Chevron 2013 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2013 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion and Analysis of

Financial Condition and Results of Operations

12 Chevron Corporation 2013 Annual Report

MCF. Fluctuations in the price of natural gas in the United

States are closely associated with customer demand relative to

the volumes produced in North America.

Outside the United States, price changes for natural gas

depend on a wide range of supply, demand and regulatory

circumstances. In some locations, Chevron is investing in

long-term projects to install infrastructure to produce and

liquefy natural gas for transport by tanker to other markets.

International natural gas realizations averaged $5.91 per MCF

during 2013, compared with $5.99 per MCF during 2012.

(See page 18 for the company’s average natural gas realizations

for the U.S. and international regions.)

e company’s worldwide net oil-equivalent production

in 2013 averaged 2.597 million barrels per day. About one-

fth of the company’s net oil-equivalent production in 2013

occurred in the OPEC-member countries of Angola, Nigeria,

Venezuela and the Partitioned Zone between Saudi Arabia

and Kuwait. OPEC quotas had no eect on the company’s

net crude oil production in 2013 or 2012. At their December

2013 meeting, members of OPEC supported maintaining the

current production quota of 30 million barrels per day, which

has been in eect since December 2008.

e company estimates that oil-equivalent production

in 2014 will average approximately 2.610 million barrels per

day, based on an average Brent price of $109 per barrel for

the full-year 2013. is estimate is subject to many factors

and uncertainties, including quotas that may be imposed

by OPEC; price eects on entitlement volumes; changes in

scal terms or restrictions on the scope of company opera-

tions; delays in construction, start-up or ramp-up of projects;

uctuations in demand for natural gas in various markets;

weather conditions that may shut in production; civil unrest;

changing geopolitics; delays in completion of maintenance

turnarounds; greater-than-expected declines in production

from mature elds; or other disruptions to operations. e

outlook for future production levels is also aected by the

size and number of economic investment opportunities and,

for new, large-scale projects, the time lag between initial

exploration and the beginning of production. Investments in

upstream projects generally begin well in advance of the start

of the associated crude oil and natural gas production. A sig-

nicant majority of Chevron’s upstream investment is made

outside the United States.

Refer to the “Results of Operations” section on pages

14 through 16 for additional discussion of the company’s

upstream business.

Refer to Table V beginning on page 73 for a tabulation of

the company’s proved net oil and gas reserves by geographic

area, at the beginning of 2011 and each year-end from 2011

through 2013, and an accompanying discussion of major

changes to proved reserves by geographic area for the three-

year period ending December 31, 2013.

On November 7, 2011, while drilling a development

well in the deepwater Frade Field about 75 miles oshore

Brazil, an unanticipated pressure spike caused oil to migrate

from the well bore through a series of ssures to the sea oor,

emitting approximately 2,400 barrels of oil. e source of

the seep was substantially contained within four days and the

well was plugged and abandoned. On March 14, 2012, the

company identied a small, second seep in a dierent part

of the eld. No evidence of any coastal or wildlife impacts

0.0

12.5

7.5

5.0

10.0

2.5

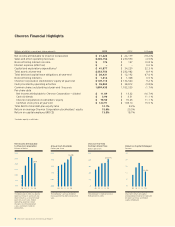

Net proved reserves for

consolidated companies and

affiliated companies decreased

1 percent in 2013.

Net Proved Reserves

Billions of BOE

United States

Other Americas

Africa

Asia

Australia

Europe

Affiliates

11. 2

09 10

11

12

13

Net Proved Reserves

Liquids vs. Natural Gas

Billions of BOE

1009 11 12 13

11. 2

Natural Gas

Liquids

12.5

7.5

0.0

10.0

5.0

2.5

Reserve replacement rate in 2013

was 85 percent. Five-year average

reserve replacement rate was

100 percent.