Virgin Media 2006 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2006 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

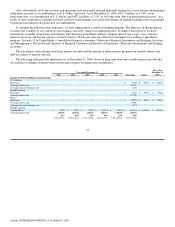

Years ended December 31, 2005 and 2004

Cash flow information provided below includes continuing and discontinued operations.

For the year ended December 31, 2005, cash provided by operating activities increased to £325.6 million from £249.3 million for

the year ended December 31, 2004. This increase was a result of an improvement in working capital compared with 2004 together

with lower cash paid for interest. For the year ended December 31, 2005, cash paid for interest, exclusive of amounts capitalized,

decreased to £216.8 million from £298.5 million during the same period in 2004. This decrease resulted from lower level of debt,

lower weighted average interest rates and re−scheduling of interest payments following our refinancing transaction.

For the year ended December 31, 2005, cash provided by investing activities was £1,172.8 million compared with cash used in

investing activities of £291.0 million for the year ended December 31, 2004. The cash provided by investing activities in the year

ended December 31, 2005 includes £1,229.0 million from the sale of our Broadcast operations and £216.2 million from the sale of our

Ireland operations. Purchases of fixed assets increased to £288.1 million for the year ended December 31, 2005 from £274.5 million

for the same period in 2004.

Cash used in financing activities for the year ended December 31, 2005 was £895.6 million compared with £382.3 million in the

year ended December 31, 2004. The principal components of the £382.3 million cash used in financing activities for the year ended

December 31, 2004 relate to the 2004 refinancing and include £812.2 million raised from the issuance of senior notes by our

subsidiary, Virgin Media Finance PLC, £2,175.0 million drawn under the then new senior credit facility, which together with some of

the proceeds of the issuance of the senior notes and cash on hand was used to repay in full our then−existing senior credit facility, and

the remaining proceeds from the issuance of the senior notes, together with cash on hand, was used to redeem the Diamond notes and

NTL Triangle debentures and pay transaction costs.

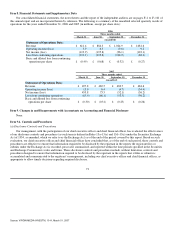

Liquidity and Capital Resources

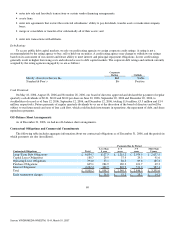

As of December 31, 2006, we had £6,159.1 million of debt outstanding, compared to £6,207.0 million as of September 30, 2006

and £2,280.0 million as of December 31, 2005, and £418.5 million of cash and cash equivalents, compared to £302.2 million as of

September 30, 2006 and £832.1 million as of December 31, 2005. The increase in debt since the previous year is primarily attributable

to the reverse acquisition of Telewest in March 2006 and the acquisition of Virgin Mobile in July 2006. Our business is capital

intensive, we are highly leveraged, and we have historically incurred operating losses and negative cash flow, partly as a result of our

construction costs, operating expenditures and interest costs.

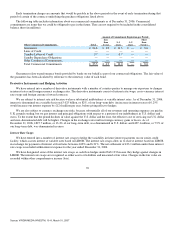

We require significant amounts of capital to connect customers to our network, expand and upgrade our network, offer new

services and integrate our billing systems and customer databases.

We must also regularly service interest payments with cash flows from operations. Our ability to sustain operations, meet

financial covenants under our indebtedness, and make required payments on our indebtedness could be impaired if we are unable to

maintain or achieve various financial performance measures. Our ability to service our capital needs, to service our obligations under

our indebtedness and to fund our ongoing operations will depend upon our ability to generate cash.

Although we expect to generate positive cash flow in the future, we cannot be certain that this will be the case. We believe that

our cash on hand, together with cash from operations and undrawn credit facility, will be sufficient for our cash requirements through

to at least December 31, 2007. However, our cash requirements after December 31, 2007 may exceed these sources of cash. This may

require that we obtain additional financing in excess of the financing incurred in the recent refinancing transaction. We may not be

able to obtain financing at all, or on favorable terms, or we may be contractually prevented by the terms of our senior notes or our

senior credit facility from incurring additional indebtedness.

66

Source: VIRGIN MEDIA INVESTM, 10−K, March 01, 2007