Chevron 2013 Annual Report Download

Download and view the complete annual report

Please find the complete 2013 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2013 Annual Report

Table of contents

-

Page 1

2013 Annual Report -

Page 2

...9 66 67 Glossary of Energy and Financial Terms Financial Review Five-Year Financial Summary Five-Year Operating Summary 81 82 83 84 Chevron History Board of Directors Corporate Ofï¬cers Stockholder and Investor Information On the cover: In mid-November 2013 the ï¬,oating production unit for the... -

Page 3

..., our downstream projects are focused on delivering competitive returns and targeted growth. The long-term investments we are making will contribute to the world's need for reliable and affordable energy and will help ensure that we deliver sustained value to our stockholders, employees, business... -

Page 4

...with a Chevron investment of more than $1 billion each, including two key deepwater projects in the U.S. Gulf of Mexico - Jack/St. Malo and Big Foot, which are expected to come online in 2014 and 2015, respectively. We continued to add resources to our portfolio through both exploration and targeted... -

Page 5

... social investments that foster economic growth, with a signiï¬cant focus on health, education and economic development programs. You can ï¬nd more information in our 2013 Corporate Responsibility Report. The men and women of Chevron are committed to our vision of being the global energy company... -

Page 6

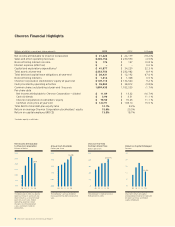

... crude oil production. The company's annual dividend increased for the 26th consecutive year. The company's stock price rose 15.5 percent in 2013. Chevron's return on capital employed declined to 13.5 percent on lower earnings and higher capital employed. 4 Chevron Corporation 2013 Annual Report -

Page 7

...Chevron S&P 500 Peer Group* 100 100 100 2009 108.10 126.45 107.14 2010 132.84 145.48 109.91 2011 159.77 148.56 123.75 2012 167.75 172.31 128.06 2013 200.03 228.15 150.16 *Peer Group: BP p.l.c.-ADS, ExxonMobil, Royal Dutch Shell p.l.c.-ADS, Total S.A.-ADS Chevron Corporation 2013 Annual Report... -

Page 8

... future, including conducting advanced biofuels research. Photo: A work crew discusses the day's upcoming activities at the Wolfcamp tight oil play in the Midland Basin, which is part of the liquids-rich Permian Basin of West Texas and southeast New Mexico. 6 Chevron Corporation 2013 Annual Report -

Page 9

... and services. This includes commercializing our equity gas resource base and maximizing the value of the company's equity natural gas, crude oil, natural gas liquids and reï¬ned products. It has global operations with major centers in Houston; London; Singapore; and San Ramon, California... -

Page 10

... production as a royalty payment, and the contractor typically owes income tax on its portion of the profit oil and/or gas. The contractor's share of PSC oil and/ or gas production and reserves varies over time as it is dependent on prices, costs and specific PSC terms. Renewables Energy resources... -

Page 11

... Note 24 Asset Retirement Obligations 64 Note 25 Other Financial Information 65 Note 26 Assets Held for Sale 65 Note 27 Earnings Per Share 65 28 Consolidated Financial Statements Reports of Management 28 Report of Independent Registered Public Accounting Firm 29 Consolidated Statement of Income 30... -

Page 12

... Chevron Corporation 2013 Annual Report To sustain its long-term competitive position in the upstream business, the company must develop and replenish an inventory of projects that offer attractive financial returns for the investment required. Identifying promising areas for exploration, acquiring... -

Page 13

... due to normal field declines. * Includes equity in afï¬liates. United States International Net natural gas production increased 2 percent in 2013 mainly due to new production from the Marcellus Shale (U.S.) and Angola. * Includes equity in afï¬liates. Chevron Corporation 2013 Annual Report 11 -

Page 14

.... In some locations, Chevron is investing in long-term projects to install infrastructure to produce and liquefy natural gas for transport by tanker to other markets. International natural gas realizations averaged $5.91 per MCF during 2013, compared with $5.99 per MCF during 2012. (See page... -

