction of $27.0 million in decommissioning

liability for a plant as a result of a revised decommissioning cost

study and changes in assumptions regarding the timing of when

decommissioning of the plant will begin. The revised estimate

resulted in miscellaneous income of $27.0 million ($16.6 million

net-of-tax), reflecting the excess of the reduction in the liability over

the amount of undepreciated asset retirement cost recorded at the

time of adoption of SFAS 143.

For the Indian Point 3 and FitzPatrick plants purchased in

2000, NYPA retained the decommissioning trusts and the

decommissioning liability. NYPA and Entergy executed

decommissioning agreements, which specify their decommissioning

obligations. NYPA has the right to require Entergy to assume

the decommissioning liability provided that it assigns the

corresponding decommissioning trust, up to a specified level,

to Entergy. If the decommissioning liability is retained by NYPA,

Entergy will perform the decommissioning of the plants at a price

equal to the lesser of a pre-specified level or the amount in the

decommissioning trusts.

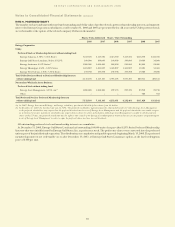

Entergy maintains decommissioning trust funds that are

committed to meeting the costs of decommissioning the nuclear

power plants. The fair values of the decommissioning trust funds and

the related asset retirement obligation regulatory assets of Entergy

as of December 31, 2008 are as follows (in millions):

Decommissioning Trust Fair Values Regulatory Asset

Utility:

ANO 1 and ANO 2 $ 390.5 $159.5

River Bend $ 303.2 $ 8.7

Waterford 3 $ 180.9 $ 77.7

Grand Gulf $ 268.8 $ 96.1

Non-Utility Nuclear $1,688.9 $ –

NOTE 10. LEASES

GE N E R A L

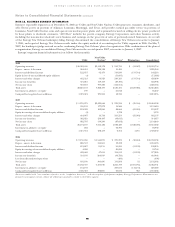

As of December 31, 2008, Entergy Corporation and subsidiaries

had capital leases and non-cancelable operating leases for

equipment, buildings, vehicles, and fuel storage facilities

(excluding nuclear fuel leases and the Grand Gulf and Waterford

3 sale and leaseback transactions) with minimum lease payments

as follows (in thousands):

Operating Capital

Year Leases Leases

2009 $ 90,085 $ 4,435

2010 113,775 4,810

2011 52,572 4,810

2012 39,373 4,810

2013 34,050 4,810

Years thereafter 118,968 44,613

Minimum lease payments 448,823 68,288

Less: Amount representing interest – 28,187

Present value of net minimum lease payments $448,823 $40,101

Total rental expenses for all leases (excluding nuclear fuel leases

and the Grand Gulf and Waterford 3 sale and leaseback transactions)

amounted to $66.4 million in 2008, $78.8 million in 2007, and

$78.0 million in 2006.

In addition to the above rental expense, railcar operating lease

payments and oil tank facilities lease payments are recorded in

fuel expense in accordance with regulatory treatment. Railcar

operating lease payments were $10.2 million in 2008, $9.0 million

in 2007, and $12.1 million in 2006 for Entergy Arkansas and $3.4

million in 2008, $4.8 million in 2007, and $3.1 million in 2006 for

Entergy Gulf States Louisiana. Oil tank facilities lease payments for

Entergy Mississippi were $3.4 million in 2008, $3.4 million in 2007,

and $3.8 million for 2006.

NU C L E A R FU E L LE A S E S

As of December 31, 2008, arrangements to lease nuclear fuel existed

in an aggregate amount up to $145 million for Entergy Arkansas,

$150 million for Entergy Gulf States Louisiana, $110 million for

Entergy Louisiana, and $205 million for System Energy. As of

December 31, 2008, the unrecovered cost base of nuclear fuel leases

amounted to approximately $125.1 million for Entergy Arkansas,

$120.2 million for Entergy Gulf States Louisiana, $74.2 million for

Entergy Louisiana, and $125.4 million for System Energy. The lessors

finance the acquisition and ownership of nuclear fuel through loans

made under revolving credit agreements, the issuance of commercial

paper, and the issuance of intermediate-term notes. The credit

agreements for Entergy Arkansas, Entergy Gulf States Louisiana,

Entergy Louisiana, and System Energy each have a termination date

of August 12, 2010. The termination dates may be extended from

time to time with the consent of the lenders. The intermediate-

term notes issued pursuant to these fuel lease arrangements have

varying maturities through September 15, 2013. It is expected that

additional financing under the leases will be arranged as needed to

acquire additional fuel, to pay interest, and to pay maturing debt.

However, if such additional financing cannot be arranged, the lessee

in each case must repurchase sufficient nuclear fuel to allow the

lessor to meet its obligations in accordance with the fuel lease.

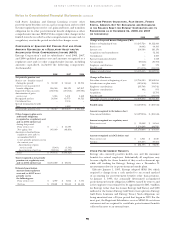

Lease payments are based on nuclear fuel use. The table below

represents the total nuclear fuel lease payments (principal and

interest), as well as the separate interest component charged

to operations, in 2008, 2007, and 2006 for the four Registrant

Subsidiaries that own nuclear power plants (in millions):

2008 2007 2006

Lease Lease Lease

Payments Interest Payments Interest Payments Interest

Entergy

Arkansas $ 63.5 $ 4.7 $ 61.7 $ 5.8 $ 55.0 $ 5.0

Entergy Gulf

States Louisiana 29.3 2.5 31.5 2.8 28.1 3.6

Entergy Louisiana 44.6 3.0 44.2 4.0 35.5 2.4

System Energy 33.0 2.9 30.4 4.0 32.8 3.6

Total $170.4 $13.1 $167.8 $16.6 $151.4 $14.6

SA L E A N D LE A S E B A C K TR A N S A C T I O N S

Waterford 3 Lease Obligations

In 1989, in three separate but substantially identical transactions,

Entergy Louisiana sold and leased back undivided interests in

Waterford 3 for the aggregate sum of $353.6 million. The interests

represent approximately 9.3% of Waterford 3. The leases expire

in 2017. Under certain circumstances, Entergy Louisiana may

repurchase the leased interests prior to the end of the term of

the leases. At the end of the lease terms, Entergy Louisiana has

the option to repurchase the leased interests in Waterford 3 at fair