Entergy 2008 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2008 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

101101

ENTERGY CORPORATION AND SUBSIDIARIES 2008

101

Notes to Consolidated Financial Statements continued

101

Notes to Consolidated Financial Statements continued

SFAS 157 establishes a fair value hierarchy that prioritizes the

inputs used to measure fair value. The hierarchy establishes the

highest priority for unadjusted market quotes in an active market for

the identical asset or liability and the lowest priority for unobservable

inputs. The three levels of fair value hierarchy defined in SFAS 157

are as follows:

nLevel 1 - Level 1 inputs are unadjusted quoted prices in active

markets for identical assets or liabilities that the entity has the

ability to access at the measurement date. Active markets are

those in which transactions for the asset or liability occur in

sufficient frequency and volume to provide pricing information

on an ongoing basis. Level 1 primarily consists of individually

owned common stocks, cash equivalents, debt instruments, and

gas hedge contracts.

nLevel 2 - Level 2 inputs are inputs other than quoted prices

included in level 1 that are, either directly or indirectly,

observable for the asset or liability at the measurement date.

Level 2 inputs include the following:

nquoted prices for similar assets or liabilities in active markets;

nquoted prices for identical assets or liabilities in inactive

markets;

ninputs other than quoted prices that are observable for the

asset or liability; or

ninputs that are derived principally from or corroborated by

observable market data by correlation or other means.

Level 2 consists primarily of individually owned debt instruments

or shares in common trusts.

nLevel 3 - Level 3 inputs are pricing inputs that are generally

less observable or unobservable from objective sources. These

inputs are used with internally developed methodologies to

produce management’s best estimate of fair value for the

asset or liability. Level 3 consists primarily of derivative power

contracts used as cash flow hedges of power sales at unregulated

power plants.

The values for the cash flow hedges that are recorded as derivative

contract assets or liabilities are based on both observable inputs

including public market prices and unobservable inputs such as

model-generated prices for longer-term markets and are classified

as Level 3 assets and liabilities. The amounts reflected as the fair

value of derivative assets or liabilities are based on the estimated

amount that the contracts are in-the-money at the balance sheet

date (treated as an asset) or out-of-the-money at the balance sheet

date (treated as a liability) and would equal the estimated amount

receivable from or payable to Entergy if the contracts were settled

at that date. These derivative contracts include cash flow hedges

that swap fixed for floating cash flows for sales of the output from

Entergy’s Non-Utility Nuclear business. The fair values are based on

the mark-to-market comparison between the fixed contract prices

and the floating prices determined each period from a combination

of quoted forward power market prices for the period for which

such curves are available, and model-generated prices using quoted

forward gas market curves and estimates regarding heat rates to

convert gas to power and the costs associated with the transportation

of the power from the plants’ busbar to the contract’s point of

delivery, generally a power market hub, for the period thereafter.

The difference between the fixed price in the swap contract and

these market-related prices multiplied by the volume specified in

the contract and discounted at the counterparties’ credit adjusted

risk free rate are recorded as derivative contract assets or liabilities.

All of the $207 million net assets at December 31, 2008 are in-

the-money contracts with counterparties who are currently all

investment grade.

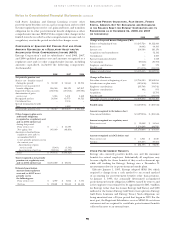

The following table sets forth, by level within the fair value

hierarchy established by SFAS 157, Entergy’s assets and liabilities that

are accounted for at fair value on a recurring basis as of December

31, 2008. The assessment of the significance of a particular input to

a fair value measurement requires judgment and may affect their

placement within the fair value hierarchy levels (in millions):

Level 1 Level 2 Level 3 Total

Assets:

Temporary cash investments $1,805 $ – $ – $1,805

Decommissioning trust funds 508 2,324 – 2,832

Power contracts – – 207 207

Securitization recovery trust account 12 – – 12

Other investments 35 – – 35

$2,360 $2,324 $207 $4,891

Liabilities:

Gas hedge contracts $ 67 $ – $ – $ 67

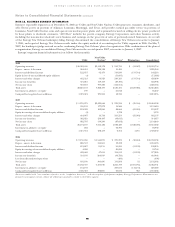

The following table sets forth a reconciliation of changes in the

assets (liabilities) for the fair value of derivatives classified as level

3 in the SFAS 157 fair value hierarchy in 2008 (in millions):

Balance as of January 1, 2008 $(12)

Price changes (unrealized gains/losses) 226

Originated (70)

Settlements 63

Balance as of December 31, 2008 $207

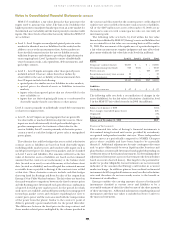

Financial Instruments

The estimated fair value of Entergy’s financial instruments is

determined using forward mid curves provided by an industry

recognized independent market surveyor. These independent

market curves are periodically compared to NYMEX Clearport

prices where available and have been found to be materially

identical. Additional adjustments for unit contingent discounts

and/or price differentials between liquid market locations and

plant busbars are internally determined and applied depending on

settlement terms of the financial instrument. In determining these

adjustments, Entergy uses a process that estimates the forward values

based on recent observed history. Due largely to the potential for

market or product illiquidity, forward estimates are not necessarily

indicative of the amounts that Entergy could realize in a current

market exchange. In addition, gains or losses realized on financial

instruments held by regulated businesses may be reflected in future

rates and therefore do not necessarily accrue to the benefit or

detriment of stockholders.

Entergy considers the carrying amounts of most of its financial

instruments classified as current assets and liabilities to be a

reasonable estimate of their fair value because of the short maturity

of these instruments. Additional information regarding financial

instruments and their fair values is included in Notes 5 and 6 to

the financial statements.