Page 15

...during 2013 and early 2014 included the following: Upstream Angola First shipment of liquefied natural gas was made from the Angola LNG Project. Argentina Signed agreements advancing the Loma Campana Project to develop the Vaca Muerta Shale. Australia Signed binding long-term LNG Sales and Purchase... -

Page 16

Management's Discussion and Analysis of Financial Condition and Results of Operations Downstream U.S. Upstream Millions of dollars 2013 2012 2011 South Korea The company's 50 percent-owned GS Caltex affiliate started commercial operations of its gas oil fluid catalytic cracking unit at the Yeosu ... -

Page 17

...in 2013 mainly due to lower crude oil production volume and prices, higher operating expenses, and lower gains on asset sales. United States International Exploration expenses increased 8 percent from 2012 mainly due to higher dry hole expense in the U.S. Chevron Corporation 2013 Annual Report 15 -

Page 18

... and other corporate charges. Net charges in 2012 increased $426 million from 2011, mainly due to higher environmental reserve additions, corporate tax items and other corporate charges, partially offset by lower employee compensation and benefits expenses. 16 Chevron Corporation 2013 Annual Report -

Page 19

... Kingdom reflecting the sale of the company's refining and marketing assets in the United Kingdom and Ireland in 2011. Partially offsetting the decrease were excise taxes associated with consolidation of Star Petroleum Refining Company beginning June 2012. Chevron Corporation 2013 Annual Report 17 -

Page 20

... ($/Bbl) $100.26 Natural Gas ($/MCF) $ 5.91 Worldwide Upstream Net Oil-Equivalent Production (MBOEPD)4 United States International Total U.S. Downstream Gasoline Sales (MBPD)5 Other Reï¬ned Product Sales (MBPD) Total Refined Product Sales (MBPD) Sales of Natural Gas Liquids (MBPD) Reï¬nery Input... -

Page 21

...outstanding public bonds issued by Chevron Corporation and Texaco Capital Inc. All of these securities are the obligations of, or guaranteed by, Chevron Corpora- tion and are rated AA by Standard & Poor's Corporation and Aa1 by Moody's Investors Service. The company's U.S. commercial paper is rated... -

Page 22

... and $41 million in 2013 and 2012, respectively. Pension Obligations Information related to pension plan contributions is included on page 61 in Note 21 to the Consolidated Financial Statements under the heading "Cash Contributions and Benefit Payments." 20 Chevron Corporation 2013 Annual Report -

Page 23

...-tax interest costs. This ratio indicates the company's ability to pay interest on outstanding debt. The company's interest coverage ratio in 2013 was lower than 2012 and 2011 due to lower income. Debt Ratio - total debt as a percentage of total debt plus Chevron Corporation Stockholders' Equity... -

Page 24

...year-end 2013, the company had no interest rate swaps. Transactions With Related Parties Chevron enters into a number of business arrangements with related parties, principally its equity affiliates. These arrangements include long-term supply or offtake agreements and long-term purchase agreements... -

Page 25

... issuance of the financial statements. Materially different results can occur as circumstances change and additional information becomes known. The discussion in this section of "critical" accounting estimates and assumptions is according to the disclosure Chevron Corporation 2013 Annual Report 23 -

Page 26

... for crude oil, natural gas, commodity chemicals and refined products. However, the impairment reviews and calculations are based on assumptions that are consistent with the company's business plans and long-term investment decisions. Refer also to the 24 Chevron Corporation 2013 Annual Report -

Page 27

... obligations for OPEB plans, which provide for certain health care and life insurance benefits for qualifying retired employees and which are not funded, are the discount rate and the assumed health care cost-trend rates. Information related to the company's processes to develop these assumptions is... -

Page 28

... possible outcomes, both in terms of the probability of loss and the estimates of such loss. New Accounting Standards Refer to Note 18, on page 54 in the Notes to Consolidated Financial Statements, for information regarding new accounting standards. 26 Chevron Corporation 2013 Annual Report -

Page 29

...Intraday price. The company's common stock is listed on the New York Stock Exchange (trading symbol: CVX). As of February 10, 2014, stockholders of record numbered approximately 160,000. There are no restrictions on the company's ability to pay dividends. Chevron Corporation 2013 Annual Report 27 -

