Entergy 2008 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2008 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

34

ENTERGY CORPORATION AND SUBSIDIARIES 2008

Management’s Financial Discussion and Analysis continued

34

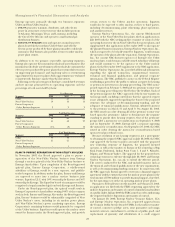

As discussed above, Entergy New Orleans was reconsolidated

retroactive to January 1, 2007 and its results are included in each

individual income statement line item for 2007. The variance

explanations for the Utility for 2007 compared to 2006 in “Results

of Operations” reflect the 2006 results of operations of Entergy

New Orleans as if it were reconsolidated in 2006, consistent with

the 2007 presentation including the results in each individual

income statement line item. Entergy’s as-reported results for

2006, which had Entergy New Orleans deconsolidated, and the

amounts needed to reconsolidate Entergy New Orleans, which

include intercompany items, are set forth in the table below

(in thousands):

For the Year Ended December 31, 2006

Entergy

Corporation Entergy

and Subsidiaries New Orleans

(as-reported) adjustment*

Operating revenues $10,932,158 $305,077

Operating expenses:

Fuel, fuel-related, and gas purchased

for resale and purchased power 5,282,310 113,888

Other operation and maintenance 2,335,364 100,094

Taxes other than income taxes 428,561 34,953

Depreciation and amortization 887,792 31,465

Other regulatory charges (credits) - net (122,680) 4,160

Other operating expenses 315,451 169

Total operating expenses $ 9,126,798 $284,729

Other income $ 348,587 $ (8,244)

Interest and other charges $ 577,805 $ 7,053

Income from continuing operations

before income taxes $ 1,576,142 $ 5,051

Income taxes $ 443,044 $ 5,051

Consolidated Net Income $ 1,132,602 $ –

* Reflects the adjustment needed to reconsolidate Entergy New Orleans

for 2006. The adjustment includes intercompany eliminations.

Net Revenue

Utility

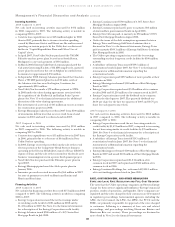

Following is an analysis of the change in net revenue comparing

2007 to 2006 (in millions):

2006 Net Revenue (includes $187 million for

Entergy New Orleans) $4,458

Retail electric price 90

Volume/weather 89

Fuel recovery 52

Transmission revenue 38

Purchased power capacity (90)

Net wholesale revenue (59)

Other 40

2007 Net Revenue $4,618

The retail electric price variance resulted from rate increases

primarily at Entergy Louisiana effective September 2006 for

the 2005 formula rate plan filing to recover LPSC-approved

incremental deferred and ongoing purchased power capacity

costs. The formula rate plan filing is discussed in Note 2 to the

financial statements.

The volume/weather variance resulted primarily from increased

electricity usage in the residential and commercial sectors,

including increased usage during the unbilled sales period.

Billed retail electricity usage increased by a total of 1,591 GWh,

an increase of 1.6%. See “Critical Accounting Estimates” herein

and Note 1 to the financial statements for a discussion of the

accounting for unbilled revenues.

The fuel recovery variance is primarily due to the inclusion of

Grand Gulf costs in Entergy New Orleans’ fuel recoveries effective

July 1, 2006. In June 2006, the City Council approved the recovery

of Grand Gulf costs through the fuel adjustment clause, without

a corresponding change in base rates (a significant portion of

Grand Gulf costs was previously recovered through base rates).

The increase is also due to purchased power costs deferred at

Entergy Louisiana and Entergy New Orleans as a result of the

re-pricing, retroactive to 2003, of purchased power agreements

among Entergy system companies as directed by the FERC.

The transmission revenue variance is due to higher rates and

the addition of new transmission customers in late-2006.

The purchased power capacity variance is due to higher capacity

charges and new purchased power contracts that began in mid-

2006. A portion of the variance is due to the amortization of

deferred capacity costs and is offset in base revenues due to base

rate increases implemented to recover incremental deferred and

ongoing purchased power capacity charges at Entergy Louisiana,

as discussed above.

The net wholesale revenue variance is due primarily to 1) more

energy available for resale at Entergy New Orleans in 2006 due to

the decrease in retail usage caused by customer losses following

Hurricane Katrina and 2) the inclusion in 2006 revenue of sales

into the wholesale market of Entergy New Orleans’ share of

the output of Grand Gulf, pursuant to City Council approval

of measures proposed by Entergy New Orleans to address the

reduction in Entergy New Orleans’ retail customer usage caused

by Hurricane Katrina and to provide revenue support for the costs

of Entergy New Orleans’ share of Grand Gulf. The net wholesale

revenue variance is partially offset by the effect of lower wholesale

revenues in the third quarter 2006 due to an October 2006 FERC

order requiring Entergy Arkansas to make a refund to a coal plant

co-owner resulting from a contract dispute.

Non-Utility Nuclear

Following is an analysis of the change in net revenue comparing

2007 to 2006 (in millions):

2006 Net Revenue $1,388

Realized price changes 264

Palisades acquisition 209

Volume variance (other than Palisades) (56)

Other 34

2007 Net Revenue $1,839

As shown in the table above, net revenue increased for Non-

Utility Nuclear by $451 million, or 33%, for 2007 compared to

2006 primarily due to higher pricing in its contracts to sell power

and additional production available resulting from the acquisition

of the Palisades plant in April 2007. Included in the Palisades net

revenue is $50 million of amortization of the Palisades purchased

power agreement in 2007, which is non-cash revenue and is

discussed in Note 15 to the financial statements. The increase was

partially offset by the effect on revenues of four refueling outages

in 2007 compared to two in 2006. Following are key performance

measures for Non-Utility Nuclear for 2007 and 2006:

2007 2006

Net MW in operation at December 31 4,998 4,200

Average realized price per MWh $52.69 $44.33

GWh billed 37,570 34,847

Capacity factor 89% 95%

Refueling outage days:

FitzPatrick – 27

Indian Point 2 – 31

Indian Point 3 24 –

Palisades 42 –

Pilgrim 33 –

Vermont Yankee 24 –