Chevron 2013 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2013 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Chevron Corporation 2013 Annual Report 57

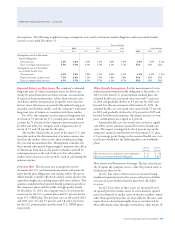

e funded status of the company’s pension and other postretirement benet plans for 2013 and 2012 follows:

Pension Benets

2013 2012 Other Benets

U.S. Int’l. U.S. Int’l. 2013 2012

Change in Benet Obligation

Benet obligation at January 1 $ 13,654 $ 6,287 $ 12,165 $ 5,519 $ 3,787 $ 3,765

Service cost 495 197 452 181 66 61

Interest cost 471 314 435 320 149 153

Plan participants’ contributions – 8 – 7 154 151

Plan amendments (78) 18 94 37 – 11

Actuarial (gain) loss (1,398) (206) 1,322 417 (636) 44

Foreign currency exchange rate changes – (187) – 114 (23) 1

Benets paid (1,064) (336) (763) (308) (359) (350)

Divestitures – – (51) – – (49)

Benet obligation at December 31 12,080 6,095 13,654 6,287 3,138 3,787

Change in Plan Assets

Fair value of plan assets at January 1 9,909 4,125 8,720 3,577 – –

Actual return on plan assets 1,546 375 1,149 375 – –

Foreign currency exchange rate changes – (21) – 90 – –

Employer contributions 819 392 844 384 205 199

Plan participants’ contributions – 8 – 7 154 151

Benets paid (1,064) (336) (763) (308) (359) (350)

Divestitures – – (41) – – –

Fair value of plan assets at December 31 11,210 4,543 9,909 4,125 – –

Funded Status at December 31 $ (870) $ (1,552) $ (3,745) $ (2,162) $ (3,138) $ (3,787)

Amounts recognized on the Consolidated Balance Sheet for the company’s pension and other postretirement benet plans at

December 31, 2013 and 2012, include:

Pension Benets

2013 2012 Other Benets

U.S. Int’l. U.S. Int’l. 2013 2012

Deferred charges and other assets $ 394 $ 128 $ 7 $ 55 $ – $ –

Accrued liabilities (76) (81) (61) (76) (215) (225)

Noncurrent employee benet plans (1,188) (1,599) (3,691) (2,141) (2,923) (3,562)

Net amount recognized at December 31 $ (870) $ (1,552) $ (3,745) $ (2,162) $ (3,138) $ (3,787)

Amounts recognized on a before-tax basis in “Accumulated other comprehensive loss” for the company’s pension and OPEB

plans were $5,464 and $9,742 at the end of 2013 and 2012, respectively. ese amounts consisted of:

Pension Benets

2013 2012 Other Benets

U.S. Int’l. U.S. Int’l. 2013 2012

Net actuarial loss $ 3,185 $ 1,808 $ 6,087 $ 2,439 $ 256 $ 968

Prior service (credit) costs (22) 167 58 170 70 20

Total recognized at December 31 $ 3,163 $ 1,975 $ 6,145 $ 2,609 $ 326 $ 988

e accumulated benet obligations for all U.S. and international pension plans were $10,876 and $5,108, respectively, at

December 31, 2013, and $12,108 and $5,167, respectively, at December 31, 2012.

Note 21 Employee Benefit Plans – Continued