Cincinnati Bell 2006 Annual Report Download - page 170

Download and view the complete annual report

Please find page 170 of the 2006 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228

|

|

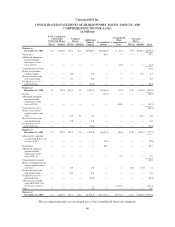

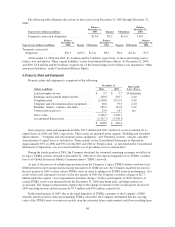

Cincinnati Bell Inc.

CONSOLIDATED STATEMENTS OF SHAREOWNERS’ EQUITY (DEFICIT) AND

COMPREHENSIVE INCOME (LOSS)

(in Millions)

6

3

⁄

4

% Cumulative

Convertible

Preferred Shares

Common

Shares Additional

Paid-in

Capital

Accumulated

Deficit

Accumulated

Other

Comprehensive

Loss

Treasury

Shares

Shares Amount Shares Amount Shares Amount Total

Balance at

December 31, 2003 3.1 $129.4 252.3 $2.5 $2,940.7 $(3,604.2) $ (2.3) (7.9) $(145.5) $(679.4)

Net income ........... — — — — — 64.2 — — — 64.2

Additional minimum

pension liability

adjustment, net of

taxes of $2.2 ........ — — — — — — (3.2) — — (3.2)

Comprehensive income 61.0

Shares issued under

employee plans ...... — — 0.9 — 3.6 — — — 0.1 3.7

Restricted stock grant

and amortization ..... — — 0.1 — 0.6 — — — — 0.6

Dividends on 6

3

⁄

4

%

preferred stock ....... — — — — (10.4) — — — — (10.4)

Balance at

December 31, 2004 3.1 129.4 253.3 2.5 2,934.5 (3,540.0) (5.5) (7.9) (145.4) (624.5)

Net loss .............. — — — — — (64.5) — — — (64.5)

Additional minimum

pension liability

adjustment, net of

taxes of $24.6 ....... — — — — — — (44.1) — — (44.1)

Comprehensive loss (108.6)

Shares issued under

employee plans and

other ............... — — 0.9 0.1 4.0 — — — (0.1) 4.0

Restricted stock grant

and amortization ..... — — 0.8 — 1.8 — — — — 1.8

Dividends on 6

3

⁄

4

%

preferred stock ....... — — — — (10.4) — — — — (10.4)

Balance at

December 31, 2005 3.1 129.4 255.0 2.6 2,929.9 (3,604.5) (49.6) (7.9) (145.5) (737.7)

Adjustment to opening

accumulated deficit, net

of taxes of $5.2 ...... — — — — — (9.0) — — — (9.0)

Net income ........... — — — — — 86.3 — — — 86.3

Additional minimum

pension liability

adjustment, net of

taxes of $(1.4) ....... — — — — — — 2.2 — — 2.2

Comprehensive income 88.5

Shares issued/(purchased)

under employee plans

and other ........... — — 0.5 — 2.6 — — (0.3) (1.3) 1.3

Restricted stock grant

and amortization ..... — — 0.2 — 2.0 — — — — 2.0

Dividends on 6

3

⁄

4

%

preferred stock ....... — — — — (10.4) — — — — (10.4)

Adjustment to initially

apply SFAS No. 158,

net of taxes of $73.3 . . — — — — — — (127.1) (127.1)

Other ................ — — — — 0.8 — — — — 0.8

Balance at

December 31, 2006 3.1 $129.4 255.7 $2.6 $2,924.9 $(3,527.2) $(174.5) (8.2) $(146.8) $(791.6)

The accompanying notes are an integral part of the consolidated financial statements.

60