Chevron 2013 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2013 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

40 Chevron Corporation 2013 Annual Report

Contingent rentals are based on factors other than the pas-

sage of time, principally sales volumes at leased service stations.

Certain leases include escalation clauses for adjusting rentals to

reect changes in price indices, renewal options ranging up to

25 years, and options to purchase the leased property during or

at the end of the initial or renewal lease period for the fair mar-

ket value or other specied amount at that time.

At December 31, 2013, the estimated future minimum

lease payments (net of noncancelable sublease rentals) under

operating and capital leases, which at inception had a non-

cancelable term of more than one year, were as follows:

At December 31

Operating Capital

Leases Leases

Year: 2014 $ 798 $ 45

2015 733 32

2016 594 20

2017 472 17

2018 306 17

ereafter 806 46

Total $ 3,709 $ 177

Less: Amounts representing interest

and executory costs $ (37)

Net present values 140

Less: Capital lease obligations

included in short-term debt (43)

Long-term capital lease obligations $ 97

Note 9

Fair Value Measurements

e three levels of the fair value hierarchy of inputs the com-

pany uses to measure the fair value of an asset or liability are

described as follows:

Level 1: Quoted prices (unadjusted) in active markets

for identical assets and liabilities. For the company,

Level 1 inputs include exchange-traded futures con-

tracts for which the parties are willing to transact at the

exchange-quoted price and marketable securities that

are actively traded.

Level 2: Inputs other than Level 1 that are observable,

either directly or indirectly. For the company, Level 2

inputs include quoted prices for similar assets or liabili-

ties, prices obtained through third-party broker quotes

and prices that can be corroborated with other observ-

able inputs for substantially the complete term of a

contract.

Level 3: Unobservable inputs. e company does not

use Level 3 inputs for any of its recurring fair value

measurements. Level 3 inputs may be required for

the determination of fair value associated with cer-

tain nonrecurring measurements of nonnancial assets

and liabilities.

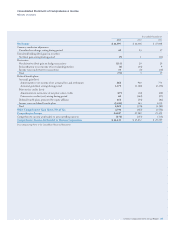

Note 7 Summarized Financial Data – Tengizchevroil LLP

Note 7

Summarized Financial Data — Tengizchevroil LLP

Chevron has a 50 percent equity ownership interest in

Tengizchevroil LLP (TCO). Refer to Note 12, on page 45,

foradiscussion of TCO operations.

Summarized nancial information for 100 percent of

TCO is presented in the following table:

Year ended December 31

2013 2012 2011

Sales and other operating revenues $ 25,239 $ 23,089 $ 25,278

Costs and other deductions 11,173 10,064 10,941

Net income attributable to TCO 9,855 9,119 10,039

At December 31

2013 2012

Current assets $ 3,598 $ 3,251

Other assets 12,964 12,020

Current liabilities 3,016 2,597

Other liabilities 2,761 3,390

Total TCO net equity $ 10,785 $ 9,284

Note 8

Lease Commitments

Certain noncancelable leases are classied as capital leases,

and the leased assets are included as part of “Properties,

plant and equipment, at cost” on the Consolidated Balance

Sheet. Such leasing arrangements involve crude oil produc-

tion and processing equipment, service stations, bareboat

charters, oce buildings, and other facilities. Other leases

are classied as operating leases and are not capitalized.

e payments on operating leases are recorded as expense.

Details of the capitalized leased assets are as follows:

At December 31

2013 2012

Upstream $ 445 $ 433

Downstream 316 316

All Other – –

Tota l 761 749

Less: Accumulated amortization 523 479

Net capitalized leased assets $ 238 $ 270

Rental expenses incurred for operating leases during

2013, 2012 and 2011 were as follows:

Year ended December 31

2013 2012 2011

Minimum rentals $ 1,049 $ 973 $ 892

Contingent rentals 1 7 11

Tota l 1,050 980 903

Less: Sublease rental income 25 32 39

Net rental expense $ 1,025 $ 948 $ 864

Notes to the Consolidated Financial Statements

Millions of dollars, except per-share amounts