Virgin Media 2006 Annual Report Download - page 175

Download and view the complete annual report

Please find page 175 of the 2006 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

VIRGIN MEDIA INVESTMENT HOLDINGS LIMITED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

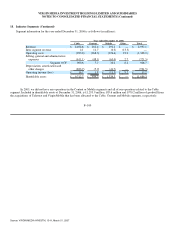

15. Income Taxes (Continued)

A valuation allowance is recorded to reduce the deferred tax asset to an amount that is more likely than not to be realized. To the

extent that the portion of the valuation allowance that existed at January 10, 2003 is reduced, the benefit would reduce excess

reorganization value, then reduce other intangible assets existing at that date, then be credited to paid in capital. The majority of the

valuation allowance relates to tax attributes that existed at January 10, 2003.

At December 31, 2006 we have U.K. net operating loss carryforwards of £3.5 billion that have no expiration date. Pursuant to

U.K. law, these losses are only available to offset income of the separate entity that generated the loss. A portion of the U.K. net

operating loss carryforwards relates to dual resident companies, of which the U.S. net operating loss carryforward amount is

£1.1 billion. U.S. tax rules will limit our ability to utilize the U.S. losses. We also have U.K. capital loss carryforwards of £12.2 billion

that have no expiration date. However, we do not expect to realize any significant benefit from these capital losses, which can only be

used to the extent we generate U.K. taxable capital gain income in the future.

At December 31, 2006, we had fixed assets on which future U.K. tax deductions can be claimed of approximately £11.8 billion.

The maximum amount that can be claimed in any one year is 25% of the remaining balance, after additions, disposals and prior

claims.

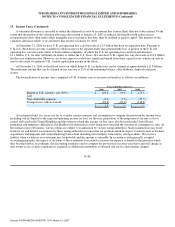

The reconciliation of income taxes computed at U.K. statutory rates to income tax benefit is as follows (in millions):

Year ended December 31,

2006 2005 2004

Benefit at U.K. statutory rate (30%) £ 103.0 £ 69.6 £ 174.3

Add:

Non−deductible expenses (6.4) (7.6) (57.5)

Foreign losses with no benefit (94.8) (62.0) (116.8)

£ 1.8 £ — £ —

At each period end, it is necessary for us to make certain estimates and assumptions to compute the provision for income taxes

including, but not limited to the expected operating income (or loss) for the year, projections of the proportion of income (or loss)

earned and taxed in the United Kingdom and the extent to which this income (or loss) may also be taxed in the United States,

permanent and temporary differences, the likelihood of deferred tax assets being recovered and the outcome of contingent tax risks. In

the normal course of business, our tax returns are subject to examination by various taxing authorities. Such examinations may result

in future tax and interest assessments by these taxing authorities for uncertain tax positions taken in respect to matters such as business

acquisitions and disposals and certain financing transactions including intercompany transactions, amongst others. We accrue a

liability when we believe an assessment may be probable and the amount is estimable. In accordance with generally accepted

accounting principles, the impact of revisions to these estimates is recorded as income tax expense or benefit in the period in which

they become known. Accordingly, the accounting estimates used to compute the provision for income taxes have and will change as

new events occur, as more experience is acquired, as additional information is obtained and our tax environment changes.

F−96

Source: VIRGIN MEDIA INVESTM, 10−K, March 01, 2007