Cincinnati Bell 2006 Annual Report Download - page 189

Download and view the complete annual report

Please find page 189 of the 2006 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

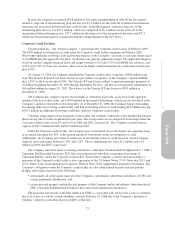

The actuarial expense calculation for the Company’s postretirement health plan is based on numerous

assumptions, estimates, and judgments including health care cost trend rates and cost sharing with retirees. The

Company’s collectively bargained-for labor contracts have historically had limits on the Company-funded

portion of retiree medical costs (referred to as “caps”). However, prior to the May 2005 labor agreement, the

Company had waived the premiums in excess of the caps for bargained-for retirees who retired during the

contract period. Similar benefits have been provided to non-bargained retirees. Prior to December 31, 2004, the

Company’s actuarial calculation of retiree medical costs included the assumption that the caps were in place in

accordance with the terms of the collectively bargained-for agreement.

Effective December 31, 2004, based on its past practice of waiving the retiree medical cost caps, the

Company began accounting for its retiree medical benefit obligation as if there were no caps. The accounting

using this assumption remained in effect through May 2005.

In May 2005, the Company reached an agreement with the union for bargained-for employees as to the

terms of a new labor contract. Employees retiring under the new agreement are provided Company-sponsored

healthcare through the use of individual Health Reimbursement Accounts (“HRAs”), which provides for

Company contributions of a fixed amount per retiree that the retiree can use to purchase their healthcare from

among the various plans offered. The Company agreed to increase the HRA amount annually over the life of the

labor agreement. The retiree pays for healthcare premiums and other costs in excess of the HRA amount.

Contrary to past practice, no agreement was made to waive the implementation of this cost-sharing feature.

Based on this new agreement, effective June 1, 2005, the Company modified its assumptions for the actuarial

calculation of retiree medical costs, including assumptions regarding cost sharing by retirees. The assumption

change for cost sharing with retirees was the primary cause for the $14.4 million increase in postretirement and

other benefits expense in 2005 compared to 2004. Postretirement medical and other expense was $35.3 million,

$35.9 million, and $21.5 million for the years ended December 31, 2006, 2005 and 2004, respectively.

The Medicare Prescription Drug, Improvement and Modernization Act of 2003 expands Medicare to include

outpatient prescription drug benefits and introduces a federal non-taxable subsidy beginning in 2006, that

provides a benefit that is at least actuarially equivalent to Medicare Part D, to sponsors of retiree health care

benefit plans. The Company received a subsidy of $0.8 million in 2006.

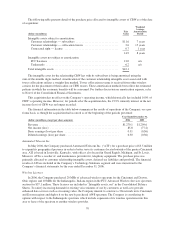

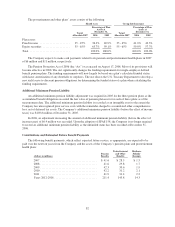

Components of Net Periodic Cost

The following information relates to all Company noncontributory defined benefit pension plans,

postretirement health care, and life insurance benefit plans. Pension and postretirement benefit costs for these

plans were comprised of:

Pension Benefits

Postretirement and

Other Benefits

(dollars in millions) 2006 2005 2004 2006 2005 2004

Service cost ........................................ $ 8.8 $ 8.0 $ 8.1 $ 3.5 $ 4.3 $ 2.1

Interest cost on projected benefit obligation ............... 27.7 27.2 27.3 19.9 20.5 16.3

Expected return on plan assets ......................... (34.9) (38.2) (41.4) (4.8) (5.6) (6.3)

Special termination benefit ............................ — — 10.5———

Amortization of:

Transition (asset)/obligation ......................... — (1.1) (1.8) 4.2 4.2 4.2

Prior service cost .................................. 3.4 3.3 3.1 7.7 10.3 3.8

Net (gain) loss .................................... 3.9 2.2 (0.9) 4.8 2.2 1.4

Benefit costs ....................................... $ 8.9 $ 1.4 $ 4.9 $35.3 $35.9 $21.5

79