Cincinnati Bell 2006 Annual Report Download - page 179

Download and view the complete annual report

Please find page 179 of the 2006 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

the use of the asset. Therefore, an impairment charge of $18.6 million was recorded in the fourth quarter of 2005

to record the TDMA assets at fair value. The Company calculated the fair value of the assets based on the

appraised amount at which the assets could be sold in a current transaction between willing parties. The

impairment charge was recorded in the Consolidated Statements of Operations under the caption “Asset

impairments and other charges.” After the impairment charges, the carrying value of the TDMA assets was less

than $1 million at December 31, 2005.

To satisfy increasing demand for existing voice minutes of use by customers as well as to provide enhanced

data services such as streaming video, the Company intends to construct a third generation (“3G”) network and

deploy it on the newly purchased Advanced Wireless Services (“AWS’’) spectrum. Due to this implementation,

lives of certain GSM assets were shortened and depreciation has been accelerated based on the new useful life.

The increase in depreciation due to this acceleration was approximately $1.3 million in the fourth quarter of

2006.

During 2004, the Company retired certain assets with a net book value of $3.5 million and recorded the

charge in the Consolidated Statements of Operations under the caption “Asset impairments and other charges.”

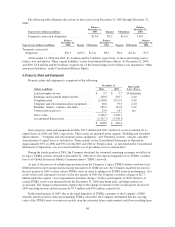

5. Acquisitions of Businesses and Wireless Licenses

Acquisition of Remaining Interest in Cincinnati Bell Wireless LLC

On February 14, 2006, the Company purchased Cingular’s 19.9% membership interest in Cincinnati Bell

Wireless LLC (“CBW”). As a result, the Company paid purchase consideration of $83.0 million in cash to

Cingular and incurred transaction expenses of $0.2 million. CBW is now a wholly-owned subsidiary of the

Company. The Company funded the purchase with its Corporate credit facility and available cash.

The transaction was accounted for as a step acquisition using the purchase method of accounting in

accordance with Statement of Financial Accounting Standards No. 141, “Business Combinations.” The Company

applied the purchase price against the minority interest and then allocated the remainder to identifiable tangible

and intangible assets and liabilities acquired as follows:

(dollars in millions)

Minority interest ...................... $27.8

Intangible assets ...................... 42.1

Goodwill ............................ 10.2

Other ............................... 3.1

Total purchase price ................... $83.2

The purchase price allocation was based upon the estimated fair values as of February 14, 2006 of the

tangible and intangible assets and liabilities. Estimated fair value was compared to the book value already

recorded, and 19.9% of the excess of estimated fair value over book value was allocated to the respective

tangible and intangible assets and liabilities. The excess purchase price over the minority interest and fair value

ascribed to the tangible and intangible assets and liabilities was recorded as goodwill. The Company anticipates

both the goodwill and intangible assets to be fully deductible for tax purposes.

69