Virgin Media 2006 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2006 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276

|

|

We are a holding company with no independent operations or significant assets other than our investments in our subsidiaries. As

a result, we will depend upon the receipt of sufficient funds from our subsidiaries to meet our obligations. In addition, the terms of our

and our subsidiaries’ existing and future indebtedness and the laws of the jurisdictions under which those subsidiaries are organized

limit the payment of dividends, loan repayments and other distributions to us under many circumstances.

Our debt agreements and the debt agreements of some of our subsidiaries contain restrictions on our ability to transfer cash

between groups of our subsidiaries. As a result of these restrictions, although our overall liquidity may be sufficient to satisfy our

obligations, we may be limited by covenants in some of our debt agreements from transferring cash to other subsidiaries that might

require funds. In addition, cross default provisions in our other indebtedness may be triggered if we default on any of these debt

agreements.

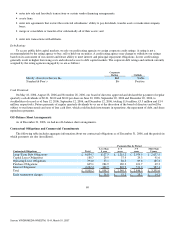

Senior Credit Facility

During the year, we entered into a new senior credit facility in an aggregate principal sterling equivalent amount of £5,275

million, comprising a £3,350 million 5 year amortizing Tranche A term loan facility, a £175 million 5 year amortizing Tranche A1

term loan facility, a £300 million 6½ year bullet Tranche B1 term loan facility, a £351 million 6½ year bullet Tranche B2 term loan

facility, a €500 million 6½ year bullet Tranche B3 term loan facility, a $650 million 6½ year bullet Tranche B4 term loan facility, a

£300 million 7 year bullet Tranche C term loan facility and a £100 million 5 year multi−currency revolving loan facility.

The senior credit facility (other than for Tranche C) has the benefit of a full and unconditional senior secured guarantee from

Virgin Media Finance PLC as well as first priority pledges of the shares and assets of substantially all of the operating subsidiaries of

Virgin Media Investment Holdings Limited (“VMIH”) and of receivables arising under any intercompany loans to those subsidiaries.

The senior secured guarantee of Virgin Media Finance PLC is secured by a first priority pledge of the entire capital stock of VMIH

and the receivables under any intercompany loans from Virgin Media Finance PLC to VMIH. The guarantee of the Tranche C of the

senior credit facility will share in the security of Virgin Media Finance PLC granted to the senior credit facility, but will receive

proceeds only after the other tranches and will not benefit from guarantees or security granted by other members of the group.

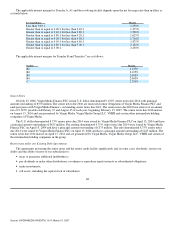

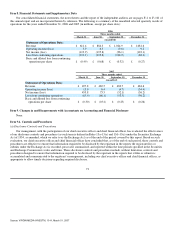

Remaining principal under Tranches A and A1 is subject to repayment each six months as follows (in millions):

Date Amount

September 28, 2007 £ 124

March 31, 2008 £ 237

September 30, 2008 £ 237

March 31, 2009 £ 265

September 30, 2009 £ 475

March 31, 2010 £ 527

September 30, 2010 £ 580

Final maturity date £ 967

The annual rate of interest payable under our new senior credit facility is the sum of (i) the London Intrabank Offer Rate

(LIBOR), US LIBOR or European Intrabank Offer Rate (EURIBOR), as applicable, plus (ii) the applicable interest margin and the

applicable cost of complying with any reserve requirement.

67

Source: VIRGIN MEDIA INVESTM, 10−K, March 01, 2007