Virgin Media 2006 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2006 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

VIRGIN MEDIA INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

17. Related Party Transactions (Continued)

2004 in connection with the transaction. Some of these stockholders, including managed accounts and affiliates of W.R. Huff Asset

Management Co., L.L.C., acquired a substantial quantity of the notes issued in the transaction. On behalf of managed accounts and

affiliates, W.R. Huff Asset Management Co., L.L.C. is a significant participant in the market for non−investment grade debt securities.

Pursuant to the participating purchaser agreements, and in consideration for their advance commitments in the rights offering,

managed accounts and affiliates for which W.R. Huff Asset Management Co., L.L.C. acts as an investment adviser were paid fees

totaling $5.3 million on March 24, 2004 and funds for which Franklin Mutual Advisers LLC acts as an agent or investment adviser

were paid fees totaling $3.1 million on November 24, 2003 and $0.3 million on March 17, 2004. In consideration for financial and

business services, subject to the successful completion of the refinancing, a related entity of W.R. Huff Asset Management Co., L.L.C.

was paid $7.5 million on April 27, 2004.

In May 2004, our board granted to each of Eric Koza and Karim Samii, who were then each employees of W.R. Huff Asset

Management Co., L.L.C. or its affiliates, the right to receive 20,000 restricted shares of our common stock under the 2003 Stock

Option Plan. The restricted stock award was made in consideration of financial and business services provided to us by Messrs. Koza

and Samii. Messrs. Koza and Samii are no longer employees of W.R. Huff Asset Management Co., L.L.C. or its affiliates. Shares

authorized under the 2003 Stock Option Plan, including those granted to Messrs. Koza and Samii, were registered under a registration

statement on Form S−8 that we filed with the SEC on May 6, 2004.

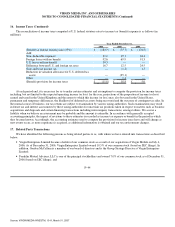

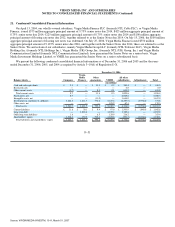

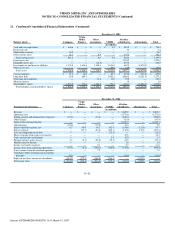

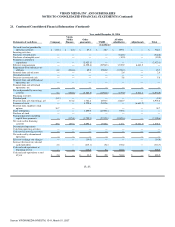

18. Shareholders’ Equity

Authorized Share Capital

Our authorized share capital for issuance consists of one billion shares of common stock, 300.0 million shares of Class B

redeemable common stock and five million shares of preferred stock with a par value of $0.01 each. As at December 31, 2006 there

were 323.9 million shares of common stock outstanding, and no Class B redeemable common stock or preferred stock outstanding.

The common stock is voting with rights to dividends as declared by the board.

In connection with the reverse acquisition of Telewest, each share of NTL Holdings (formerly known as NTL Incorporated now

known as Virgin Media Holdings) common stock issued and outstanding immediately prior to the effective time of the acquisition was

converted into the right to receive 2.5 shares of NTL Incorporated (now known as Virgin Media Inc.) new common stock. On

March 3, 2006, we issued 212,931,048 shares of common stock for this purpose. For accounting purposes, the acquisition of Virgin

Media Holdings has been treated as a reverse acquisition. Accordingly, the 212,931,048 shares issued to acquire Virgin Media

Holdings have been treated as outstanding from January 1, 2004 (as adjusted for historical issuances and repurchases during the period

from January 1, 2004 to March 3, 2006). In addition, on March 3, 2006, each share of Telewest’s common stock issued and

outstanding immediately prior to the acquisition was converted into 0.2875 shares of Virgin Media Inc. new common stock (and

redeemable stock that was redeemed). These 70,728,375 shares of Virgin Media Inc. new common stock have been treated as issued

on the acquisition date.

F−47

Source: VIRGIN MEDIA INVESTM, 10−K, March 01, 2007