Cincinnati Bell 2006 Annual Report Download - page 199

Download and view the complete annual report

Please find page 199 of the 2006 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

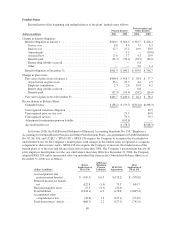

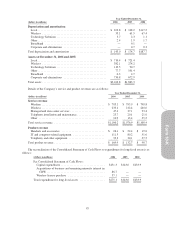

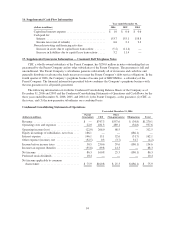

As of December 31, 2006, the Company had approximately $1.6 billion of federal operating loss tax

carryforwards, with a deferred tax asset value of approximately $559.4 million and approximately $155.3 million

in deferred tax assets related to state and local operating loss tax carryforwards. The majority of the remaining

tax loss carryforwards will generally expire between 2017 and 2023. U.S. tax laws limit the annual utilization of

tax loss carryforwards of acquired entities. These limitations should not materially impact the utilization of the

tax carryforwards. The Company had a valuation allowance of $150.7 million and $183.9 million for the years

ended December 31, 2006 and 2005, respectively. The net decrease in the valuation allowance of $33.2 million

during 2006 was primarily due to a change in future utilization estimates of state net operating loss carryforwards

and the impact of Texas legislation instituting a gross margin tax while eliminating the Texas corporate income

tax.

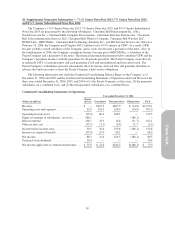

The ultimate realization of the deferred income tax assets depends upon the Company’s ability to generate

future taxable income during the periods in which basis differences and other deductions become deductible, and

prior to the expiration of the net operating loss carryforwards. The Company concluded, due to the sale of the

broadband business and the historical and future projected earnings of the remaining businesses, that the

Company will utilize future deductions and available net operating loss carryforwards prior to their expiration.

The Company also concluded that it was more likely than not that certain state tax loss carryforwards would not

be realized based upon the analysis described above and therefore provided a valuation allowance.

14. Stock-Based Compensation Plans

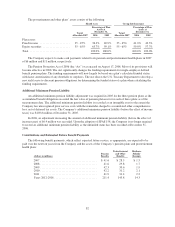

The Company generally grants performance-based awards, time-based restricted shares and stock options.

The numbers of shares authorized and available for grant under these plans were approximately 78.3 million and

33.8 million, respectively, at December 31, 2006.

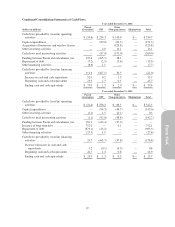

Performance-Based Awards

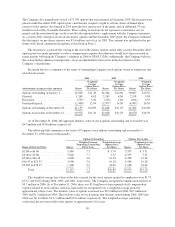

Awards granted generally vest over three years and upon the achievement of certain cash flow objectives. Prior

to January 1, 2006, performance-based awards were accounted for under APB 25. Upon the adoption of SFAS

123(R), performance-based awards are now expensed based on its grant date fair value if it is probable that the

performance conditions will be achieved. The Company granted, in 2006, performance units that provide for the

recipients to receive up to 819,750 shares, of which 273,250 shares vested in 2006. The fair value of the

performance units on the date of grant was $4.29 per share. During 2005, the Company granted 809,700 shares of

performance-based stock awards, of which 360,000 shares were vested in 2005. Of the awards granted in 2005,

171,130 shares vested and 5,836 shares were forfeited in 2006. The fair value of the 2005 performance-based

awards was $4.30 per share. There were no performance-based awards granted in 2004. The Company recognized

expense of $2.2 million in 2006 and $1.4 million in 2005, related to these awards. As of December 31, 2006,

unrecognized compensation expense related to performance-based awards was $0.3 million, which is expected to be

recognized in 2007.

Time-Based Restricted Shares

The Company issued 253,199 of time-based restricted shares in December 2006, which vest in one-third

increments over a period of three years and have a fair value of $4.74 per share at the grant date. In 2005, the

Company issued 27,400 shares of time-based restricted shares, of which 23,600 vested in 2006 and the remaining

3,800 awards were forfeited. The fair value of the time-based restricted shares granted in 2005 was $4.60 per

share at the date of grant. The Company granted 140,000 shares of time-based restricted shares during 2004 with

a two-year vesting period, of which 10,000 shares were forfeited in 2005 and 130,000 shares vested in 2006. The

fair value of the shares granted in 2004 was $5.43 per share at the date of grant. The Company recognized

compensation expense of $0.1 million in 2006, $0.4 million in 2005 and $0.3 million in 2004, related to time-

based restricted shares. As of December 31, 2006, unrecognized compensation expense related to these shares

was $0.8 million, which is expected to be recognized over the next three years.

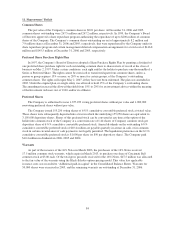

Stock Option Awards

Generally, stock options have ten-year terms and vesting terms of three years. On December 30, 2005, the

Company accelerated the vesting of all “out-of-the-money” options, defined as those options for which the option

exercise price was greater than the closing market price on December 30, 2005 of the Company’s common stock.

89