Page 30

... directors who are not officers or employees of the company. The Audit Committee meets regularly with members of management, the internal auditors and the independent registered public accounting firm to review accounting, internal control, auditing and financial reporting matters. Both the internal... -

Page 31

Report of Independent Registered Public Accounting Firm To the Stockholders and the Board of Directors of Chevron Corporation: In our opinion, the accompanying consolidated balance sheet and the related consolidated statements of income, comprehensive income, equity and of cash flows present ... -

Page 32

... 31 2013 2012 2011 Revenues and Other Income Sales and other operating revenues* Income from equity afï¬liates Other income Total Revenues and Other Income Costs and Other Deductions Purchased crude oil and products Operating expenses Selling, general and administrative expenses Exploration... -

Page 33

... Income taxes on defined benefit plans Total Other Comprehensive Gain (Loss), Net of Tax Comprehensive Income Comprehensive income attributable to noncontrolling interests Comprehensive Income Attributable to Chevron Corporation See accompanying Notes to the Consolidated Financial Statements. $ 21... -

Page 34

... compensation and benefit plan trust Treasury stock, at cost (2013 - 529,073,512 shares; 2012 - 495,978,691 shares) Total Chevron Corporation Stockholders' Equity Noncontrolling interests Total Equity Total Liabilities and Equity See accompanying Notes to the Consolidated Financial Statements. $ 16... -

Page 35

... Acquisition of Atlas Energy Advance to Atlas Energy Capital expenditures Proceeds and deposits related to asset sales Net sales (purchases) of time deposits Net sales (purchases) of marketable securities Repayment of loans by equity affiliates Net sales (purchases) of other short-term investments... -

Page 36

...31 Treasury Stock at Cost Balance at January 1 Purchases Issuances - mainly employee beneï¬t plans Balance at December 31 Total Chevron Corporation Stockholders' Equity at December 31 Noncontrolling Interests Total Equity See accompanying Notes to the Consolidated Financial Statements. - 2,442,677... -

Page 37

...Inventories Crude oil, petroleum products and chemicals inventories are generally stated at cost, using a last-in, firstout method. In the aggregate, these costs are below market. "Materials, supplies and other" inventories generally are stated at average cost. Chevron Corporation 2013 Annual Report... -

Page 38

... successful efforts method is used for crude oil and natural gas exploration and production activities. All costs for development wells, related plant and equipment, proved mineral interests in crude oil and natural gas properties, and related asset retirement obligation (ARO) assets are capitalized... -

Page 39

... in employee benefit costs for the year ending December 31, 2013. Related income taxes for the same period, totaling $313, are reflected in Income Tax Expense on the Consolidated Statement of Income. All other reclassified amounts were insignificant. Chevron Corporation 2013 Annual Report 37 -

Page 40

... share repurchase program, respectively. In 2013, 2012 and 2011, "Net sales (purchases) of other short-term investments" generally consisted of restricted cash associated with tax payments, upstream abandonment activities, funds held in escrow for asset acquisitions and capital investment projects... -

Page 41

... $945 in 2011. Note 5 Summarized Financial Data - Chevron U.S.A. Inc. Chevron U.S.A. Inc. (CUSA) is a major subsidiary of Chevron Corporation. CUSA and its subsidiaries manage and operate most of Chevron's U.S. businesses. Assets include those related to the exploration and production of crude oil... -

Page 42

... leased assets are as follows: At December 31 2013 2012 Year: 2014 2015 2016 2017 2018 Thereafter Total Less: Amounts representing interest and executory costs Net present values Less: Capital lease obligations included in short-term debt Long-term capital lease obligations $ 798 733 594 472 306... -

Page 43

...futures, swaps and options contracts traded in active markets such as the New York Mercantile Exchange. Derivatives classified as Level 2 include swaps, options, and forward contracts, principally with financial institutions and other oil and gas companies, the fair values of which are obtained from... -

Page 44

... 31, 2012, respectively. At December 31, 2013, these investments are classified as Level 1 and include restricted funds related to tax payments and certain upstream abandonment activities which are reported in "Deferred charges and other assets" on the Consolidated Balance Sheet. Long-term debt of... -

