Cincinnati Bell 2006 Annual Report Download - page 197

Download and view the complete annual report

Please find page 197 of the 2006 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

$11 million, which payment has been made on their behalf by their insurers, to a fund to settle the claims of, and

obtain a release of all claims from, the class members. On March 13, 2006, the Court issued an order giving

preliminary approval of the Agreement and scheduled a Settlement Fairness Hearing. The Settlement Fairness

Hearing took place on June 22, 2006. On October 5, 2006, the Court issued a final order approving the Stipulation

and Agreement of Settlement as submitted by the parties. Accordingly, this case has been dismissed with prejudice.

Freedom Wireless vs. BCGI, et al U.S. District Court, District of Massachusetts, Case No. 05-110620-EFH.

On September 16, 2005, Freedom Wireless filed a patent infringement action against 24 wireless service

providers, including CBW. The suit alleged that the defendant wireless service providers were in violation of a

patent owned by Freedom Wireless. CBW obtained its rights to use the technology in question through Boston

Communications Group Inc. (“BCGI”). BCGI has acknowledged its obligation to indemnify CBW in accordance

with the terms of the license agreement. This lawsuit was preceded by a direct patent infringement suit against

BCGI by Freedom Wireless, in which BCGI was found liable. On July 21, 2006, BCGI issued a press release

indicating that it had reached a settlement agreement with Freedom Wireless in the underlying patent

infringement action. On October 16, 2006, Freedom Wireless filed a Notice of Dismissal dismissing with

prejudice all patent infringement claims against CBW arising from the alleged patent infringement by BCGI.

Accordingly, the Company considers this case to be closed.

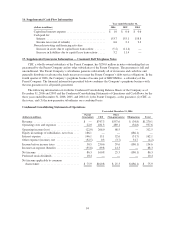

Indemnifications Related to the Sale of Broadband Assets

The Company indemnified the buyer of the broadband assets against certain potential claims, but all

indemnifications have expired except for those related to title and authorization. The title and authorization

indemnification was capped at 100% of the purchase price of the broadband assets, which is approximately $71

million.

In order to determine the fair value of the indemnity obligations, the Company performed a probability-

weighted discounted cash flow analysis, utilizing the minimum and maximum potential claims and several

scenarios within the range of possibilities. In 2006, the Company decreased the liability related to the indemnity

obligations from $4.1 million to $1.2 million and recorded $2.9 million of income as a result of the expiration of

certain warranties and guarantees. This income was included in “Gain on sale of broadband assets” in the

Consolidated Statement of Operations. During 2005, no additional representations or warranties expired. In 2004,

the Company decreased the liability related to the indemnity obligations to $4.1 million due to the expiration of

the general representations and warranties and no broker warranties, and recorded $3.7 million as “Gain on sale

of broadband assets” in the Consolidated Statement of Operations.

Additionally, in 2004, the Company paid $2.7 million related to indemnity obligations under a legal

settlement agreement.

13. Income Taxes

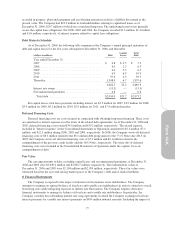

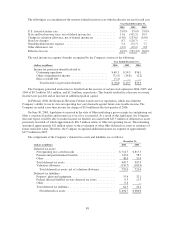

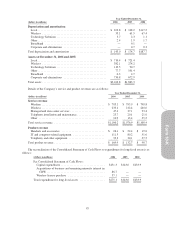

Income tax provision (benefit) consists of the following:

Year Ended December 31,

(dollars in millions) 2006 2005 2004

Current:

Federal ........................................ $ 2.6 $ 1.0 $ (0.5)

State and local .................................. 3.7 1.2 1.5

Total current .................................... 6.3 2.2 1.0

Investment tax credits ................................ (0.4) (0.5) (0.3)

Deferred:

Federal ........................................ 50.1 (21.2) 52.8

State and local .................................. 45.5 34.1 10.4

Total deferred ................................... 95.6 12.9 63.2

Valuation allowance .................................. (33.2) 39.7 (27.8)

Total ...................................... $68.3 $ 54.3 $ 36.1

87