Chevron 2013 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2013 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Chevron Corporation 2013 Annual Report 65

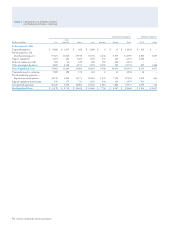

Note 27

Earnings Per Share

Basic earnings per share (EPS) is based upon “Net Income Attributable to Chevron Corporation” (“earnings”) and includes the

eects ofdeferrals of salary and other compensation awards that areinvested in Chevron stock units by certain ocers and

employees of the company. Diluted EPSincludes the eects of these items as well as the dilu tive eects of outstanding stock

options awarded under the company’s stock option programs (refer to Note 20, “Stock Options and Other Share-Based Compen-

sation,” beginning on page 55). e table below sets forth the computation ofbasic and diluted EPS:

Year ended December 31

2013 2012 2011

Basic EPS Calculation

Earnings available to common stockholders – Basic* $ 21,423 $ 26,179 $ 26,895

Weighted-average number of common shares outstanding 1,916 1,950 1,986

Add: Deferred awards held as stock units 1 – –

Total weighted-average number of common shares outstanding 1,917 1,950 1,986

Earnings per share of common stock – Basic $ 11.18 $ 13.42 $ 13.54

Diluted EPS Calculation

Earnings available to common stockholders – Diluted* $ 21,423 $ 26,179 $ 26,895

Weighted-average number of common shares outstanding 1,916 1,950 1,986

Add: Deferred awards held as stock units 1 – –

Add: Dilutive eect of employee stock-based awards 15 15 15

Total weighted-average number of common shares outstanding 1,932 1,965 2,001

Earnings per share of common stock – Diluted $ 11.09 $ 13.32 $ 13.44

*ere was no eect of dividend equivalents paid on stock units or dilutive impact of employee stock-based awards on earnings.

Note 25 Other Financial Information

Note 25

Other Financial Information

Earnings in 2013 included after-tax gains of approximately

$500 relating to the sale of nonstrategic properties. Of this

amount, approximately $300 and $200 related to down-

stream and upstream assets, respectively. Earnings in 2012

included after-tax gains of approximately $2,800 relat-

ing to the sale of nonstrategic properties. Of this amount,

approximately $2,200 and $600 related to upstream and

downstream assets, respectively.

Other nancial information is as follows:

Year ended December 31

2013 2012 2011

Total nancing interest and debt costs $ 284 $ 242 $ 288

Less: Capitalized interest 284 242 288

Interest and debt expense $ – $ – $ –

Research and development expenses $ 750 $ 648 $ 627

Foreign currency eects* $ 474 $ (454) $ 121

*

Includes $244, $(202) and $(27) in 2013, 2012 and 2011, respectively, for the com-

pany’s share of equity aliates’ foreign currency eects.

e excess of replacement cost over the carrying value

of inventories for which the last-in, rst-out (LIFO) method

is used was $9,150, and $9,292 at December 31, 2013 and

2012, respectively. Replacement cost is generally based on

average acquisition costs for the year. LIFO prots (charges)

of $14, $121 and $193 were included in earnings for the years

2013, 2012 and 2011, respectively.

e company has $4,639 in goodwill on the Con-

solidated Balance Sheet related to the 2005 acquisition of

Unocal and to the 2011 acquisition of Atlas Energy, Inc. e

company tested this goodwill for impairment during 2013

and concluded no impairment was necessary.

Note 26

Assets Held for Sale

At December 31, 2013, the company classied $580 of net

properties, plant and equipment as “Assets Held for Sale” on

the Consolidated Balance Sheet. ese assets are associated

with upstream operations that are anticipated to be sold in

2014. e revenues and earnings contributions of these assets

in 2013 were not material.