Virgin Media 2006 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2006 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276

|

|

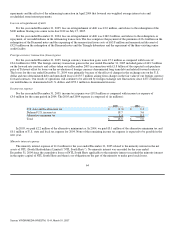

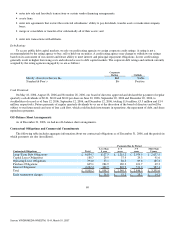

decrease is attributable to declines in telephony voice revenue and lower wholesale and other revenues, partially offset by greater data

installation and rental revenue.

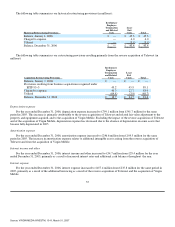

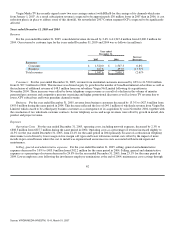

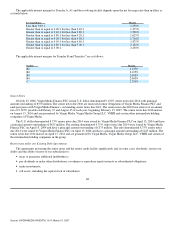

Cable segment OCF

For the year ended December 31, 2006, pro forma Cable segment OCF decreased by 3.9% to £1,145.2 million from £1,191.7

million for the year ended December 31, 2005. The decrease in OCF is primarily due to increased selling, general and administrative

expenses, which included pre−acquisition charges of £20.9 million relating to the reverse acquisition of Telewest, consisting of legal

and professional charges of £11.7 million and executive compensation costs and insurance expenses of £9.2 million, together with

integration costs incurred since the acquisition.

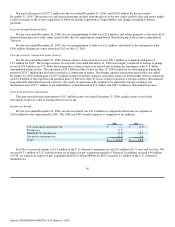

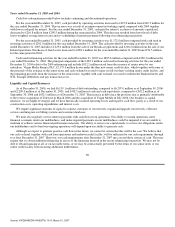

Summary Cable Statistics

Selected statistics for residential cable customers of Virgin Media, excluding customers off our network and Virgin Mobile

customers, for the three months ended December 31, 2006 as well as the four prior quarters, are set forth in the table below.

For the three months ended

December 31,

2006 September 30,

2006 June 30,

2006 March 31,

2006 December 31,

2005

Opening customers 4,891,500 4,928,700 4,983,800 3,089,800 3,097,300

Data cleanse(1) — — (36,200) — (18,100)

Adjusted opening

customers 4,891,500 4,928,700 4,947,600 3,089,800 3,079,200

Increase in customers

on acquisition of

Telewest — — — 1,880,400 —

Customer additions 213,500 229,200 192,300 167,100 162,800

Customer disconnects (250,500) (266,500) (211,200) (153,500) (142,200)

Net customer

movement (37,000) (37,300) (18,900) 13,600 20,600

Reduction in customer

count(2) — — — — (10,000)

Closing customers 4,854,500 4,891,500 4,928,700 4,983,800 3,089,800

Churn(3) 1.7% 1.8% 1.5% 1.4% 1.6%

Revenue generating

units(4)

Television 3,353,900 3,315,400 3,293,100 3,315,900 1,942,700

DTV (included in

Television) 3,005,900 2,922,000 2,836,200 2,786,500 1,445,100

Telephone 4,114,000 4,178,300 4,233,000 4,268,100 2,573,100

Broadband 3,058,500 2,980,400 2,902,300 2,821,700 1,625,200

Total Revenue

Generating Units 10,526,400 10,474,100 10,428,400 10,405,700 6,141,000

RGU/Customers 2.17x 2.14x 2.12x 2.09x 1.99x

Internet dial−up and

DTV access(5) 73,300 97,000 113,300 140,400 123,700

Cable average revenue

per user(6) £ 42.82 £ 42.48 £ 42.21 £ 40.37 £ 38.96

ARPU calculation:

On−net revenues

(millions) £ 626.7 £ 625.4 £ 628.4 £ 443.3 £ 361.6

Average customers(7) 4,878,800 4,907,400 4,962,300 3,660,500 3,093,500

(1) Data cleanse activity in Q2−06 resulted in a decrease of 36,200 customers and 69,000 RGUs, a decrease of approximately 13,500

Telephone, 24,400 Broadband and 31,100 TV RGUs. Data cleanse

59

Source: VIRGIN MEDIA INVESTM, 10−K, March 01, 2007