Entergy 2008 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2008 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

7878

ENTERGY CORPORATION AND SUBSIDIARIES 2008

Notes to Consolidated Financial Statements continued

78

loads. In its opinion, the D.C. Circuit concluded that the FERC

(1) acted arbitrarily and capriciously by allowing the Utility

operating companies to phase-in the effects of the elimination

of the interruptible load over a 12-month period of time; (2)

failed to adequately explain why refunds could not be ordered

under Section 206(c) of the Federal Power Act; and (3) exercised

appropriately its discretion to defer addressing the cost of sulfur

dioxide allowances until a later time. The D.C. Circuit remanded

the matter to the FERC for a more considered determination

on the issue of refunds. The FERC issued its order on remand in

September 2007, in which it directs Entergy to make a compliance

filing removing all interruptible load from the computation of

peak load responsibility commencing April 1, 2004 and to issue

any necessary refunds to reflect this change. In addition, the order

directs the Utility operating companies to make refunds for the

period May 1995 through July 1996. Entergy, the APSC, the MPSC,

and the City Council requested rehearing of the FERC’s order

on remand. The FERC granted the Utility operating companies’

request to delay the payment of refunds for the period May

1995 through July 1996 until 30 days following a FERC order on

rehearing. The FERC issued in September 2008 an order denying

rehearing. The refunds were made by the Utility operating

companies that owed refunds to the Utility operating companies

that were due a refund on October 15, 2008. The APSC and the

Utility operating companies appealed the FERC decisions to the

D.C. Circuit. The procedural schedule calls for briefing during the

first half of 2009. Because of its refund obligation to customers as a

result of this proceeding and a related LPSC proceeding, Entergy

Louisiana recorded provisions during 2008 of approximately

$16 million, including interest, for rate refunds.

CO-OW N E R -IN I T I A T E D PR O C E E D I N G A T T H E FERC

(EN T E R G Y AR K A N S A S )

In October 2004, Arkansas Electric Cooperative Corporation

(AECC) filed a complaint at the FERC against Entergy Arkansas

relating to a contract dispute over the pricing of substitute energy at

the co-owned Independence and White Bluff coal plants. The main

issue in the case related to the consequences under the governing

contracts when the dispatch of the coal units is constrained due

to system operating conditions. A hearing was held on the AECC

complaint and an ALJ Initial Decision was issued in January 2006

in which the ALJ found AECC’s claims to be without merit. On

October 25, 2006, the FERC issued its order in the proceeding. In

the order, the FERC reversed the ALJ’s findings. Specifically, the

FERC found that the governing contracts do not recognize the

effects of dispatch constraints on the co-owned units. The FERC

explained that for over twenty-three years the course of conduct of

the parties was such that AECC received its full entitlement to the

two coal units, regardless of any reduced output caused by system

operating constraints. Based on the order, Entergy Arkansas is

required to refund to AECC all excess amounts billed to AECC

as a result of the system operating constraints. The FERC denied

Entergy Arkansas’ request for rehearing and Entergy Arkansas

refunded $22.1 million (including interest) to AECC in September

2007. Entergy Arkansas had previously recorded a provision for

the estimated effect of this refund. AECC has filed a protest at

the FERC claiming that Entergy Arkansas owes an additional $2.5

million plus interest. Entergy Arkansas has appealed the FERC’s

decision to the D.C. Circuit.

NOTE 3. INCOME TAXES

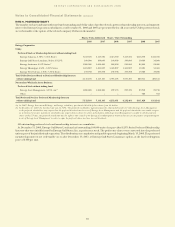

Income tax expenses from continuing operations for 2008, 2007,

and 2006 for Entergy Corporation and subsidiaries consist of the

following (in thousands):

2008 2007 2006

Current:

Federal $451,517 $(1,379,288) $(266,464)

Foreign 256 316 64

State 146,171 27,174 (74,319)

Total 597,944 (1,351,798) (340,719)

Deferred - net 23,022 1,884,383 801,745

Investment tax credit

adjustments - net (17,968) (18,168) (17,982)

Income tax expense from

continuing operations $602,998 $ 514,417 $ 443,044

Total income taxes from continuing operations for Entergy

Corporation and subsidiaries differ from the amounts computed

by applying the statutory income tax rate to income before taxes.

The reasons for the differences for the years 2008, 2007, and 2006

are (in thousands):

2008 2007 2006

Consolidated net income $1,220,566 $1,134,849 $1,132,602

Discontinued operations

(net of income tax expense

of $67 in 2006) – – 496

Preferred dividend requirements 19,969 25,105 27,783

Income before preferred stock

dividends of subsidiaries 1,240,535 1,159,954 1,160,881

Income taxes before

discontinued operations 602,998 514,417 443,044

Pretax income $1,843,533 $1,674,371 $1,603,925

Computed at statutory

rate (35%) $ 645,237 $ 586,030 $ 561,374

Increases (reductions) in tax

resulting from:

State income taxes net of

federal income tax effect 9,926 31,066 44,230|

Regulatory differences -

utility plant items 45,543 50,070 50,211

Amortization of investment

tax credits (17,458) (17,612) (17,460)

Decommissioning

trust fund basis (417) (35,684) –

Capital gains (losses) (74,278) 7,126| (79,427)

Flow-through/permanent

differences 14,656 (49,609) (52,866)

Tax reserves (27,970) (25,821) (53,610)

Valuation allowance 11,770 (8,676) 22,300

Other - net (4,011) (22,473) (31,708)

Total income taxes as reported

from continuing operations $ 602,998 $ 514,417 $ 443,044|

Effective income tax rate 32.7% 30.7%| 27.6%

The capital loss for 2006 includes a loss for tax purposes recorded

in the fourth quarter 2006 resulting from the liquidation of Entergy

Power International Holdings, Entergy’s holding company for

Entergy-Koch, LP. The $79.4 million tax benefit is net of other

capital gains.