Page 45

... equivalents, time deposits, marketable securities, derivative financial instruments and trade receivables. The company's short-term investments are placed with a wide array of financial institutions with high credit ratings. Company investment policies limit the company's exposure both to credit... -

Page 46

... fuel oils and other products derived from crude oil. This segment also generates revenues from the manufacture and sale of additives for fuels and lubricant oils and the transportation and trading of refined products, crude oil and natural gas liquids. 44 Chevron Corporation 2013 Annual Report -

Page 47

... 31 2013 2012 2011 Upstream Tengizchevroil $ 5,875 Petropiar 858 Caspian Pipeline Consortium 1,298 Petroboscan 1,375 Angola LNG Limited 3,423 Other 2,835 Total Upstream 15,664 Downstream GS Caltex Corporation 2,518 Chevron Phillips Chemical Company LLC 4,312 Star Petroleum Refining Company Ltd... -

Page 48

...-share amounts Note 12 Investment and Advances - Continued Petropiar Chevron has a 30 percent interest in Petropiar, a joint stock company formed in 2008 to operate the Hamaca heavy-oil production and upgrading project. The project, located in Venezuela's Orinoco Belt, has a 25-year contract term... -

Page 49

... of $627, $629 and $628 in 2013, 2012 and 2011, respectively. 5 Primarily mining operations, power and energy services, real estate assets and management information systems. Note 14 Litigation MTBE Chevron and many other companies in the petroleum industry have used methyl tertiary butyl ether... -

Page 50

... 13, 2013, the National Court ratified the judgment but nullified the $8,600 punitive damage assessment resulting in a judgment of $9,500. On December 23, 2013, Chevron appealed the decision to the Ecuador Constitutional Court, Ecuador's highest court. 48 Chevron Corporation 2013 Annual Report -

Page 51

... May 30, 2012, the Lago Agrio plaintiffs filed an action against Chevron Corporation, Chevron Canada Limited, and Chevron Canada Finance Limited in the Ontario Superior Court of Justice in Ontario, Canada, seeking to recognize and enforce the Ecuadorian judgment. On May 1, 2013, the Ontario Superior... -

Page 52

... hear Chevron's denial of justice claims, but on January 2, 2014, the Tribunal postponed Phase Two and held a procedural hearing on January 20-21, 2014. The Tribunal set a hearing on April 28-30, 2014 to address remaining issues relating to Phase One. It also set a hearing on April 20 to May 6, 2015... -

Page 53

... decrease was primarily due to a lower effective tax rate in international upstream operations. The lower international upstream effective tax rate was driven by a greater portion of equity income in 2013 than in 2012 (equity income is included as part of Chevron Corporation 2013 Annual Report 51 -

Page 54

... ended December 31, 2013, 2012 and 2011. The term "unrecognized tax benefits" in the accounting standards for income taxes refers to the differences between a tax position taken or expected to be taken in a tax return and the benefit measured and recognized in the financial statements. Interest and... -

Page 55

... as longterm. Settlement of these obligations is not expected to require the use of working capital within one year, as the company has both the intent and the ability, as evidenced by committed credit facilities, to refinance them on a long-term basis. Chevron Corporation 2013 Annual Report 53 -

Page 56

... Financial Statements Millions of dollars, except per-share amounts Note 17 Long-Term Debt Note 17 Long-Term Debt Note 18 New Accounting Standards Total long-term debt, excluding capital leases, at December 31, 2013, was $19,960. The company's long-term debt outstanding at year-end 2013 and 2012... -

Page 57

... full payment for shares by the award recipient. For the major types of awards outstanding as of December 31, 2013, the contractual terms vary between three years for the performance units and 10 years for the stock options and stock appreciation rights. Chevron Corporation 2013 Annual Report 55 -

Page 58

... than 4 percent each year. Certain life insurance benefits are paid by the company. The company recognizes the overfunded or underfunded status of each of its defined benefit pension and OPEB plans as an asset or liability on the Consolidated Balance Sheet. 56 Chevron Corporation 2013 Annual Report -

