Entergy 2008 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2008 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

32

ENTERGY CORPORATION AND SUBSIDIARIES 2008

32

Management’s Financial Discussion and Analysis continued

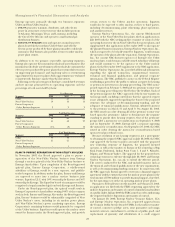

As shown in the table above, net revenue for Non-Utility

Nuclear increased by $495 million, or 27%, in 2008 compared to

2007 primarily due to higher pricing in its contracts to sell power,

additional production available from the acquisition of Palisades

in April 2007, and fewer outage days. In addition to the refueling

outages shown in the table below, 2007 was affected by a 28 day

unplanned outage. Included in the Palisades net revenue is $76

million and $50 million of amortization of the Palisades purchased

power agreement in 2008 and 2007, respectively, which is non-cash

revenue and is discussed in Note 15 to the financial statements.

Following are key performance measures for 2008 and 2007:

2008 2007

Net MW in operation at December 31 4,998 4,998

Average realized price per MWh $59.51 $52.69

GWh billed 41,710 37,570

Capacity factor 95% 89%

Refueling outage days:

FitzPatrick 26 –

Indian Point 2 26 –

Indian Point 3 – 24

Palisades – 42

Pilgrim – 33

Vermont Yankee 22 24

Realized Price per MWh

When Non-Utility Nuclear acquired its six nuclear power plants

it also entered into purchased power agreements with each of

the sellers. For four of the plants, the 688 MW Pilgrim, 838 MW

FitzPatrick, 1,028 MW Indian Point 2, and 1,041 MW Indian Point

3 plants, the original purchased power agreements with the sellers

expired in 2004. The purchased power agreement with the seller

of the 605 MW Vermont Yankee plant extends into 2012, and the

purchased power agreement with the seller of the 798 MW Palisades

plant extends into 2022. Market prices in the New York and New

England power markets, where the four plants with original

purchased power agreements that expired in 2004 are located,

increased since the purchase of these plants, and the contracts

that Non-Utility Nuclear entered into after the original contracts

expired, as well as realized day ahead and spot market sales, have

generally been at higher prices than the original contracts. Non-

Utility Nuclear’s annual average realized price per MWh increased

from $39.40 for 2003 to $59.51 for 2008. In addition, as shown

in the contracted sale of energy table in “Market and Credit Risk

Sensitive Instruments,” Non-Utility Nuclear has sold forward 86%

of its planned energy output for 2009 for an average contracted

energy price of $61 per MWh. Power prices increased in the

period from 2003 through 2008 primarily because of increases in

the price of natural gas. Natural gas prices increased in the period

from 2003 through 2008 primarily because of rising production

costs and limited imports of liquefied natural gas, both caused

by global demand and increases in the price of crude oil. In

addition, increases in the price of power during this period were

caused secondarily by rising heat rates, which in turn were caused

primarily by load growth outpacing new unit additions. The

majority of the existing long-term contracts for power from these

four plants expire by the end of 2011. Recent trends in the energy

commodity markets have resulted in lower natural gas prices and

consequently current prevailing market prices for electricity in the

New York and New England power regions are generally below

the prices in Non-Utility Nuclear’s existing contracts in those

regions. Therefore, it is uncertain whether Non-Utility Nuclear

will continue to experience increases in its annual realized price

per MWh.

Other Income Statement Items

Utility

Other operation and maintenance expenses increased from $1,856

million for 2007 to $1,867 million for 2008. The variance includes:

nthe write-off in the fourth quarter 2008 of $52 million of

costs previously accumulated in Entergy Arkansas’s storm

reserve and $16 million of removal costs associated with

the termination of a lease, both in connection with the

December 2008 Arkansas Court of Appeals decision in Entergy

Arkansas’ base rate case. The base rate case is discussed in

more detail in Note 2 to the financial statements;

na decrease of $39 million in payroll-related and benefits costs;

na decrease of $21 million related to expenses recorded in 2007

in connection with the nuclear operations fleet alignment, as

discussed above;

na decrease of approximately $23 million as a result of the

deferral or capitalization of storm restoration costs for

Hurricane Gustav and Hurricane Ike, which hit the Utility’s

service territories in September 2008;

nan increase of $18 million in storm damage charges as a result

of several storms hitting Entergy Arkansas’ service territory in

2008, including Hurricane Gustav and Hurricane Ike in the

third quarter 2008. Entergy Arkansas discontinued regulatory

storm reserve accounting beginning July 2007 as a result of

the APSC order issued in Entergy Arkansas’ base rate case.

As a result, non-capital storm expenses of $41 million were

charged in 2008 to other operation and maintenance expenses.

In December 2008, $19 million of these storm expenses were

deferred per an APSC order and will be recovered through

revenues in 2009. See Note 2 to the financial statements for

discussion of the APSC order; and

nan increase of $17 million in fossil plant expenses due to the

Ouachita plant acquisition in 2008.

Depreciation and amortization expenses increased primarily

due to:

na revision in the third quarter 2007 related to depreciation

on storm cost-related assets. Recoveries of the costs of those

assets are now through the Act 55 financing of storm costs, as

approved by the LPSC in the third quarter 2007. See “Liquidity

and Capital Resources - Hurricane Katrina and Hurricane Rita”

below and Note 2 to the financial statements for a discussion of

the Act 55 storm cost financing;

na revision in the fourth quarter 2008 of estimated depreciable

lives involving certain intangible assets in accordance with

formula rate plan treatment; and

nan increase in plant in service.

Other income increased primarily due to dividends earned of

$29.5 million by Entergy Louisiana and $10.3 million by Entergy Gulf

States Louisiana on investments in preferred membership interests of

Entergy Holdings Company. This increase was substantially offset by

the cessation of carrying charges on storm restoration costs as a result

of the Act 55 storm cost financing in 2007 and lower interest earned on

the decommissioning trust funds. The dividends on preferred stock

are eliminated in consolidation and have no effect on net income

since the investment is in another Entergy subsidiary.

Non-Utility Nuclear

Other operation and maintenance expenses increased from

$760 million in 2007 to $773 million in 2008. This increase was

primarily due to deferring costs for amortization from three

refueling outages in 2008 compared to four refueling outages

in 2007 and to a $34 million increase associated with owning the

Palisades plant, which was acquired in April 2007, for the entire

32

ENTERGY CORPORATION AND SUBSIDIARIES 2008

Management’s Financial Discussion and Analysis continued