Cincinnati Bell 2006 Annual Report Download - page 173

Download and view the complete annual report

Please find page 173 of the 2006 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

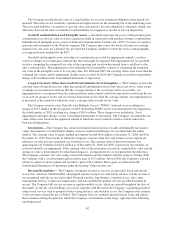

Advanced billings for customer wireline phone service connection and activation are deferred and amortized

into revenue on a straight-line basis over the average customer life. The associated connection and activation

costs, to the extent of the upfront fees, are also deferred and amortized on a straight-line basis over the average

customer life. For wireless activation revenue, since activation costs exceed activation revenues, both the

activation revenue and associated costs are recorded upon the sale of the wireless handset.

With respect to arrangements with multiple deliverables, the Company follows the guidance in EITF 00-21,

“Revenue Arrangements with Multiple Deliverables,” to determine whether more than one unit of accounting

exists in an arrangement. To the extent that the deliverables are separable into multiple units of accounting, total

consideration is allocated to the individual units of accounting based on their relative fair value, determined by

the price of each deliverable when it is regularly sold on a stand-alone basis. Revenue is recognized for each unit

of accounting as delivered or as service is performed depending on the nature of the deliverable comprising the

unit of accounting.

The Company recognizes equipment revenue generally upon the performance of contractual obligations,

such as shipment, delivery, installation or customer acceptance. The Company is a distributor of IT and

telephony equipment and considers the criteria of EITF 99-19, “Reporting Revenue Gross as a Principal versus

Net as an Agent,” when recording revenue, such as title transfer, risk of product loss, and collection risk. Based

on this guidance, these equipment revenues and associated costs have generally been recorded on a gross basis,

rather than recording the revenues net of the associated costs.

Pricing of local services is generally subject to oversight by both state and federal regulatory commissions.

Such regulation also covers services, competition and other public policy issues. Various regulatory rulings and

interpretations could result in adjustments to revenue in future periods. The Company monitors these proceedings

closely and adjusts revenue accordingly.

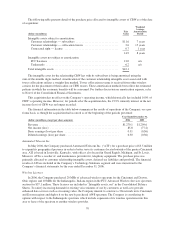

Advertising — Costs related to advertising are expensed as incurred and amounted to $26 million, $26

million, and $25 million in 2006, 2005, and 2004, respectively.

Legal Expenses — Legal costs incurred in connection with loss contingencies are expensed as incurred.

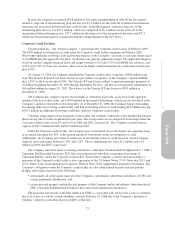

Income and Operating Taxes — The income tax provision consists of an amount for taxes currently

payable and an amount for tax consequences deferred to future periods. Deferred investment tax credits are being

amortized as a reduction of the provision for income taxes over the estimated useful lives of the related property,

plant and equipment. At December 31, 2006, the Company has $694.7 million of deferred tax assets. The

ultimate realization of the deferred income tax assets depends upon the Company’s ability to generate future

taxable income during the periods in which basis differences and other deductions become deductible and prior

to the expiration of the net operating loss carryforwards. The Company’s previous tax filings are subject to

normal reviews by regulatory agencies until the related statute of limitations expires. The Company believes

adequate provision has been made for all open tax years in accordance with the Statement of Financial

Accounting Standards No. 5, “Accounting for Contingencies.” The ultimate resolution to these issues may differ

from the amounts currently estimated, in which case an adjustment would be made to the tax provision in that

period. See “Recently Issued Accounting Standards” below for further discussion of FIN 48, which changes the

requirements for recognition of tax benefits associated with tax deductions.

The Company incurs certain operating taxes that are reported as expenses in operating income, such as

property, sales, use, and gross receipts taxes. These taxes are not included in income tax expense because the

amounts to be paid are not dependent on the level of income generated by the Company. The Company also

records expense against operating income for the establishment of liabilities related to certain operating tax audit

exposures. These liabilities are established based on the Company’s assessment of the probability of payment.

Upon resolution of audit, any remaining liability not paid is released and increases operating income.

Stock-Based Compensation — In December 2004, the Financial Accounting Standards Board (“FASB”)

issued Statement of Financial Accounting Standards No. 123(R), “Share-Based Payment” (“SFAS 123(R)”),

which is a revision of Statement of Financial Accounting Standards No. 123, “Accounting for Stock-Based

Compensation” (“SFAS 123”), and supersedes Accounting Principles Board Opinion No. 25, “Accounting for

Stock Issued to Employees” (“APB 25”). SFAS 123(R) requires all share-based payments to employees,

including grants of employee stock options, to be valued at fair value on the date of grant and to be expensed

over the applicable vesting period. The Company adopted SFAS 123(R) on January 1, 2006 using the modified

prospective application method. Under this method, SFAS 123(R) applies to new awards, awards modified,

63