Page 59

...$ 2,439 170 $ 2,609 $ $ 256 70 326 $ $ 968 20 988 The accumulated benefit obligations for all U.S. and international pension plans were $10,876 and $5,108, respectively, at December 31, 2013, and $12,108 and $5,167, respectively, at December 31, 2012. Chevron Corporation 2013 Annual Report 57 -

Page 60

... per-share amounts Note 21 Employee Benefit Plans - Continued Information for U.S. and international pension plans with an accumulated benefit obligation in excess of plan assets at December 31, 2013 and 2012, was: Pension Benefits 2013 U.S. Int'l. U.S. 2012 Int'l. Projected benefit obligations... -

Page 61

...For 2013, the company used an expected long-term rate of return of 7.5 percent for U.S. pension plan assets, which account for 71 percent of the company's pension plan assets. In 2012 and 2011, the company used a long-term rate of return of 7.5 and 7.8 percent for this plan. The market-related value... -

Page 62

.... 5 The "Other" asset class includes net payables for securities purchased but not yet settled (Level 1); dividends and interest- and tax-related receivables (Level 2); insurance contracts and investments in private-equity limited partnerships (Level 3). 60 Chevron Corporation 2013 Annual Report -

Page 63

...: Fixed Income Corporate Mortgage-Backed Securities Real Estate Other Total Total at December 31, 2011 Actual Return on Plan Assets: Assets held at the reporting date Assets sold during the period Purchases, Sales and Settlements Transfers in and/or out of Level 3 Total at December 31, 2012 Actual... -

Page 64

...Consolidated Financial Statements Millions of dollars, except per-share amounts Note 21 Employee Benefit Plans - Continued and $225 in 2013, 2012 and 2011, respectively, represent open market purchases. Employee Stock Ownership Plan Within the Chevron ESIP is an employee stock ownership plan (ESOP... -

Page 65

... remaining $443 was associated with various sites in international downstream $79, upstream $313 and other businesses $51. Liabilities at all sites, whether operating, closed or divested, were primarily associated with the company's plans and activities to Chevron Corporation 2013 Annual Report 63 -

Page 66

... an estimate of the financial effects, if any, can be made at this time. Chevron receives claims from and submits claims to customers; trading partners; U.S. federal, state and local regulatory bodies; governments; contractors; insurers; and 64 Chevron Corporation 2013 Annual Report suppliers. The... -

Page 67

... after-tax gains of approximately $2,800 relating to the sale of nonstrategic properties. Of this amount, approximately $2,200 and $600 related to upstream and downstream assets, respectively. Other financial information is as follows: Year ended December 31 2013 2012 2011 The excess of replacement... -

Page 68

... Dividends Per Share Balance Sheet Data (at December 31) Current assets Noncurrent assets Total Assets Short-term debt Other current liabilities Long-term debt and capital lease obligations Other noncurrent liabilities Total Liabilities Total Chevron Corporation Stockholders' Equity Noncontrolling... -

Page 69

... day 2013 2012 2011 2010 2009 United States Net production of crude oil and natural gas liquids Net production of natural gas1 Net oil-equivalent production Refinery input Sales of refined products Sales of natural gas liquids Total sales of petroleum products Sales of natural gas International Net... -

Page 70

... section provides supplemental information on oil and gas exploration and producing activities of the company in seven separate tables. Tables I through IV provide historical cost information pertaining to costs incurred in exploration, property acquisitions and development; capitalized costs; and... -

Page 71

... of the company's major equity affiliates. Table II - Capitalized Costs Related to Oil and Gas Producing Activities Consolidated Companies Affiliated Companies TCO Other Millions of dollars U.S. Other Americas Africa Asia Australia Europe Total At December 31, 2013 Unproved properties... -

Page 72

... II Capitalized Costs Related to Oil and Gas Producing Activities - Continued Consolidated Companies Affiliated Companies TCO Other Millions of dollars U.S. Other Americas Africa Asia Australia Europe Total At December 31, 2011 Unproved properties Proved properties and related producing... -

Page 73

... for the years 2013, 2012 and 2011 are shown in the following table. Net income from exploration and production activities as reported on page 44 reflects income taxes computed on an effective rate basis. Table III - Results of Operations for Oil and Gas Producing Activities1 Income taxes in Table... -

