Cincinnati Bell 2006 Annual Report Download - page 198

Download and view the complete annual report

Please find page 198 of the 2006 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

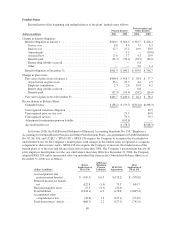

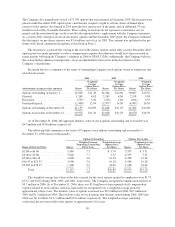

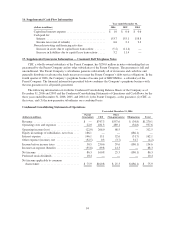

The following is a reconciliation of the statutory federal income tax rate with the effective tax rate for each year:

Year Ended December 31,

2006 2005 2004

U.S. federal statutory rate ........................................ 35.0% 35.0% 35.0%

State and local income taxes, net of federal income tax ................ 11.6 (101.2) 10.5

Change in valuation allowance, net of federal income tax .............. (14.0) (253.6) (18.0)

State law changes .............................................. 8.7 (120.7) —

Nondeductible interest expense ................................... 5.4 (72.7) 7.7

Other differences, net ........................................... (2.5) (19.2) 0.8

Effective tax rate .............................................. 44.2% (532.4)% 36.0%

The total income tax expense (benefit) recognized by the Company consists of the following:

Year Ended December 31,

(dollars in millions) 2006 2005 2004

Income tax provision (benefit) related to:

Continuing operations ............................... $68.3 $ 54.3 $36.1

Other comprehensive income ......................... (71.9) (24.6) (2.2)

Effect of SAB 108 .................................. (5.2) — —

Total income tax provision (benefit) .................. $ (8.8) $29.7 $33.9

The Company generated an income tax benefit from the exercise of certain stock options in 2006, 2005, and

2004 of $0.7 million, $0.1 million, and $1.3 million, respectively. This benefit resulted in a decrease in current

income taxes payable and an increase in additional paid-in capital.

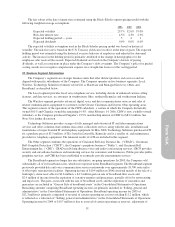

In February 2006, the Kentucky Revenue Cabinet issued state tax regulations, which may limit the

Company’s ability to use its state net operating loss carryforwards against future state taxable income. The

Company recorded a one-time income tax charge of $3.6 million in the first quarter of 2006.

On June 30, 2005, legislation was passed in the state of Ohio instituting a gross receipts tax and phasing out

Ohio’s corporate franchise and income tax over a five year period. As a result of this legislation, the Company

does not expect it will be able to realize income tax benefits associated with $47.5 million of deferred tax assets

previously recorded, of which approximately $36.5 million relates to Ohio net operating losses. The remaining

amount of approximately $11 million relates to the revaluation of other Ohio deferred tax assets to estimates of

future realizable value. Therefore, the Company recognized additional income tax expense of approximately

$47.5 million in 2005.

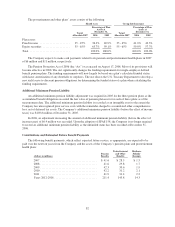

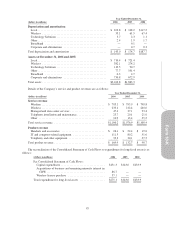

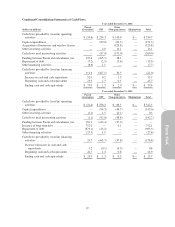

The components of the Company’s deferred tax assets and liabilities are as follows:

December 31,

(dollars in millions) 2006 2005

Deferred tax assets:

Net operating loss carryforwards ............................ $714.7 $ 817.3

Pension and postretirement benefits .......................... 147.0 58.7

Other .................................................. 48.0 31.9

Total deferred tax assets ................................... 909.7 907.9

Valuation allowance ...................................... (150.7) (183.9)

Total deferred tax assets, net of valuation allowance ........... 759.0 724.0

Deferred tax liabilities:

Property, plant and equipment .............................. 55.4 32.1

Federal deferred liability on state deferred tax assets ............ 8.3 11.3

Other .................................................. 0.6 —

Total deferred tax liabilities ................................ 64.3 43.4

Net deferred tax assets .................................. $694.7 $ 680.6

88