Chevron 2013 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2013 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Chevron Corporation 2013 Annual Report 59

Other Benet Assumptions For the measurement of accu-

mulated postretirement benet obligation at December 31,

2013, for the main U.S. postretirement medical plan, the

assumed health care cost-trend rates start with 7.3 percent

in 2014 and gradually decline to 4.5 percent for 2025 and

beyond. For this measurement at December 31, 2012, the

assumed health care cost-trend rates started with 7.5 percent

in 2013 and gradually declined to 4.5 percent for 2025 and

beyond. In both measurements, the annual increase to com-

pany contributions was capped at 4 percent.

Assumed health care cost-trend rates can have a signi-

cant eect on the amounts reported for retiree health care

costs. e impact is mitigated by the 4 percent cap on the

company’s medical contributions for the primary U.S. plan.

A 1-percentage-point change in the assumed health care cost-

trend rates would have the following eects on worldwide

plans:

1 Percent 1 Percent

Increase Decrease

Eect on total service and interest cost components $ 13 $ (11)

Eect on postretirement benet obligation $ 137 $ (115)

Plan Assets and Investment Strategy e fair value hierar-

chy of inputs the company uses to value the pension assets is

divided into three levels:

Level 1: Fair values of these assets are measured using

unadjusted quoted prices for the assets or the prices of identi-

cal assets in active markets that the plans have the ability

toaccess.

Level 2: Fair values of these assets are measured based

on quoted prices for similar assets in active markets; quoted

prices for identical or similar assets in inactive markets; inputs

other than quoted prices that are observable for the asset; and

inputs that are derived principally from or corroborated by

observable market data through correlation or other means. If

Expected Return on Plan Assets e company’s estimated

long-term rates of return on pension assets are driven pri-

marily by actual historical asset-class returns, an assessment

of expected future performance, advice from external actu-

arial rms and the incorporation of specic asset-class risk

factors. Asset allocations are periodically updated using pen-

sion plan asset/liability studies, and the company’s estimated

long-term rates of return are consistent with these studies.

For 2013, the company used an expected long-term rate

of return of 7.5 percent for U.S. pension plan assets, which

account for 71 percent of the company’s pension plan assets.

In 2012 and 2011, the company used a long-term rate of

return of 7.5 and 7.8 percent for this plan.

e market-related value of assets of the major U.S. pen-

sion plan used in the determination of pension expense was

based on the market values in the three months preceding

the year-end measurement date. Management considers the

three-month time period long enough to minimize the eects

of distortions from day-to-day market volatility and still be

contemporaneous to the end of the year. For other plans,

market value of assets as of year-end is used in calculating the

pension expense.

Discount Rate e discount rate assumptions used to

determine the U.S. and international pension and postretire-

ment benet plan obligations and expense reect the rate at

which benets could be eectively settled, and is equal to the

equivalent single rate resulting from yield curve analysis. is

analysis considered the projected benet payments specic to

the company’s plans and the yields on high-quality bonds.

At December 31, 2013, the company used a 4.3 percent dis-

count rate for the U.S. pension plans and 4.7 percent for the

main U.S. OPEB plan. e discount rates at the end of 2012

and 2011 were 3.6 and 3.9 percent and 3.8 and 4.0 percent

for the U.S. pension plans and the main U.S. OPEB plans,

respectively.

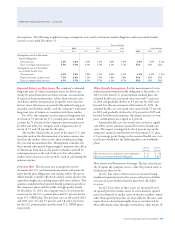

Note 21 Employee Benefit Plans – Continued

Assumptions e following weighted-average assumptions were used to determine benet obligations and net periodic benet

costs for years ended December 31:

Pension Benets

2013 2012 2011 Other Benets

U.S. Int’l. U.S. Int’l. U.S. Int’l. 2013 2012 2011

Assumptions used to determine

benet obligations:

Discount rate 4.3% 5.8% 3.6% 5.2% 3.8% 5.9% 4.9% 4.1% 4.2%

Rate of compensation increase 4.5% 5.5% 4.5% 5.5% 4.5% 5.7% N/A N/A N/A

Assumptions used to determine

net periodic benet cost:

Discount rate 3.6% 5.2% 3.8% 5.9% 4.8% 6.5% 4.1% 4.2% 5.2%

Expected return on plan assets 7.5% 6.8% 7.5% 7.5% 7.8% 7.8% N/A N/A N/A

Rate of compensation increase 4.5% 5.5% 4.5% 5.7% 4.5% 6.7% N/A N/A N/A