Cincinnati Bell 2006 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2006 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

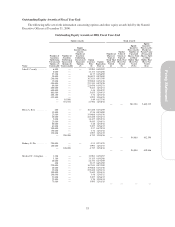

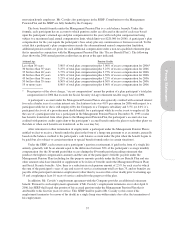

Nonqualified Deferred Compensation

The following table sets forth information concerning compensation deferred by the Named Executive

Officers:

Nonqualified Deferred Compensation for 2006 Fiscal Year

Name

Executive

Contributions

in Last Fiscal

Year

($) (a)

Company

Contributions

in Last Fiscal

Year

($)

Aggregate

Earnings in

Last Fiscal

Year

($)

Aggregate

Withdrawals/

Distributions

($)

Aggregate Balance at

December 31, 2006

($)

John F. Cassidy .............. 1,046,615 — 138,730 (b)(c) — 1,237,995

Brian A. Ross ............... 113,866 — 13,363 (b) — 127,229

Rodney D. Dir .............. — — — — —

Michael W. Callaghan ........ — — 140,730 (d) — 894,497

Christopher J. Wilson ......... — — — — —

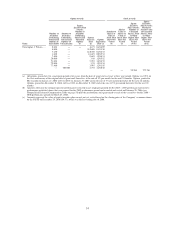

(a) Mr. Cassidy deferred receipt of his performance restricted share award of 255,896 shares earned for 2005 for

the 2005 – 2007 performance period that was paid on February 28, 2006. For the same period, Mr. Ross also

deferred his performance restricted share award of 27,840 shares. The amounts shown in the column are

based on the closing price of the Company’s stock ($4.09) on February 28, 2006, the deferral date, for their

shares. Although paid in 2006, these amounts represent awards earned in and for 2005 performance and,

therefore, are not included in the Summary Compensation Table.

(b) The amounts include the difference between the closing price of the Company’s stock ($4.09) on

February 28, 2006, the deferral date, and the closing price of the Company’s stock ($4.57) on December 29,

2006, which was the last day of trading on the NYSE for the 2006 fiscal year for shares deferred by Messrs.

Cassidy and Ross.

(c) For Mr. Cassidy, the amount shown also includes 15,000 shares of stock that were deferred on May 2, 2002.

(d) For Mr. Callaghan, the amount shown represents amounts earned on deferrals of his base salary and bonus

payments for periods prior to 2006.

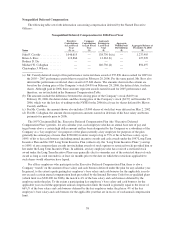

The 1997 Cincinnati Bell Inc. Executive Deferred Compensation Plan (the “Executive Deferred

Compensation Plan”) permits, for any calendar year, each employee who has an annual base rate of pay and

target bonus above a certain high dollar amount and has been designated by the Company or a subsidiary of the

Company as a “key employee” for purposes of the plan (currently a key employee for purposes of the plan

generally has annual pay of more than $220,000) to defer receipt of up to 75% of his or her base salary, up to

100% of his or her cash bonuses (including annual incentive awards and cash awards under the 1997 Long Term

Incentive Plan and the 2007 Long Term Incentive Plan (collectively, the “Long Term Incentive Plans”)) and up

to 100% of any common share awards (not including awards of stock options or restricted stock) provided him or

her under the Long Term Incentive Plans. In addition, any key employee who has received a restricted stock

award under the Long Term Incentive Plans may generally elect to surrender any of the restricted shares of such

award as long as such surrender is at least six months prior to the date on which the restrictions applicable to

such shares would otherwise have lapsed.

For all key employees who participate in the Executive Deferred Compensation Plan, there is also a

Company “match” on the amount of base salary and cash bonuses deferred under the plan for any calendar year.

In general, to the extent a participating key employee’s base salary and cash bonuses for the applicable year do

not exceed a certain annual compensation limit prescribed by the Internal Revenue Code for tax-qualified plans

(which limit was $220,000 for 2006), the match is 4% of the base salary and cash bonuses deferred by the

employee under the plan. To the extent a participating key employee’s base salary and cash bonuses for the

applicable year exceed the appropriate annual compensation limit, the match is generally equal to the lesser of

662/3% of the base salary and cash bonuses deferred by the key employee under the plan or 4% of the key

employee’s base salary and cash bonuses for the applicable year that are in excess of such annual compensation

limit.

58