Virgin Media 2006 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2006 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

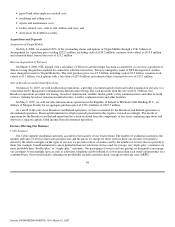

guidance on the consideration of the effects of prior year misstatements in quantifying current year misstatements for the purpose of a

materiality assessment. SAB 108 establishes an approach that requires quantification of financial statement errors based on the effects

of each of a company’s balance sheet and statement of operations and the related financial statement disclosures. SAB 108 is effective

for fiscal years ending after December 15, 2006. The adoption of SAB 108 did not have a material impact on our consolidated

financial statements.

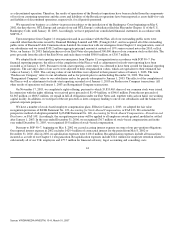

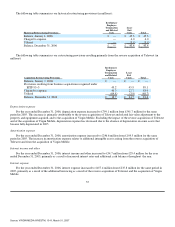

Consolidated Results of Operations from Continuing Operations

Years ended December 31, 2006 and 2005

Revenue

For the year ended December 31, 2006, revenue increased by 85.0% to £3,602.2 million from £1,947.6 million for 2005. This

increase is primarily due to the reverse acquisition of Telewest and the inclusion of its revenues from March 3, 2006, and to the acquisition of Virgin Mobile and

the inclusion of its revenues from July 4, 2006.

Cable ARPU has increased steadily through the year, reflecting our drive to encourage “triple−play” bundling and a focus on

better quality customers. Our focus on acquiring new bundled customers and on cross−selling to existing customers is shown by

Revenue Generating Units (RGUs) per customer increasing from 1.99 at December 31, 2005 to 2.17 at December 31, 2006 and by the

percentage of our customers with “triple−play” growing from 29.3% at December 31, 2005 to 40.6% at December 31, 2006. These

increases arise primarily because the number of RGUs per customer and the percentage of customers with “triple−play” were higher in

the legacy Telewest business than in NTL.

Expenses

Operating costs. For the year ended December 31, 2006, operating costs, including network expenses, increased by 94.6% to

£1,572.8 million from £808.3 million during the same period in 2005. This increase is primarily attributable to the reverse acquisition

of Telewest and to the acquisition of Virgin Mobile. Operating costs as a percentage of revenue increased to 43.7% for the year ended

December 31, 2006, from 41.5% for the same period in 2005, in part due to the inclusion of the Telewest content segment subsequent

to the reverse acquisition of Telewest and the new Mobile segment subsequent to the acquisition of Virgin Mobile, since these

segments have lower margins than our Cable segment.

Selling, general and administrative expenses. For the year ended December 31, 2006, selling, general and administrative

expenses increased by 87.8% to £906.9 million from £483.0 million for the same period in 2005. This increase is primarily attributable

to the reverse acquisition of Telewest and to the acquisition of Virgin Mobile. Selling, general and administrative expenses as a

percentage of revenue increased slightly to 25.2% for the year ended December 31, 2006, from 24.8% for the same period in 2005,

partly due to costs incurred in connection with the integration of NTL and Telewest and increased stock based compensation expense

offset by savings from lower employee related costs as a result of involuntary employee terminations in the year ended December 31,

2006.

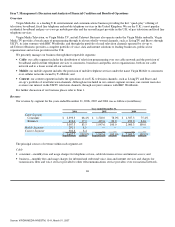

In January 2007, we began the extensive marketing campaign behind our new Virgin Media rebrand. We expect this to increase

our normal marketing and advertising costs by over £25.0 million in 2007.

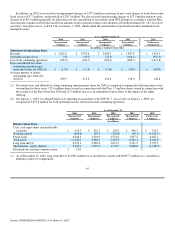

Other charges

Other charges of £67.0 million in the year ended December 31, 2006 relate primarily to employee termination costs and lease exit costs in

connection with our restructuring programs initiated in respect of the reverse acquisition of Telewest.

54

Source: VIRGIN MEDIA INVESTM, 10−K, March 01, 2007