Chevron 2013 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2013 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

38 Chevron Corporation 2013 Annual Report

Note 3

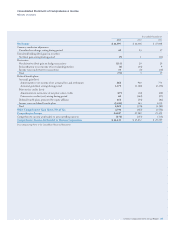

Noncontrolling Interests

Ownership interests in the company’s subsidiaries held by

parties other than the parent are presented separately from

the parent’s equity on the Consolidated Balance Sheet. e

amount of consolidated net income attributable to the par-

ent and the noncontrolling interests are both presented on

the face of the Consolidated Statement of Income. e term

“earnings” is dened as “Net Income Attributable to Chevron

Corporation.”

Activity for the equity attributable to noncontrolling

interests for 2013, 2012 and 2011 is as follows:

2013 2012 2011

Balance at January 1 $ 1,308 $ 799 $ 730

Net income 174 157 113

Distributions to noncontrolling interests (99) (41) (71)

Other changes, net* (69) 393 27

Balance at December 31 $ 1,314 $ 1,308 $ 799

* Includes components of comprehensive income, which are disclosed separately in the

Consolidated Statement of Comprehensive Income.

Note 4

Information Relating to the Consolidated Statement of Cash Flows

Year ended December 31

2013 2012 2011

Net (increase) decrease in operating

working capital was composed of the

following:

(Increase) decrease in accounts and

notes receivable $ (1,101) $ 1,153 $ (2,156)

Increase in inventories (237) (233) (404)

Decrease (increase) in prepaid

expenses and other current assets 834 (471) (853)

Increase in accounts payable

and accrued liabilities 160 544 3,839

(Decrease) increase in income and

other taxes payable (987) (630) 1,892

Net (increase) decrease in operating

working capital $ (1,331) $ 363 $ 2,318

Net cash provided by operating

activities includes the following

cash payments for income taxes:

Income taxes $ 12,898 $ 17,334 $ 17,374

Net sales (purchases) of marketable

securities consisted of the following

gross amounts:

Marketable securities purchased $ (7) $ (35) $ (112)

Marketable securities sold 10 32 38

Net sales (purchases) of marketable

securities $ 3 $ (3) $ (74)

Net sales (purchases) of time deposits

consisted of the following

gross amounts:

Time deposits purchased $ (2,317) $ (717) $ (6,439)

Time deposits matured 3,017 3,967 5,335

Net sales (purchases) of time deposits $ 700 $ 3,250 $ (1,104)

e “Net (increase) decrease in operating working capital”

includes reductions of $79, $98 and $121 for excess income

tax benets associated with stock options exercised during

2013, 2012 and 2011, respectively. ese amounts are oset

by an equal amount in “Net purchases of treasury shares.”

“Other” includes changes in postretirement benets obliga-

tions and other long-term liabilities.

In February 2011, the company acquired Atlas Energy,

Inc. (Atlas) for the aggregate purchase price of approximately

$4,500. e purchase price included assumption of debt

and certain payments noted below. e “Acquisition of Atlas

Energy” reects the $3,009 cash paid for all the common

shares of Atlas. An “Advance to Atlas Energy” of $403 was

made to facilitate the purchase of a 49 percent interest in

Laurel Mountain Midstream LLC on the day of closing. e

“Repayments of long-term debt and other nancing obliga-

tions” in 2011 includes $761 for repayment of Atlas debt and

$271 for payo of the Atlas revolving credit facility. e “Net

(increase) decrease in operating working capital” includes

$184 for payments made in connection with Atlas equity

awards subsequent to the acquisition. e remaining impacts

of the acquisition did not have a material impact on the Con-

solidated Statement of Cash Flows.

e “Net purchases of treasury shares” represents the cost of

common shares acquired less the cost of shares issued for share-

based compensation plans. Purchases totaled $5,004, $5,004 and

$4,262 in 2013, 2012 and 2011, respectively. In 2013, 2012 and

2011, the company purchased 41.6 million, 46.6 million and

42.3 million common shares for $5,000, $5,000 and $4,250

under its ongoing share repurchase program, respectively.

In 2013, 2012 and 2011, “Net sales (purchases) of other

short-term investments” generally consisted of restricted cash

associated with tax payments, upstream abandonment activi-

ties, funds held in escrow for asset acquisitions and capital

investment projects that was invested in cash and short-term

securities and reclassied from “Cash and cash equivalents” to

“Deferred charges and other assets” on the Consolidated Bal-

ance Sheet. e company issued $374 in 2011 of tax exempt

bonds as a source of funds for U.S. renery projects, which is

included in “Proceeds from issuance of long-term debt.”

e Consolidated Statement of Cash Flows excludes

changes to the Consolidated Balance Sheet that did not aect

cash. e 2012 period excludes the eects of $800 of proceeds

to be received in future periods for the sale of an equity interest

in the Wheatstone Project, of which $82 was received in 2013.

“Capital expenditures” in the 2012 period excludes a $1,850

increase in “Properties, plant and equipment” related to an

upstream asset exchange in Australia. Refer also to Note 24,

on page 64, for a discussion of revisions to the company’s

AROs that also did not involve cash receipts or payments for the

three years ending December 31, 2013.

Note 3 Noncontrolling Interests

Notes to the Consolidated Financial Statements

Millions of dollars, except per-share amounts