Virgin Media 2006 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2006 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

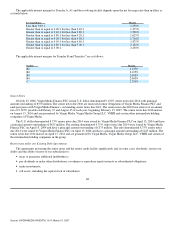

Cross−currency Interest Rate Swaps

We have entered into a number of cross−currency interest rate swaps to hedge the variability in the pound sterling value of

interest payments on the U.S. dollar denominated 8.75% senior notes due 2014, interest payments on the euro denominated 8.75%

senior notes due 2014, interest payments on the U.S. dollar denominated senior notes due 2016 and interest payments on the U.S.

dollar and euro denominated tranches of our senior credit facility. Under these cross−currency interest rate swaps, we receive interest

in U.S. dollars at various fixed and floating rates and in euros at various fixed and floating rates in exchange for payments of interest

in pound sterling at various fixed and floating rates. The net settlement of £5.0 million under these cross−currency interest rate swaps

is included within interest expense for the year ended December 31, 2006.

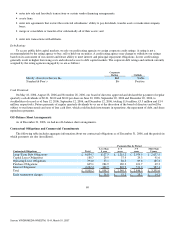

We have designated cross−currency interest rate swaps as cash flow hedges under FAS 133 because they hedge against changes

in the pound sterling value of the interest payments on the senior notes and senior credit facility that result from changes in the U.S.

dollar, pound sterling and euro exchange rates. The cross−currency interest rate swaps are recognized as either assets or liabilities and

measured at fair value. Changes in the fair value are recorded within other comprehensive income (loss).

Foreign Currency Forward Contracts

We have entered into a number of forward contracts maturing on April 14, 2009 to purchase a total of $425 million. These

contracts hedge changes in the pound sterling value of the U.S. dollar denominated principal obligation of the 8.75% senior notes due

2014 caused by changes in the U.S. dollar and pound sterling exchange rates. The principal obligations under the €225 million 8.75%

senior notes due 2014, the $550 million 9.125% senior notes due 2016, and the $646 million and €498 million principal obligations

under the senior credit facility are hedged via the aforementioned cross−currency interest rate swaps, and are not separate forward rate

contracts.

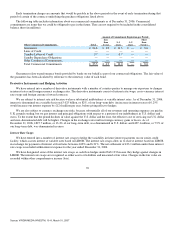

These foreign currency forward rate contracts have not been designated as hedges under FAS 133. As such, the contracts are

carried at fair value on our balance sheet with changes in the fair value recognized immediately in the income statement. The foreign

currency forward rate contracts do not subject us to material volatility in our earnings and cash flows because changes in the fair value

directionally and partially mitigate the gains or losses on the translation of our U.S. dollar and Euro denominated debt into our

functional currency pound sterling in accordance with FASB Statement No. 52, “Foreign Currency Translation”. Changes in fair

value of these contracts are reported with foreign exchanges gains (losses).

Foreign Currency Forward Contracts—Forecasted Transactions

In December 2006, we entered into forward rate contracts to purchase $127.0 million U.S. dollars at various dates throughout

2007 in order to mitigate changes in the U.S. dollar to sterling exchange rate when purchasing goods and services from our suppliers.

Of this total amount, instruments totalling $68.0 million were designated as cash flow hedges of forecasted transactions impacting our

operating costs through 2007. The remaining contracts were not designated as hedges and changes in value of these contracts will be

recognized through gains and losses on derivative instruments in the statement of operations.

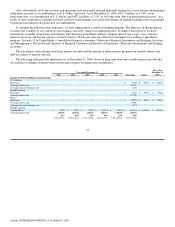

Item 7A. Quantitative and Qualitative Disclosures About Market Risk

We are exposed to various market risks, including changes in foreign currency exchange rates and interest rates. Market risk is

the potential loss arising from adverse changes in market rates and prices, like foreign currency exchange and interest rates. As some

of our indebtedness accrues interest at variable rates, we have exposure to volatility in future cash flows and earnings associated with

variable interest rate payments.

71

Source: VIRGIN MEDIA INVESTM, 10−K, March 01, 2007