Cincinnati Bell 2006 Annual Report Download - page 158

Download and view the complete annual report

Please find page 158 of the 2006 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Statutory changes enacted by the Ohio General Assembly in August 2005 give the Public Utilities

Commission of Ohio (the “PUCO”) the authority to provide ILECs with pricing flexibility for basic local rates

upon a showing that consumers have sufficient competitive alternatives (House Bill 218). In May 2006, the

PUCO adopted rules in accordance with the new law to establish more detailed requirements for Ohio ILECs to

apply for this additional pricing flexibility. On August 7, 2006, the Company applied for authority to increase its

rates for basic local exchange service in certain of its exchanges. In November 2006, the PUCO granted the

Company’s application. In January 2007, the PUCO denied a request, by the Ohio Consumer Counsel, for a

re-hearing.

Recently Issued Accounting Standards

Staff Accounting Bulletin No. 108

In September 2006, the SEC issued Staff Accounting Bulletin No. 108, “Considering the Effects of Prior

Year Misstatements When Quantifying Misstatements in Current Year Financial Statements,” (“SAB 108”)

which provides interpretive guidance on how registrants should quantify financial statement misstatements.

Under SAB 108, registrants are required to consider both a “rollover” method, which analyzes the impact of the

misstatement on the financial statements based on the amount of the error originating in the income statement

being analyzed, and the “iron curtain” method, which analyzes the impact of the misstatement on the financial

statements based on the cumulative effect of the error on the income statement being analyzed. The transition

provisions of SAB 108 permit a registrant to adjust retained earnings for the cumulative effect of immaterial

errors relating to prior years. The Company was required to adopt SAB 108 in 2006.

As of December 31, 2006, the Company has recorded a net adjustment of $9.0 million to opening retained

earnings comprised of $14.2 million in operating tax liabilities, net of expected refunds, offset by the income tax

effects of $5.2 million. The Company has determined that its past filing positions should have resulted in an

accrual of a contingent liability in prior years. Historically, the Company has evaluated uncorrected differences

utilizing the rollover approach. The Company believes the impact of not recording the operating taxes was not

material to prior fiscal years under the rollover method. However, under SAB 108, adopted in 2006, the

Company must assess materiality using both the rollover method and the iron-curtain method, which resulted in

the $9.0 million adjustment to opening retained earnings.

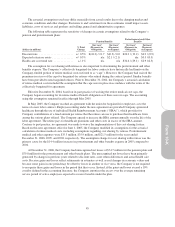

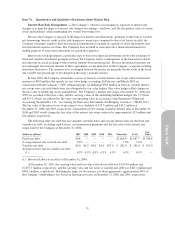

The expense from the cumulative error arose from the following periods:

(dollars in millions) 2005 2004 Prior to 2004

Expense adjustment before income taxes ................. $5.3 $3.1 $5.8

Expense adjustment after income taxes .................. $3.3 $2.0 $3.7

The after-tax amounts for 2006 associated with the first three quarters of the year were $0.9 million in the

first quarter, $0.9 million in the second quarter, and $0.6 million in the third quarter, and have been determined to

be immaterial to those quarters. Accordingly, the entire impact for 2006 has been recorded in the fourth quarter.

The Company believes it has meritorious defenses related to the payment of these operating taxes and

intends to defend its position in order to limit the ultimate payment of the fees.

Other Recently Issued Accounting Standards

In February 2006, the FASB issued Statement of Financial Accounting Standards No. 155, “Accounting for

Certain Hybrid Financial Instruments: an amendment of FASB Statements No. 133 and 140.” The objective of

the Statement is to simplify accounting for certain hybrid financial instruments, eliminate interim guidance in

Statement 133 Implementation Issue No. D1 “Application of Statement 133 to Beneficial Interests in Securitized

Financial Assets,” and eliminate a restriction on the passive derivative instruments that a qualifying special-

purpose entity may hold. This Statement is effective for all financial instruments acquired or issued after the

beginning of the entity’s first fiscal year that begins after September 15, 2006. Implementation of this Statement

is not expected to have a material impact on the Company’s financial statements.

In June 2006, the FASB ratified Emerging Issues Task Force Issue No. 06-3, “How Taxes Collected from

Customers and Remitted to Governmental Authorities Should Be Presented in the Income Statement” (“EITF

06-3”). This guidance requires that taxes imposed by a governmental authority on a revenue producing

48