Cincinnati Bell 2006 Annual Report Download - page 194

Download and view the complete annual report

Please find page 194 of the 2006 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

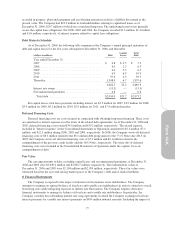

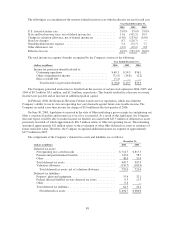

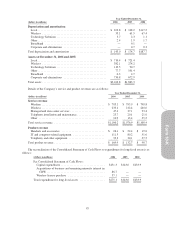

11. Shareowners’ Deficit

Common Shares

The par value of the Company’s common shares is $0.01 per share. At December 31, 2006 and 2005,

common shares outstanding were 247.5 million and 247.2 million, respectively. In 1999, the Company’s Board

of Directors approved a share repurchase program authorizing the repurchase of up to $200 million of common

shares of the Company. The Company’s common shares outstanding are net of approximately 8.2 million and

7.9 million shares at December 31, 2006 and 2005, respectively, that were repurchased by the Company under its

share repurchase program and certain management deferred compensation arrangements for a total cost of $146.8

million and $145.5 million at December 31, 2006 and 2005, respectively.

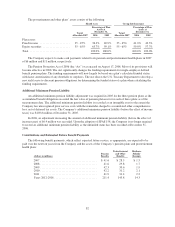

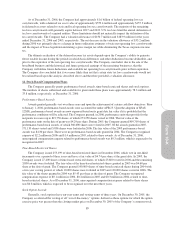

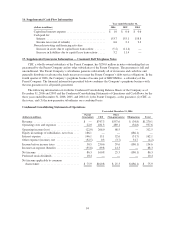

Preferred Share Purchase Rights Plan

In 1997, the Company’s Board of Directors adopted a Share Purchase Rights Plan by granting a dividend of

one preferred share purchase right for each outstanding common share to shareowners of record at the close of

business on May 2, 1997. Under certain conditions, each right entitles the holder to purchase one-thousandth of a

Series A Preferred Share. The rights cannot be exercised or transferred apart from common shares, unless a

person or group acquires 15% or more, or 20% or more for certain groups, of the Company’s outstanding

common shares. The rights will expire May 2, 2007, if they have not been redeemed. The plan was amended in

2002. Under the original plan, no single entity was allowed to hold 15% of the Company’s outstanding shares.

The amendment increased the allowed threshold from 15% to 20% for an investment adviser within the meaning

of the Investment Advisers Act of 1940, and/or its affiliates.

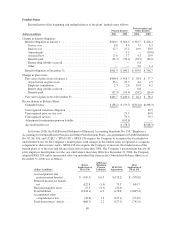

Preferred Shares

The Company is authorized to issue 1,357,299 voting preferred shares without par value and 1,000,000

nonvoting preferred shares without par value.

The Company issued 155,250 voting shares of 6

3

⁄

4

% cumulative convertible preferred stock at stated value.

These shares were subsequently deposited into a trust in which the underlying 155,250 shares are equivalent to

3,105,000 depositary shares. Shares of this preferred stock can be converted at any time at the option of the

holder into common stock of the Company at a conversion rate of 1.44 shares of Company common stock per

depositary share of 6

3

⁄

4

% cumulative convertible preferred stock. Annual dividends on the outstanding 6

3

⁄

4

%

cumulative convertible preferred stock of $10.4 million are payable quarterly in arrears in cash, or in common

stock in certain circumstances if cash payment is not legally permitted. The liquidation preference on the 6

3

⁄

4

%

cumulative convertible preferred stock is $1,000 per share (or $50 per depositary share). The Company paid

$10.4 million in dividends in 2006, 2005 and 2004.

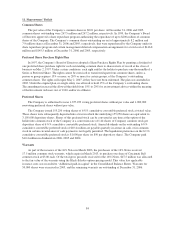

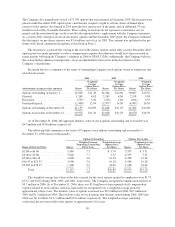

Warrants

As part of the issuance of the 16% Notes in March 2003, the purchasers of the 16% Notes received

17.5 million common stock warrants, which expire in March 2013, to purchase one share of Cincinnati Bell

common stock at $3.00 each. Of the total gross proceeds received for the 16% Notes, $47.5 million was allocated

to the fair value of the warrants using the Black-Scholes option-pricing model. This value less applicable

issuance costs was recorded to “Additional paid-in capital” in the Consolidated Balance Sheets. Warrants for

50,000 shares were exercised in 2005, and the remaining warrants are outstanding at December 31, 2006.

84