Chevron 2013 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2013 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Chevron Corporation 2013 Annual Report 5

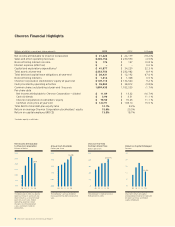

Chevron Operating Highlights1

2013 2012 % Change

Net production of crude oil, condensate and natural gas liquids (Thousands of barrels per day) 1,731 1,764 (1.9) %

Net production of natural gas (Millions of cubic feet per day) 5,192 5,074 2.3 %

Total net oil-equivalent production (Thousands of oil-equivalent barrels per day) 2,597 2,610 (0.5) %

Refinery input (Thousands of barrels per day) 1,638 1,702 (3.8) %

Sales of refined products (Thousands of barrels per day) 2,711 2,765 (2.0) %

Net proved reserves of crude oil, condensate and natural gas liquids2 (Millions of barrels)

— Consolidated companies 4,303 4,353 (1.1) %

— Affiliated companies 2,042 2,128 (4.0) %

Net proved reserves of natural gas2 (Billions of cubic feet)

— Consolidated companies 25,670 25,654 0.1 %

— Affiliated companies 3,476 3,541 (1.8) %

Net proved oil-equivalent reserves2 (Millions of barrels)

— Consolidated companies 8,582 8,629 (0.5) %

— Affiliated companies 2,621 2,718 (3.6) %

Number of employees at year-end3 61,345 58,286 5.2 %

1 Includes equity in affiliates, except number of employees

2 At the end of the year

3 Excludes service station personnel

Performance Graph

The stock performance graph at right shows how

an initial investment of $100 in Chevron stock

would have compared with an equal investment in

the S&P 500 Index or the Competitor Peer Group.

The comparison covers a five-year period begin ning

December 31, 2008, and ending December 31, 2013,

and for the peer group is weighted by market capital-

ization as of the beginning of each year. It includes

the reinvestment of all dividends that an investor

would be entitled to receive and is adjusted for stock

splits. The interim measurement points show the

value of $100 invested on December 31, 2008, as

of the end of each year between 2009 and 2013.

*Peer Group: BP p.l.c.-ADS, ExxonMobil, Royal Dutch Shell p.l.c.-ADS, Total S.A.-ADS

Chevron

S&P 500

Peer Group*

2008

100

100

100

2009

108.10

126.45

107.14

2010

132.84

145.48

109.91

2011

159.77

148.56

123.75

2013

200.03

228.15

150.16

2012

167.75

172.31

128.06

Five-Year Cumulative Total Returns

(Calendar years ended December 31)

2008 2009 2010 2011 2012 2013

Dollars

Chevron S&P 500 Peer Group*

250

200

150

100

50