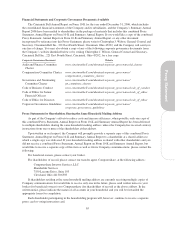

Cincinnati Bell 2006 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2006 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

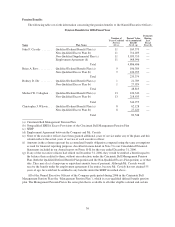

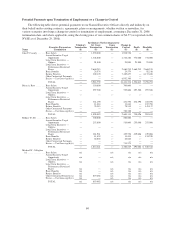

Name

Executive Payment on

Termination

Voluntary

Termination

($)

Involuntary Not

for Cause

Termination

($)

Involuntary for

Cause

Termination

($)

Change in

Control

($)

Death

($)

Disability

($)

Christopher J. Wilson Base Salary — 250,000 — 500,000 — —

Annual Incentive Target

Opportunity — 125,000 — 250,000 125,000 125,000

Long Term Incentives —

Options — — — — — —

Long Term Incentives —

Performance Restricted Shares — 222,582 — 272,281 272,281 272,281

Basic Benefits — 9,334 — 9,334 — 149,636

Retiree Benefits — 30,208 — 30,208 — 97,428

Other Contractual Payments — — — — — —

Excise — Tax Gross-up (b)(c) — — — 451,251 — —

TOTAL — 637,124 — 1,513,074 397,281 644,345

(a) Mr. Callaghan retired December 31, 2006, which was deemed an involuntary termination pursuant to the

terms of his employment agreement, and the table reflects benefits received by Mr. Callaghan as a result.

Pursuant to his employment agreement with the Company, Mr. Callaghan was entitled to a payment equal to

two times the sum of his base salary plus target bonus since he elected to terminate his employment with the

Company by December 31, 2006. In addition, Mr. Callaghan is entitled to continue his medical, dental,

vision and life insurance at active employee contribution rates until December 31, 2008. Mr. Callaghan also

received an additional amount equal to the present value of an additional two years of participation in the

Management Pension Plan based on his base salary and target bonus in effect on December 31, 2006.

(b) These amounts are meant to defray related tax liabilities related to a change in control. The discount rate used

for retiree benefit parachute values was 5.75%, consistent with financial statements for purposes of FAS 87.

(c) The executives are subject to restrictive covenants post-termination that were, in part, consideration for

compensation of benefits. The value of these restrictive covenants would be favorable and were not

considered for this calculation.

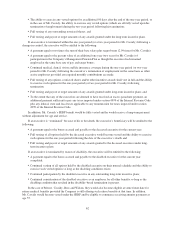

If any of the executives elects to voluntarily terminate employment with the Company, or if they are

terminated by the Company for cause, they are entitled to no payments from the Company other than those

benefits in which they have a non-forfeitable vested right to receive, which include any shares of stock they own

outright, vested options which may be exercisable for a period of 90 days following termination, deferred

compensation amounts and vested amounts under the Company’s pension and savings plans. Mr. Cassidy,

however, is entitled to receive payment of the nonqualified retirement benefit of $968,996 provided for in his

employment agreement in which he is already vested. Payment of such accrued, vested and non-forfeitable

amounts is also applicable to each of the other four termination scenarios detailed in the above table and

discussed below and each executive is still bound by the non-disclosure, non-compete and non-solicitation

provisions of their agreements.

If an executive is terminated by the Company without cause, the executive will be entitled to the following:

•A payment equal to the sum of the executive’s base salary plus target bonus (two times the sum in the case

of Mr. Cassidy);

•A payment equal to the present value of an additional one year (two years for Mr. Cassidy) of

participation in the Company’s Management Pension Plan as though the executive had remained

employed at the same base rate of pay and target bonus;

•Continued medical, dental, vision and life insurance benefits during the one-year period (or two-year

period for Mr. Cassidy) following the executive’s termination of employment on the same basis as any

active salaried employee provided any required monthly contributions are made;

•Continued treatment as an active employee during the one-year period following termination with respect

to any outstanding long-term incentive cycles the executive may be participating in and any unvested

stock options will continue to vest under the normal vesting schedule as though the executive was still an

active employee;

61

Proxy Statement