Virgin Media 2006 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2006 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

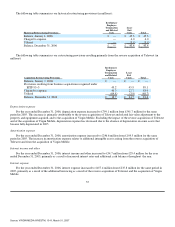

Loss from continuing operations

For the year ended December 31, 2006, loss from continuing operations was £509.2 million compared with a loss of

£241.7 million for the same period in 2005. The increase in loss from continuing operations is primarily attributable to the reverse

acquisition of Telewest and the acquisition of Virgin Mobile together with the associated increases in depreciation, amortization,

interest expense, foreign exchange losses and loss on extinguishment of debt partially offset by increased income from those

acquisitions during the year.

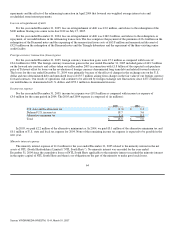

Cumulative effect of changes in accounting principle

In June 2005, the Financial Accounting Standards Board issued FSP FAS 143−1, Accounting for Electronic Waste Obligations

(FSP 143−1) addressing the accounting for certain obligations associated with the Waste Electrical and Electronic Equipment

Directive adopted by the European Union (EU). FSP 143−1 requires that the commercial user should apply its provisions to certain

obligations associated with historical waste (as defined by the Directive), since this type of obligation is an asset retirement obligation.

The Directive was adopted by the U.K. on December 12, 2006, and is effective January 2, 2007. Management have reviewed their

obligations under the law and have concluded that an obligation exists for certain of our customer premises equipment. As a result we

have recognized a retirement obligation of £58.2 million and fixed assets of £24.4 million on the balance sheet and a cumulative effect

change in accounting principle of £33.8 million in the consolidated statement of operations.

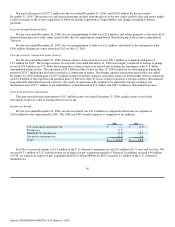

Loss from continuing operations per share

Basic and diluted loss from continuing operations per common share for the year ended December 31, 2006 was £1.74 compared

to £1.13 for the year ended December 31, 2005. Basic and diluted loss from continuing operations per share is computed using a

weighted average of 292.9 million shares issued in the year ended December 31, 2006 and a weighted average of 213.8 million shares

issued for the same period in 2005. Options and warrants to purchase 37.4 million shares at December 31, 2006 are excluded from the

calculation of diluted loss from continuing operations per share, since the inclusion of such options and warrants is anti−dilutive.

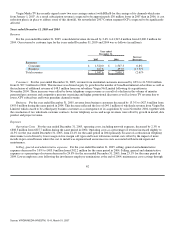

Segment Information

A description of the products and services, as well as year−to−date financial data, for each segment can be found below in note

20 to Virgin Media’s consolidated financial statements. The segment results for the year ended December 31, 2006 included in our

consolidated financial statements are reported on an actual basis and include the results of Telewest from March 3, 2006 and the

results of Virgin Mobile from July 4, 2006.

The results of operations of each of our Cable and Content segments for the years ended December 31, 2006 and 2005 are

reported in this section on a pro forma combined basis as if the reverse acquisition of Telewest had occurred at the beginning of the

periods presented and combine Telewest’s historical Content and sit−up segments into the combined company’s Content segment. The

pro forma data has been calculated on a basis consistent with the pro forma financial information filed with the Securities and

Exchange Commission under our Form 8−K/A on May 10, 2006. We believe that a pro forma comparison of these segments is more

relevant than a historic comparison as: (a) in respect of our Cable segment, the size of the acquired legacy Telewest cable business

would obscure any meaningful discussion of changes in our Cable segment if viewed on a historical basis; and (b) we did not have a

Content segment in 2005. Comparative pro forma results of our Mobile segment have not been presented.

57

Source: VIRGIN MEDIA INVESTM, 10−K, March 01, 2007