Chevron 2013 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2013 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Chevron Corporation 2013 Annual Report 75

At year-end 2013, the company held approximately 1.6 bil-

lion BOE of proved undeveloped reserves that have remained

undeveloped for ve years or more. e reserves are held by

consolidated and aliated companies and the majority of these

reserves are in locations where the company has a proven track

record of developing major projects.

In Africa, the majority of the approximately 300 million

BOE of proved undeveloped reserves that have remained unde-

veloped for ve years or more is related to deepwater and natural

gas developments in Nigeria. Major Nigerian deepwater develop-

ment projects include Agbami, which started production in 2008

and has ongoing development activities to maintain full utiliza-

tion of infrastructure capacity, and the Usan development, which

started production in 2012. Also in Nigeria, various elds and

infrastructure associated with the Escravos gas projects are cur-

rently under development.

In Asia, less than 200 million BOE remain classied as

proved undeveloped for more than ve years. e majority relate

to ongoing development activities in the Pattani Field in ailand

and the Azeri-Chirag-Gunashli elds in Azerbaijan.

Aliates account for 1.1 billion barrels of proved unde-

veloped reserves that have remained undeveloped for ve years

or more, with the majority related to the TCO aliate in

Kazakhstan. At TCO, further eld development to convert the

remaining proved undeveloped reserves is scheduled to occur in

line with reservoir depletion. In Venezuela, development drilling

continues at Hamaca to optimize utilization of upgrader capacity.

Annually, the company assesses whether any changes have

occurred in facts or circumstances, such as changes to develop-

ment plans, regulations or government policies, that would

warrant a revision to reserve estimates. For 2013, this assess-

ment did not result in any material changes in reserves classied

as proved undeveloped. Over the past three years, the ratio of

proved undeveloped reserves to total proved reserves has ranged

between 44 percent and 46 percent. e consistent completion

of major capital projects has kept the ratio in a narrow range over

this time period.

Proved Reserve Quantities At December 31, 2013,

proved reserves for the company were 11.2billion BOE.

Approximately 18 percent of the total reserves were located in

the United States.

Aside from the TCO aliate’s Tengiz Field in

Kazakhstan, no single property accounted for more than

5 percent of the company’s total oil-equivalent proved

reserves. About 18 other individual properties in the compa-

ny’s portfolio of assets each contained between 1 percent and

5 percent of the company’s oil-equivalent proved reserves,

which in the aggregate accounted for 44 percent of the com-

pany’s total oil-equivalent proved reserves. ese properties

were geographically dispersed, located in the United States,

Canada, South America, Africa, Asia and Australia.

In the United States, total proved reserves at year-end

2013 were 2.0 billion BOE. California properties accounted

for 30 percent of the U.S. reserves, with most classied as

heavy oil. Because of heavy oil’s high viscosity and the need

to employ enhanced recovery methods, most of the com-

pany’s heavy oil elds in California employ a continuous

steamooding process. e Gulf of Mexico region contains

26 percent of the U.S. reserves and production operations are

mostly oshore. Other U.S. areas represent the remaining

44 percent of U.S. reserves. For production of crude oil, some

elds utilize enhanced recovery methods, including water-

ooding and CO2 injection.

For the three years ending December 31, 2013, the pat-

tern of net reserve changes shown in the following tables are

not necessarily indicative of future trends. Apart from acqui-

sitions, the company’s ability to add proved reserves can be

aected by, among other things, events and circumstances

that are outside the company’s control, such as delays in gov-

ernment permitting, partner approvals of development plans,

changes in oil and gas prices, OPEC constraints, geopolitical

uncertainties, and civil unrest.

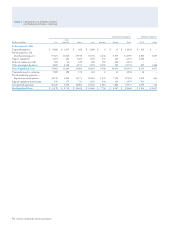

e company’s estimated net proved reserves of crude

oil, condensate, natural gas liquids and synthetic oil and

changes thereto for the years 2011, 2012 and 2013 are shown

in the table on page 76. e company’s estimated net proved

reserves of natural gas are shown on page 77.

Table V Reserve Quantity Information – Continued