Cincinnati Bell 2006 Annual Report Download - page 183

Download and view the complete annual report

Please find page 183 of the 2006 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

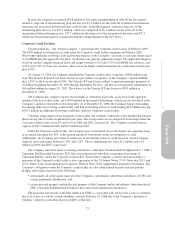

In total, the Company recognized $99.8 million of loss upon extinguishment of debt. In the first quarter,

related to stage one of the refinancing plan, the loss was $7.9 million for the write-off of unamortized deferred

financing fees associated with the previous credit facility. In the third quarter, related to stage two of the

refinancing plan, the loss was $91.9 million, which was composed of $9.1 million for the write-off of the

unamortized deferred financing fees, $27.7 million for the write-off of the unamortized discount, and $55.1

million for the premium paid in conjunction with the extinguishment of the 16% Notes.

Corporate Credit Facilities

Cincinnati Bell Inc., (the “Parent Company”), entered into the Corporate credit facility in February 2005.

The $250 million revolving line of credit under the Corporate credit facility terminates in February 2010.

Borrowings under the revolving credit facility bear interest, at the Company’s election, at a rate per annum equal

to (i) LIBOR plus the applicable margin or (ii) the base rate plus the applicable margin. The applicable margin is

based on certain Company financial ratios and ranges between 1.25% and 2.25% for LIBOR rate advances, and

0.25% and 1.25% for base rate advances. Base rate is the higher of the bank prime rate or the federal funds rate

plus 0.50%.

On August 31, 2005, the Company amended the Corporate credit facility to include a $400 million term

loan. The Tranche B Term Loan bears interest at a per annum rate equal to, at the Company’s option, LIBOR

plus 1.50% or the base rate plus 0.50%. The Tranche B Term Loan is subject to quarterly principal payments of

$1 million beginning December 31, 2005 through September 30, 2011, and then in four quarterly installments of

$94 million ending on August 31, 2012. The balance on the Tranche B Term Loan was $395 million at

December 31, 2006.

The Company has a right to request, but no lender is committed to provide, an increase in the aggregate

amount of the new credit facility, up to $500 million in incremental borrowings, which may be structured at the

Company’s option as term debt or revolving debt. As of December 31, 2006, the Company had no outstanding

borrowings under its revolving credit facility, and had outstanding letters of credit totaling $4.8 million, leaving

$245.2 million in additional borrowing availability under its Corporate credit facility.

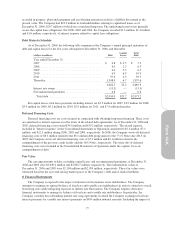

Voluntary prepayments of the Corporate credit facility and voluntary reductions of the unutilized portion of

the revolving line of credit are permitted at any time. The average interest rate charged on borrowings under the

Corporate credit facility was 6.6% and 5.6% in 2006 and 2005, respectively. The Company recorded interest

expense of $27.9 million in 2006 and $9.5 million in 2005.

Under the Corporate credit facility, the Company pays commitment fees to the lenders on a quarterly basis

at an annual rate equal to 0.50% of the unused amount of borrowings on the revolving line of credit.

Additionally, the Company pays letter of credit fees on outstanding letters of credit based on certain Company

financial ratios and ranges between 1.25% and 2.25%. These commitment fees were $1.2 million and $1.4

million in 2006 and 2005, respectively.

The Company and all its future or existing subsidiaries (other than Cincinnati Bell Telephone LLC (“CBT”),

Cincinnati Bell Extended Territories LLC and certain immaterial subsidiaries) guarantee borrowings of

Cincinnati Bell Inc. under the Corporate credit facility. Each of the Company’s current subsidiaries that is a

guarantor of the Corporate credit facility is also a guarantor of the 7% Senior Notes, 7

1

⁄

4

% Notes due 2013, and

8

3

⁄

8

% Notes, with certain immaterial exceptions. Refer to Note 18 for supplemental guarantor information. The

Company’s obligations under the Corporate credit facility are also collateralized by perfected first priority

pledges and security interests in the following:

•substantially all of the equity interests of the Company’s subsidiaries (other than subsidiaries of CBT and

certain immaterial subsidiaries); and,

•certain personal property and intellectual property of the Company and its subsidiaries (other than that of

CBT, Cincinnati Bell Extended Territories LLC and certain immaterial subsidiaries).

The guarantee and security reflect the addition of CBW as a guarantor and certain of its assets as collateral

due to its status as a wholly-owned subsidiary effective February 14, 2006 due to the Company’s purchase of

Cingular’s minority ownership interest in CBW on that date.

73