Virgin Media 2006 Annual Report Download - page 148

Download and view the complete annual report

Please find page 148 of the 2006 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276

|

|

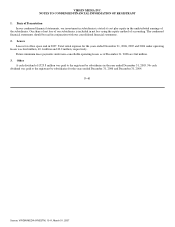

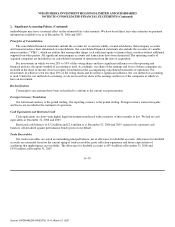

VIRGIN MEDIA INVESTMENT HOLDINGS LIMITED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

1. Organization and Business (Continued)

• Mobile: our mobile segment includes the provision of mobile telephone services under the name Virgin Mobile to consumers

over cellular networks owned by T−Mobile; and

• Content: our content segment includes the operations of our U.K. television channels, such as LivingTV and Bravo, and

sit−up’s portfolio of retail television channels. Although not included in our content segment revenue, our content team also

oversees our interest in the UKTV television channels, through our joint ventures with BBC Worldwide.

2. Significant Accounting Policies

Basis of Presentation

The accompanying consolidated financial statements have been prepared in accordance with U.S. Generally Accepted

Accounting Principles.

On March 3, 2006, NTL Holdings Inc. (formerly known as NTL Incorporated and now known as Virgin Media Holdings Inc, or

Virgin Media Holdings), merged with a subsidiary of NTL Incorporated (formerly known as Telewest Global, Inc., or Telewest, and

now known as Virgin Media Inc., or Virgin Media).

We have accounted for the acquisition of Telewest UK Limited and its subsidiaries by applying the principles of APB 16 in

respect to transactions between entities under common control. As a result, the assets acquired and liabilities assumed have been

recognized at their historical cost and the results of operations and cashflows for Telewest UK Limited are included in the

consolidated financial statements from June 19, 2006, the date the restructuring was completed.

Use of Estimates

The preparation of financial statements in conformity with U.S. Generally Accepted Accounting Principles requires management

to make estimates and assumptions that affect the amounts reported in the financial statements and accompanying notes. Such

estimates and assumptions impact, among others, the following: the amount of uncollectible accounts and notes receivable, the amount

to be paid to terminate certain agreements included in restructuring costs, amounts accrued for vacated properties, the amount to be

paid for other liabilities, including contingent liabilities, our pension expense and pension funding requirements, amounts to be paid

under our employee incentive plans, costs for interconnection, the amount of costs to be capitalized in connection with the

construction and installation of our network and facilities, long−lived assets, certain other intangible assets and the computation of our

income tax expense and liability. Actual results could differ from those estimates.

Fair Values

We have determined the estimated fair value amounts presented in these consolidated financial statements using available market

information and appropriate methodologies. However, considerable judgment is required in interpreting market data to develop the

estimates of fair value. The estimates presented in these consolidated financial statements are not necessarily indicative of the amounts

that we could realize in a current market exchange. The use of different market assumptions and/or estimation

F−69

Source: VIRGIN MEDIA INVESTM, 10−K, March 01, 2007