Virgin Media 2006 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2006 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

VIRGIN MEDIA INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

11. Derivative Financial Instruments and Hedging Activities (Continued)

senior notes due 2016, the €225 million senior notes due 2014 and the $646 million and €498 million principal obligations under the

senior credit facility are hedged via the aforementioned cross−currency interest rate swaps, and not by separate forward rate contracts.

These foreign currency forward rate contracts have not been designated as hedges under FAS 133. As such, the contracts are

carried at fair value on our balance sheet with changes in the fair value recognized immediately in the statement of operations. The

foreign currency forward rate contracts do not subject us to material volatility in our earnings and cash flows because changes in the

fair value partially mitigate the gains or losses on the translation of our U.S. dollar denominated debt into our functional currency

pound sterling in accordance with FAS 52, “Foreign Currency Translation”. Changes in fair value of these contracts are reported

within foreign exchanges gains (losses).

Foreign Currency Forward Rate Contracts—Relating to the purchase price of Telewest Global, Inc.

As of December 31, 2005, we had outstanding foreign currency forward rate contracts to purchase the U.S. dollar equivalent of

£1.8 billion, maturing in April 2006. These contracts hedged changes in the pound sterling value of the borrowed position of the cash

purchase price of Telewest.

These foreign currency forward rate and collar contracts were not accounted for as hedges under FAS 133. As such, the contracts

were carried at fair value in our balance sheet with changes in the fair value recognized immediately in the statement of operations.

Losses on the settlement of these contracts totalling £101.0 million are reported within foreign exchange gains (losses) in the

statement of operations.

Foreign Currency Forward Rate Contracts—Forecasted Transactions

In December 2006, we entered into forward rate contracts to purchase $127.0 million U.S. dollars at various dates throughout

2007 in order to mitigate changes in the U.S. dollar to sterling exchange rate when purchasing goods and services from our suppliers.

Of this total amount, instruments totalling $68.0 million were designated as cash flow hedges of forecasted transactions. Changes in

the value of these contracts will be recognized through the statement of operations when the hedged transactions impact our operating

costs. The remaining contracts were not designated as hedges and changes in value of these contracts will be recognized through gains

and losses on derivative instruments in the statement of operations.

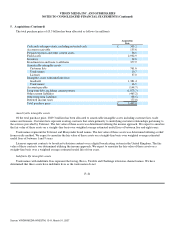

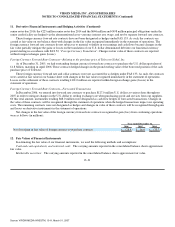

Net changes in the fair value of the foreign currency forward rate contracts recognized in gain (loss) from continuing operations

were as follows (in millions):

Year ended December 31,

2006 2005 2004

Net (loss)/gain in fair value of foreign currency forward rate contracts £ (28.9) £ 16.9 £ (33.7)

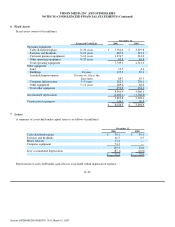

12. Fair Values of Financial Instruments

In estimating the fair value of our financial instruments, we used the following methods and assumptions:

Cash and cash equivalents, and restricted cash: The carrying amounts reported in the consolidated balance sheets approximate

fair value.

Marketable securities: The carrying amounts reported in the consolidated balance sheets approximate fair value.

F−31

Source: VIRGIN MEDIA INVESTM, 10−K, March 01, 2007