Cincinnati Bell 2006 Annual Report Download - page 200

Download and view the complete annual report

Please find page 200 of the 2006 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

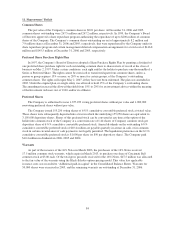

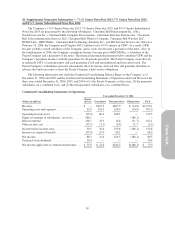

The Company also immediately vested 1,673,700 options that were granted in December 2005. Restrictions were

placed on the December 2005 option grant, such that the recipient’s right to sell any shares obtained upon

exercise of the options was limited to 28% upon the first anniversary of the grant, and an additional 3% per

month in each of the 24 months thereafter. These selling restrictions do not represent a substantive service

period, and the restrictions lapse in the event that the option holder’s employment with the Company terminates.

As a result of the vesting of all out-of-the-money options and the December 2005 grant, the Company estimated

that the impact on pro forma expense was $3.4 million, net of tax, in 2005. This amount was included in the pro

forma stock based compensation expense as disclosed in Note 1.

The decision to accelerate the vesting of the out-of-the-money options and to fully vest the December 2005

option grant was made primarily to reduce compensation expense that otherwise would have been recorded in

future periods following the Company’s adoption in 2006 of SFAS 123(R). Additionally, the Company believes

this action further enhances management’s focus on shareholder return and is in the best interest of the

Company’s shareholders.

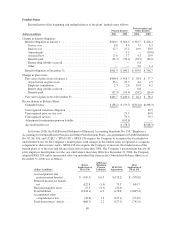

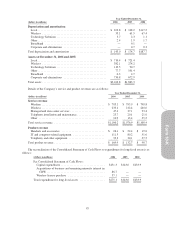

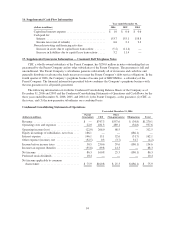

Presented below is a summary of the status of outstanding Company stock options issued to employees and

related transactions:

2006 2005 2004

(in thousands, except per share amounts) Shares

Weighted-

Average

Option Prices

Per Share Shares

Weighted-

Average

Option Prices

Per Share Shares

Weighted-

Average

Option Prices

Per Share

Options outstanding at January 1, ....... 22,828 $11.28 24,364 $12.06 30,007 $13.45

Granted ............................ 1,260 4.61 2,163 4.06 2,198 3.98

Exercised .......................... (535) 3.56 (722) 3.48 (854) 3.55

Forfeited/expired .................... (2,400) 12.94 (2,977) 14.38 (6,987) 16.58

Options outstanding at December 31, .... 21,153 $10.89 22,828 $11.28 24,364 $12.06

Options exercisable at December 31, ..... 19,974 $11.26 22,828 $11.28 18,670 $14.30

As of December 31, 2006, the aggregate intrinsic value of stock options outstanding and exercisable was

$4.9 million and $4.8 million, respectively.

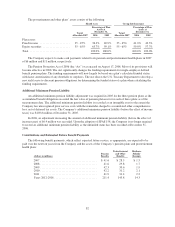

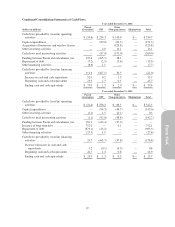

The following table summarizes the status of Company stock options outstanding and exercisable at

December 31, 2006 (shares in thousands):

Options Outstanding Options Exercisable

Range of Exercise Prices Shares

Weighted-Average

Remaining Contractual

Life in Years

Weighted-Average

Option Prices

Per Share Shares

Weighted-Average

Option Prices

Per Share

$1.88 to $4.00 ................ 5,469 7.5 $ 3.70 5,375 $ 3.71

$4.06 to $5.66 ................ 5,420 7.7 5.32 4,335 5.47

$5.68 to $16.18 ............... 4,498 3.0 12.24 4,498 12.24

$16.43 to $23.53 .............. 4,598 2.9 19.18 4,598 19.18

$23.69 to $38.19 .............. 1,168 3.2 32.62 1,168 32.62

Total .................... 21,153 5.3 $10.89 19,974 $11.26

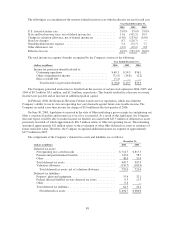

The weighted average fair values at the date of grant for the stock options granted to employees were $1.57,

$1.37, and $1.09 during 2006, 2005, and 2004, respectively. The Company recognized compensation expense of

$0.2 million in 2006. As of December 31, 2006, there was $1.6 million of unrecognized stock compensation

expense related to stock options, which is expected to be recognized over a weighted-average period of

approximately three years. The intrinsic value of options exercised was $0.5 million in 2006, $0.7 million in

2005 and $1.1 million in 2004. The total fair value of stock options that became vested during 2006, 2005 and

2004 was $0.1 million, $13.1 million and $19.6 million, respectively. The weighted-average remaining

contractual life for exercisable stock options is approximately five years.

90