Chevron 2013 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2013 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Chevron Corporation 2013 Annual Report 53

Note 15 Taxes – Continued

e company completed its assessment of the potential

impact of the August 2012 decision by the U.S. Court of

Appeals for the ird Circuit that disallowed the Historic

Rehabilitation Tax Credits claimed by an unrelated taxpayer.

e ndings of this assessment did not result in a material

impact on the company’s nancial position, results of opera-

tions or cash ows.

On the Consolidated Statement of Income, the company

reports interest and penalties related to liabilities for uncertain

tax positions as “Income tax expense.” As of December 31,

2013, accruals of $215 for anticipated interest and penalty

obligations were included on the Consolidated Balance Sheet,

compared with accruals of $293 as of year-end 2012. Income

tax expense (benet) associated with interest and penalties was

$(42), $145 and $(64) in 2013, 2012 and 2011, respectively.

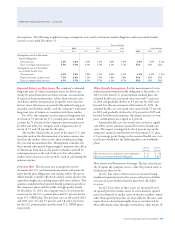

Taxes Other an on Income

Year ended December 31

2013 2012 2011

United States

Excise and similar taxes on

products and merchandise $ 4,792 $ 4,665 $ 4,199

Import duties and other levies 4 1 4

Property and other

miscellaneous taxes 1,036 782 726

Payroll taxes 255 240 236

Taxes on production 333 328 308

Total United States 6,420 6,016 5,473

International

Excise and similar taxes on

products and merchandise 3,700 3,345 3,886

Import duties and other levies 41 106 3,511

Property and other

miscellaneous taxes 2,486 2,501 2,354

Payroll taxes 168 160 148

Taxes on production 248 248 256

Total International 6,643 6,360 10,155

Total taxes other than on income $ 13,063 $ 12,376 $ 15,628

Note 16

Short-Term Debt

At December 31

2013 2012

Commercial paper* $ 5,130 $ 2,783

Notes payable to banks and others with

originating terms of one year or less 49 23

Current maturities of long-term debt – 20

Current maturities of long-term

capital leases 34 38

Redeemable long-term obligations

Long-term debt 3,152 3,151

Capital leases 9 12

Subtotal 8,374 6,027

Reclassied to long-term debt (8,000) (5,900)

Total short-term debt $ 374 $ 127

* Weighted-average interest rates at December 31, 2013 and 2012, were 0.09 percent

and 0.13 percent, respectively.

Redeemable long-term obligations consist primarily of tax-

exempt variable-rate put bonds that are included as current

liabilities because they become redeemable at the option of the

bondholders during the year following the balance sheet date.

e company may periodically enter into interest rate

swaps on a portion of its short-term debt. At December 31,

2013, the company had no interest rate swaps on short-

term debt.

At December 31, 2013, the company had $8,000 in com-

mitted credit facilities with various major banks, expiring in

December 2016, that enable the renancing of short-term

obligations on a long-term basis. ese facilities support com-

mercial paper borrowing and can also be used for general

corporate purposes. e company’s practice has been to

continually replace expiring commitments with new commit-

ments on substantially the same terms, maintaining levels

management believes appropriate. Any borrowings under the

facilities would be unsecured indebtedness at interest rates

based on the London Interbank Oered Rate or an average of

base lending rates published by specied banks and on terms

reecting the company’s strong credit rating. No borrowings

were outstanding under these facilities at December 31, 2013.

At December 31, 2013 and 2012, the company classied

$8,000 and $5,900, respectively, of short-term debt as long-

term. Settlement of these obligations is not expected to require

the use of working capital within one year, as the company has

both the intent and the ability, as evidenced by committed

credit facilities, to renance them on a long-term basis.