Cincinnati Bell 2006 Annual Report Download - page 193

Download and view the complete annual report

Please find page 193 of the 2006 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

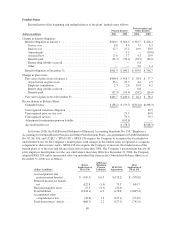

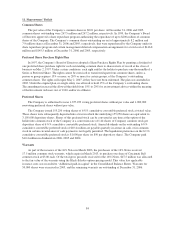

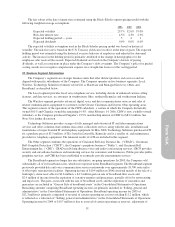

Assumptions

The following are the weighted average assumptions used in accounting for the pension and postretirement

benefit cost:

Pension Benefits

Postretirement and

Other Benefits

2006 2005 2004 2006 2005 2004

Discount rate ......................................... 5.50% 5.50% 6.00% 5.50% 5.46% 6.00%

Expected long-term rate of return on pension and health

plan assets ......................................... 8.25% 8.25% 8.25% 8.25% 8.25% 8.25%

Expected long-term rate of return on group life plan assets ..... n/a n/a n/a 8.25% 8.25% 8.00%

Future compensation growth rate ......................... 4.10% 4.10% 4.50% 4.10% 4.10% 4.50%

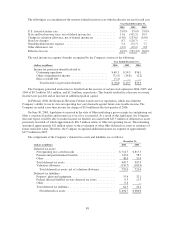

The following are the weighted average assumptions used in accounting for and measuring the pension and

postretirement benefit obligation:

Pension Benefits

Postretirement and

Other Benefits

December 31, December 31,

2006 2005 2006 2005

Discount rate ................................... 5.75% 5.50% 5.75% 5.50%

Future compensation growth rate ................... 4.10% 4.10% 4.10% 4.10%

The expected long-term rate of return on plan assets, developed using the building block approach, is based

on the participants’ benefit horizons, the mix of investments held directly by the plans, and the current view of

expected future returns, which is influenced by historical averages.

Changes in actual asset return experience and discount rate assumptions can impact the Company’s

operating results, financial position and cash flows. Actual asset return experience results in an increase or

decrease in the asset base and this effect, in conjunction with a decrease in the pension discount rate, may result

in a plan’s assets being less than a plan’s benefit obligation.

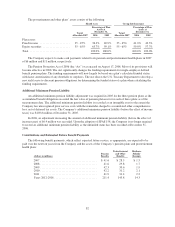

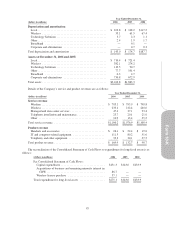

The assumed health care cost trend rate used to measure the postretirement health benefit obligation at

December 31, 2006, was 10.0% and is assumed to decrease gradually to 4.5% by the year 2013. In addition, a

one-percentage point change in assumed health care cost trend rates would have the following effect on the

postretirement benefit costs and obligation:

(dollars in millions) 1% Increase 1% Decrease

2006 service and interest costs ........................... $ 2.9 $ (2.3)

Postretirement benefit obligation at December 31, 2006 ....... $34.6 $(29.1)

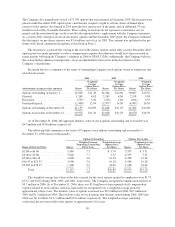

10. Minority Interest

For the periods presented in these Consolidated Financial Statements through February 14, 2006, Cingular

maintained a 19.9% ownership in CBW. The minority interest balance was adjusted as a function of Cingular’s

19.9% share of the net income (loss) of CBW, with an offsetting amount being reflected in the Consolidated

Statements of Operations under the caption “Minority interest income.” On February 14, 2006, the Company

purchased Cingular’s 19.9% membership interest in CBW for $83.2 million. As a result, CBW is now a wholly-

owned subsidiary of the Company, and for periods after the acquisition date, no further CBW minority interest

was recorded. Refer to Note 5 for discussion of the transaction.

83