Cincinnati Bell 2006 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2006 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

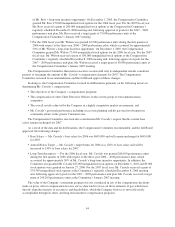

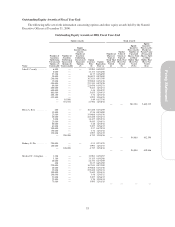

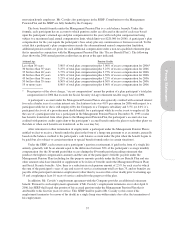

Grants of Plan-Based Awards

The following table sets forth information concerning option grants to the Named Executive Officers during the fiscal year ended December 31, 2006 as

well as estimated future payouts under cash incentive plans:

Grant of Plan-Based Awards in 2006 Fiscal Year

Name

Grant

Date

Estimated Future Payouts

Under Non-Equity Incentive

Plan Awards

Estimated Future Payouts

Under Equity Incentive Plan

Awards (a)

All Other

Stock Awards:

Number of

Shares of

Stock or Units

(#)

All Other

Option Awards:

Number of

Securities

Underlying

Options

(#) (b)

Exercise

or Base

Price of

Option

Awards

($/Sh)

Closing

Price of

Company

Shares

on Grant

Date

($/Sh)

Grant Date

Fair Value

of Stock

and Option

Awards

($) (c)

Threshold

($)

Target

($)

Maximum

($)

Threshold

(#)

Target

(#)

Maximum

(#)

John F. Cassidy ........ 01/27/06 — — — — — — — 85,000 3.49 3.48 92,208

12/08/06 — — — — — — — 574,350 4.735 4.73 935,616

03/27/06 — — — 214,875 286,500 429,750 — — — 4.36 —

Brian A. Ross .......... 12/08/06 — — — — — — — 200,000 4.735 4.73 325,800

03/27/06 — — — 46,875 62,500 93,750 — — — 4.36 —

Rodney D. Dir ......... 12/08/06 — — — — — — — 100,000 4.735 4.73 162,900

03/27/06 — — — 37,500 50,000 75,000 — — — 4.36 —

Michael W. Callaghan . . . N/A — — — — — — — — — — —

Christopher J. Wilson .... 12/08/06 — — — — — — — 100,000 4.735 4.73 162,900

03/27/06 — — — 32,625 43,500 65,250 — — — 4.36 —

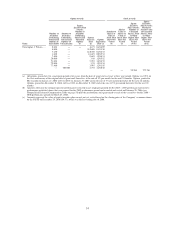

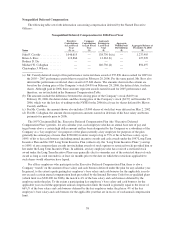

(a) The Company granted performance units to each of the executives named above, except Mr. Callaghan who retired on December 31, 2006. If the Company

attains the cumulative three-year free cash flow goal for the 2006 – 2008 performance period, each of the executives will be awarded their target units and

paid in shares of common stock. If the Company achieves 90% of the cumulative three-year free cash flow goal, each of the executives will be awarded units

equal to 75% of their original target unit grant. If the Company achieves 100% of the cumulative three-year cash flow goal, each of the executives will be

awarded units equal to 100% of their target unit grant. If the Company’s cumulative three-year free cash flow is 110% or more of the cumulative three-year

goal, each of the executives will be awarded units equal to 150% of the original target unit grant. The fair market value of one unit is equivalent to one share

of common stock and, as required under the Cincinnati Bell Inc. 1997 Long Term Incentive Plan, is determined by averaging the low and high traded price of

the Company’s stock on the NYSE on the date of grant. The average of the high and low price of the Company’s common shares on the NYSE on March 27,

2006 was $4.285.

(b) The material terms of the options granted are: grant type — non-incentive; exercise price — fair market value on grant date; vesting — 28% on the first

anniversary of the original grant date and thereafter at the rate of 3% per month for the next 24 months; term of grant — 10 years; termination — except in

the case of death, disability or retirement, any unvested options will be cancelled 90 days following termination of employment.

(c) The amounts set forth in this column represent the amount that will be expensed by the Company over the three-year vesting period. The grant date fair value

was determined using the Black-Scholes option-pricing model. For further discussion of assumptions and valuation, refer to Note 14 to our Consolidated

Financial Statements included in our Annual Report on Form 10-K for the year ended December 31, 2006.

49

Proxy Statement