Cincinnati Bell 2006 Annual Report Download - page 56

Download and view the complete annual report

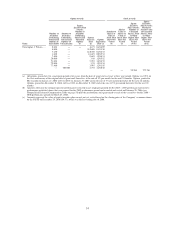

Please find page 56 of the 2006 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.of Mr. Ross’s long-term incentive opportunity. On December 1, 2005, the Compensation Committee

granted Mr. Ross 150,000 nonqualified stock options for the 2006 fiscal year. For the 2007 fiscal year,

Mr. Ross received a grant of 200,000 nonqualified stock options at the Compensation Committee’s

regularly scheduled December 8, 2006 meeting and, following approval of goals for the 2007 – 2009

performance unit plan, Mr. Ross received a target grant of 75,000 performance units at the

Compensation Committee’s January 2007 meeting.

•For the 2006 fiscal year Mr. Wilson was granted 43,500 performance units during the first quarter of

2006 with respect to the three-year 2006 – 2008 performance plan, which accounted for approximately

50% of Mr. Wilson’s long-term incentive opportunity. On December 1, 2005, the Compensation

Committee granted Mr. Wilson 77,400 nonqualified stock options for the 2006 fiscal year. For the 2007

fiscal year, Mr. Wilson received a grant of 100,000 nonqualified stock options at the Compensation

Committee’s regularly scheduled December 8, 2006 meeting and, following approval of goals for the

2007 – 2009 performance unit plan, Mr. Wilson received a target grant of 50,000 performance units at

the Compensation Committee’s January 2007 meeting.

The Compensation Committee then met in executive session with only its independent outside consultant

present, to determine the amount of Mr. Cassidy’s compensation elements for 2007. The Compensation

Committee reviewed its recommendations and the full Board approved those changes.

In doing so, the Compensation Committee focused its deliberations primarily on the following factors in

determining Mr. Cassidy’s compensation:

•The objectives of the Company’s compensation programs;

•The compensation of other Chief Executive Officers in the custom group of telecommunications

companies;

•The overall results achieved by the Company in a highly competitive market environment; and

•Mr. Cassidy’s personal performance including succession planning and his personal involvement in

community affairs in the greater Cincinnati area.

The Compensation Committee also took into consideration Mr. Cassidy’s request that his current base

salary remain unchanged for 2007.

As a result of the data and the deliberations, the Compensation Committee recommended, and the full Board

approved, the following changes:

•Base Salary — Mr. Cassidy’s base salary for 2006 was $645,000 and will remain unchanged at $645,000

for 2007.

•Annual Bonus Target — Mr. Cassidy’s target bonus for 2006 was 120% of base salary and will be

increased to 130% of base salary for 2007.

•Long-Term Incentives — For the 2006 fiscal year, Mr. Cassidy was granted 286,500 performance units

during the first quarter of 2006 with respect to the three-year 2006 – 2008 performance plan, which

accounted for approximately 50% of Mr. Cassidy’s long-term incentive opportunity. In addition, the

Committee also granted Mr. Cassidy 425,000 nonqualified stock options on December 1, 2005 and 85,000

stock options were granted on January 27, 2006. For the 2007 fiscal year, Mr. Cassidy received a grant of

574,350 nonqualified stock options at the Committee’s regularly scheduled December 8, 2006 meeting

and, following approval of goals for the 2007 – 2009 performance unit plan, Mr. Cassidy received a target

grant of 298,200 performance units at the Committee’s January 2007 meeting.

The value of the Company’s retirement program was not considered in any of the compensation decisions

made on proxy officer compensation because survey data tends to focus on those elements of pay which most

directly align the interests of executives and shareholders, which the Company believes is most effectively

accomplished through its short- and long-term incentive compensation programs.

44