Virgin Media 2006 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2006 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

VIRGIN MEDIA INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

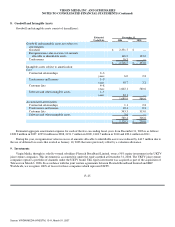

2. Significant Accounting Policies (Continued)

Stock−Based Compensation

We have a number of stock−based employee compensation plans, described more fully in Note 13. Prior to January 1, 2006 we

accounted for these plans using the fair value recognition provisions of FASB Statement No. 123, Accounting for Stock−Based

Compensation (FAS 123). On December 16, 2004, the Financial Accounting Standards Board (“FASB”) issued Statement No. 123

(revised 2004), Share Based Payment (FAS 123R), which is a revision of FAS 123. FAS 123R also supersedes APB 25 and amends

FASB Statement No. 95, Statement of Cash Flows (FAS 95). FAS 123R differs from FAS 123, by requiring all entities to measure

liabilities incurred in stock based payment transactions at fair value and to estimate the number of instruments for which the requisite

service period is expected to be rendered rather than accounting for forfeitures as they occur. Under FAS 123R, modifications to the

terms or conditions of an award are measured by comparing the fair value of the modified award with the fair value of the award

immediately before the modification, as opposed to measuring the effects of a modification as the difference between the fair value of

the modified award at the date it is granted and the fair value of the awards immediately before the modification. FAS 123R also

clarifies and expands current guidance under FAS 123 including the measurement of fair value, classifying an award as either equity

or as a liability and attributing compensation cost to reporting periods. FAS 123R amends FAS 95 requiring that the excess tax

benefits be reported as a financing cash inflow rather than as a reduction of taxes paid.

We adopted FAS 123R on January 1, 2006 and elected to use the modified prospective method, therefore, prior period results

were not restated. As a result of the adoption of FAS 123R, we have recorded a cumulative effect of a change in accounting principle

of £1.2 million to reduce compensation expense recognized in previous periods.

Pensions

We account for our defined benefit pension plans using FASB Statement No. 87, Employer’s Accounting for Pensions (FAS

87) and the disclosure rules under FASB Statement No. 132 (revised), Employers Disclosures about Pensions and Other

Postretirement Benefits, an Amendment of FASB Statements 87, 88 and 106 (FAS 132R). Under FAS 87, pension expense is

recognized on an accrual basis over employees’ approximate service periods. Pension expense calculated under FAS 87 is generally

independent of funding decisions or requirements.

In September 2006, the FASB issued SFAS No. 158, “Employers’ Accounting for Defined Benefit Pension and Other

Postretirement Plans—An Amendment of FASB No. 87, 88, 106 and 132(R)” (SFAS 158). SFAS 158 requires that the funded status of

defined benefit postretirement plans be recognized on a company’s balance sheet, and changes in the funded status be reflected in

comprehensive income, effective fiscal years ending after December 15, 2006, which we have adopted for the year ended

December 31, 2006. SFAS 158 also requires companies to measure the funded status of the plan as of the date of its fiscal year−end,

effective for fiscal years ending after December 15, 2008. The impact of adopting the recognition provisions of SFAS 158 as of

December 31, 2006 is an increase in liabilities of £9.4 million and a pre−tax increase in the accumulated other comprehensive loss of

£9.4 million. We expect to implement the measurement provisions of SFAS 158 effective December 31, 2008.

F−15

Source: VIRGIN MEDIA INVESTM, 10−K, March 01, 2007