Page 74

... have been deducted from net production in calculating the unit average sales price and production cost. This has no effect on the results of producing operations. Natural gas converted to oil-equivalent gas (OEG) barrels at a rate of 6 MCF = 1 OEG barrel. 72 Chevron Corporation 2013 Annual Report -

Page 75

... worldwide exploration and production activities. The Manager of Corporate Reserves has more than 30 years' experience working in the oil and gas industry and a Master of Science in Petroleum Engineering degree from Stanford University. His experience includes Chevron Corporation 2013 Annual Report... -

Page 76

... project in adverse and remote locations, physical limitations of infrastructure or plant capacities that dictate project timing, compression projects that are pending reservoir pressure declines, and contractual limitations that dictate production levels. 74 Chevron Corporation 2013 Annual Report -

Page 77

... net proved reserves of crude oil, condensate, natural gas liquids and synthetic oil and changes thereto for the years 2011, 2012 and 2013 are shown in the table on page 76. The company's estimated net proved reserves of natural gas are shown on page 77. Chevron Corporation 2013 Annual Report 75 -

Page 78

... balances in Africa were 37, 41 and 38 and in South America were 117, 123 and 119 in 2013, 2012 and 2011, respectively. 4 Included are year-end reserve quantities related to production-sharing contracts (PSC). PSC-related reserve quantities are 20 percent, 20 percent and 22 percent for consolidated... -

Page 79

... and 2012 conformed to 2013 presentation. 4 Includes reserve quantities related to production-sharing contracts (PSC). PSC-related reserve quantities are 20 percent, 21 percent and 21 percent for consolidated companies for 2013, 2012 and 2011, respectively. 3 Chevron Corporation 2013 Annual Report... -

Page 80

..., sales in Alaska and other smaller fields reduced reserves 95 BCF. In 2012, sales decreased reserves by 538 BCF. Sales of a portion of the company's equity interest in the Wheatstone Project were responsible for the 439 BCF reserves reduction in Australia. 78 Chevron Corporation 2013 Annual Report -

Page 81

... of dollars U.S. Other Americas Africa Asia Australia Europe Total At December 31, 2013 Future cash inflows from production1 Future production costs Future development costs Future income taxes Undiscounted future net cash flows 10 percent midyear annual discount for timing of estimated cash... -

Page 82

... of discount Net change in income tax Net change for 2011 Present Value at December 31, 2011 Sales and transfers of oil and gas produced net of production costs Development costs incurred Purchases of reserves Sales of reserves Extensions, discoveries and improved recovery less related costs... -

Page 83

...Texaco), to combine Socal's exploration and production interests in the Middle East and Indonesia and provide an outlet for crude oil through The Texas Company's marketing network in Africa and Asia. 2011 Acquired Atlas Energy, Inc., an independent U.S. developer and producer of shale gas resources... -

Page 84

... President, Strategy and Development; Corporate Vice President and President, Chevron International Exploration and Production Company; Vice President and Chief Financial Officer; and Corporate Vice President, Strategic Planning. He is a member of the Board of Directors and the Executive Committee... -

Page 85

...upstream, downstream and midstream businesses. Previously Corporate Vice President and President, Chevron Gas and Midstream. Joined the company in 1982. Stephen W. Green, 56 Vice President, Policy, Government and Public Affairs, since 2011. Responsible for U.S. and international government relations... -

Page 86

.... All of these terms are used for convenience only and are not intended as a precise description of any of the separate companies, each of which manages its own affairs. Corporate Headquarters 6001 Bollinger Canyon Road San Ramon, CA 94583-2324 925 842 1000 84 Chevron Corporation 2013 Annual Report -

Page 87

...Exchange Commission and the Supplement to the Annual Report, containing additional financial and operating data, are available on the company's website, Chevron.com, or copies may be requested by writing to: Comptroller's Department Chevron Corporation 6001 Bollinger Canyon Road, A3201 San Ramon, CA... -

Page 88

Chevron Corporation 6001 Bollinger Canyon Road San Ramon, CA 94583-2324 USA www.chevron.com 10% Recycled 100% Recyclable © 2014 Chevron Corporation. All rights reserved. 912-0971