Chevron 2013 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2013 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion and Analysis of

Financial Condition and Results of Operations

22 Chevron Corporation 2013 Annual Report

Derivative Commodity Instruments Chevron is

exposed to market risks related to the price volatility of crude

oil, rened products, natural gas, natural gas liquids, lique-

ed natural gas and renery feedstocks. e company uses

derivative commodity instruments to manage these exposures

on a portion of its activity, including rm commitments and

anticipated transactions for the purchase, sale and storage of

crude oil, rened products, natural gas, natural gas liquids

and feedstock for company reneries. e company also

uses derivative commodity instruments for limited trading

purposes. e results of these activities were not material to

the company’s nancial position, results of operations or cash

ows in 2013.

e company’s market exposure positions are monitored

on a daily basis by an internal Risk Control group in accor-

dance with the company’s risk management policies, which

have been approved by the Audit Committee of the com-

pany’s Board of Directors.

Derivatives beyond those designated as normal purchase

and normal sale contracts are recorded at fair value on the

Consolidated Balance Sheet with resulting gains and losses

reected in income. Fair values are derived principally from

published market quotes and other independent third-party

quotes. e change in fair value of Chevron’s derivative

commodity instruments in 2013 was not material to the

company’s results of operations.

e company uses the Monte Carlo simulation method

with a 95 percent condence level as its Value-at-Risk (VaR)

model to estimate the maximum potential loss in fair value

from the eect of adverse changes in market conditions on

derivative commodity instruments held or issued. A one-day

holding period is used on the assumption that market-risk

positions can be liquidated or hedged within one day. Based

on these inputs, the VaR for the company’s primary risk

exposures in the area of derivative commodity instruments at

December 31, 2013 and 2012 was not material to the compa-

ny’s cash ows or results of operations.

Foreign Currency e company may enter into foreign

currency derivative contracts to manage some of its foreign

currency exposures. ese exposures include revenue and

anticipated purchase transactions, including foreign currency

capital expenditures and lease commitments. e foreign cur-

rency derivative contracts, if any, are recorded at fair value on

the balance sheet with resulting gains and losses reected in

income. ere were no open foreign currency derivative con-

tracts at December 31, 2013.

Interest Rates e company may enter into interest rate

swaps from time to time as part of its overall strategy to

manage the interest rate risk on its debt. Interest rate swaps,

if any, are recorded at fair value on the balance sheet with

resulting gains and losses reected in income. At year-end

2013, the company had no interest rate swaps.

Transactions With Related Parties

Chevron enters into a number of business arrangements with

related parties, principally its equity aliates. ese arrange-

ments include long-term supply or otake agreements and

long-term purchase agreements. Refer to “Other Information”

in Note 12 of the Consolidated Financial Statements, page 46,

for further discussion. Management believes these agreements

have been negotiated on terms consistent with those that

would have been negotiated with an unrelated party.

Litigation and Other Contingencies

MTBE Information related to methyl tertiary butyl ether

(MTBE) matters is included on page 47 in Note 14 to

the Consolidated Financial Statements under the heading

“MTBE.”

Ecuador Information related to Ecuador matters is

included in Note 14 to the Consolidated Financial Statements

under the heading “Ecuador,” beginning on page 47.

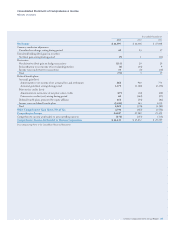

Environmental e following table displays the annual

changes to the company’s before-tax environmental

remediation reserves, including those for federal Superfund

sites and analogous sites under state laws.

Millions of dollars 2013 2012 2011

Balance at January 1 $ 1,403 $ 1,404 $ 1,507

Net Additions 488 428 343

Expenditures (435) (429) (446)

Balance at December 31 $ 1,456 $ 1,403 $ 1,404